Diversified real estate investment trusts (REITs) are entities that invest in more than one type of commercial real estate. Instead of focusing on a specific property type (e.g., retail, industrial, residential, or office properties) like most REITs, these entities get a meaningful percentage of their rental income from more than one type of property (e.g., they own a mix of retail and industrial properties).

Here's a closer look at why some REITs opt to diversify and the advantages and disadvantages of being a diversified REIT. We'll also look at some of the top diversified REITs for investors to consider.

Understanding them

Understanding diversified REITs

A diversified REIT owns a diversified portfolio of commercial real estate assets, which can include:

- Office buildings and business parks.

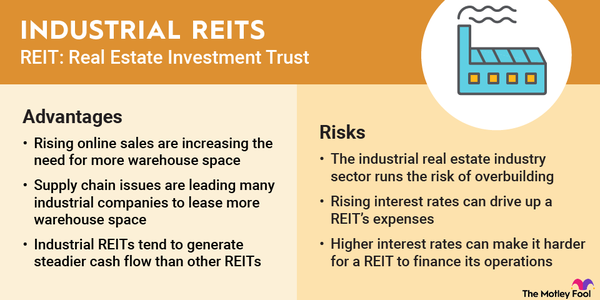

- Warehouses and other industrial buildings.

- Multifamily properties.

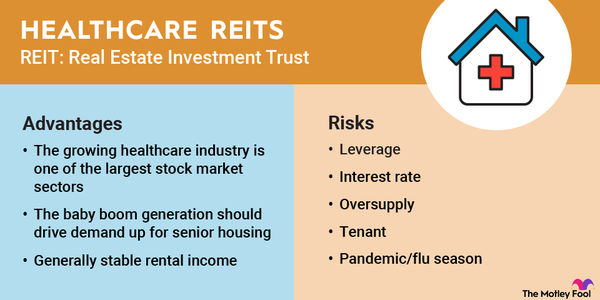

- Healthcare-related real estate, like medical office buildings.

- Retail properties, including freestanding retail buildings and shopping centers.

- Hotels and resorts.

- Gas stations and travel centers.

- Self-storage facilities.

- Mixed-use properties that include offices, retail, and multifamily units.

Many diversified REITs focus on owning single-tenant net lease real estate. These are properties secured by long-term triple net (NNN) leases with the occupying tenant. This lease structure makes the tenant responsible for maintenance, building insurance, and real estate taxes, enabling the REIT to collect steady rental income.

NNN

However, some diversified REITs will own multi-tenant properties with some rental income variability due to a shorter-term lease structure or variable expenses. In addition, some diversified REITs own properties that they operate alongside a third-party manager (e.g., hotels and self-storage facilities). These properties can have even more income variability since occupancy and rates can decline quickly during a recession.

Diversified REITs don't buy properties at random. They develop an investment strategy that focuses their efforts on a specific theme. For example, some diversified REITs concentrate on a particular type of property (e.g., global net lease real estate or service-related properties). Meanwhile, others focus on owning a diversified real estate portfolio in a specific city.

Advantages

Advantages of investing in diversified REITs

Diversified REITs make it easy to invest in real estate. These REITs typically own a diversified portfolio providing investors with reasonably broad exposure to several types of commercial real estate, often with offsetting risk profiles. In some ways, owning a diversified REIT is similar to investing in a REIT ETF. They both can provide instant diversification across several property types.

Risks

Risks of investing in diversified REITs

While diversified REITs can help reduce an investor's risk profile, they aren't without risk. Here are some risk factors to keep in mind before investing in diversified REITs:

- Higher dividend payout ratios: Because of their diversified operations, many diversified REITs have chosen to pay out the bulk of their cash flow via dividends and therefore have high dividend payout ratios. While that typically means they are high dividend REITs, it increases the risk of a dividend reduction if a property segment runs into trouble.

- Slower growth: Because diversified REITs retain less cash, they tend to be slower-growing companies.

- Potential for financial issues: The high dividend payout ratio also tends to cause these REITs to heavily rely on debt and issuing stock to expand. This can cause financial troubles if a property segment faces issues or market conditions grow more challenging.

- Property type-specific issues: While diversification reduces some risks, it increases other potential risk factors, such as the potential for one property type to drag on its results. For example, office and retail properties have experienced headwinds in recent years. This issue has led several formerly diversified REITs to shift their strategies by narrowing their investment focus to property types with the best long-term growth prospects.

- Interest rate risks: As interest rates rise, it becomes more expensive for REITs to borrow money and refinance their debt. In addition, higher interest rates make lower-risk, yield-focused investments such as government and corporate bonds more attractive to income investors. As a result, REIT stock prices tend to fall, pushing up dividend yields to compensate investors for their higher risk profiles.

Our list

3 top diversified REITs to buy

There were 12 publicly traded diversified REITs in late 2025, according to the National Association of Real Estate Investment Trusts (NAREIT). This number has been shrinking in recent years. Several formerly diversified REITs have chosen to focus on a specific property type after years of underperformance in some of their other property segments.

Despite the shrinkage, investors still have several interesting diversified REITs to consider. The three biggest diversified REITs by market capitalization are:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| W.P. Carey (NYSE:WPC) | $15 billion | 5.23% | Equity Real Estate Investment Trusts (REITs) |

| Broadstone Net Lease (NYSE:BNL) | $3 billion | 6.31% | Equity Real Estate Investment Trusts (REITs) |

| Global Net Lease (NYSE:GNL) | $2 billion | 11.44% | Equity Real Estate Investment Trusts (REITs) |

Here's a closer look at these diversified REITs.

1. W.P. Carey

1. W.P. Carey

W.P. Carey (WPC 1.77%) is one of the largest and most diversified REITs. It focuses on owning operationally critical properties net leased to high-quality tenants. In late 2025, this REIT had about 1,600 properties, with roughly 180 million square feet of rentable space net leased to around 370 tenants across more than a dozen industries. Its properties include single-tenant industrial (37.7% of its annual base rent), warehouse (26.2%), retail (22.3%), and other (13.7%). Other property types include education facilities, self-storage, specialty, laboratory, hotels, office, research and development, and land. W.P. Carey owns most of its properties in the U.S. (60.2% of its real estate assets) and Europe (33.9%). Other countries -- Canada and Mexico (5.4%) and Mauritius and Japan (0.6%) -- make up the remainder of its portfolio. W.P. Carey also owns and operates 66 self-storage properties.

The REIT's focus on the global net lease market has enabled it to generate stable cash flow. That had allowed W.P. Carey to pay a consistently rising dividend. This REIT had increased its dividend every year since its initial public offering (IPO) in 1998 until late 2023. However, it reduced its dividend when it made the strategic decision to exit the troubled office sector. Even with that cut, it has historically offered an above-average dividend yield, making it an excellent option for those seeking to generate passive income backed by commercial real estate. As of late 2025, W.P. Carey has increased its dividend every quarter since the reset at the end of 2023.

2. Broadstone Net Lease

2. Broadstone Net Lease

Broadstone Net Lease (BNL 1.58%) has a very diversified real estate portfolio. As of late 2025, its portfolio consisted of industrial (60.7% of its annualized base rent), retail (31%), and other properties (8.3%), including offices and clinical and surgical facilities. The REIT owned around 766 properties in 44 states and four Canadian provinces, and net leased to 205 tenants across 56 industries.

Broadstone has made some notable changes to its investment strategy in recent years. It has reduced its exposure to the healthcare sector by selling off clinically oriented properties while retaining those focused on consumer-centric healthcare. The REIT has also secured several build-to-suit projects (primarily industrial and retail properties) that will drive its growth over the next few years as it completes construction and starts collecting rent on those properties. The strategy shift should enable Broadstone to continue paying an attractive and growing dividend.

3. Global Net Lease

3. Global Net Lease

Global Net Lease (GNL 0.8%) entered 2025 with more than 911 properties with 44 million square feet of space. Its portfolio included industrial and distribution (47% of its rent), retail (26%), and single-tenant office (27%) properties across North America and Europe.

Global Net Lease became a sector-leading diversified REIT in 2023 following its merger with The Necessity REIT. The deal created a $9.6 billion REIT with over 1,350 properties.

However, the deal also increased its debt, leading Global Net Lease to focus on selling non-core properties to reduce debt. In 2025, the company sold off its multi-tentant portfolio in a three-phased deal that generated $1.8 billion in proceeds. This sale enabled the company to reduce debt and transform it into a single-tenant net lease REIT.

How to invest

How to invest in diversified REITs

It's easy to add a diversified REIT to your portfolio. Here's a step-by-step guide on how to invest in diversified REITs:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Related investing topics

Diversified REITs can be great options for real estate investors

Diversified REITs enable investors to own a diversified real estate portfolio through one investment, reducing risk. However, it's essential to know what's in a diversified REIT's portfolio. That's because most of these companies develop a strategy around a particular theme, which has its pros and cons. While some of these strategies have worked well over the years, others have faced headwinds, leading the REIT to shift gears.

FAQ

Diversified REITs FAQ

Are diversified REIT stocks a good buy now?

Diversified REITs are a good buy now if you're seeking to generate passive dividend income from real estate. Most top diversified REITs own high-quality portfolios that produce stable rental income, enabling them to pay high-yielding dividends.

How do diversified REITs perform during economic downturns?

Historically, REITs have declined during a recession. However, the sector tends to outperform the S&P 500 during downturns. More defensive REIT sectors, such as those that own properties secured by triple-net leases (a focus area of most diversified REITs), tend to hold up better during a recession. However, REITs that hold offices and hotels (which include some diversified REITs) typically underperform. Given these dynamics, a diversified REIT that owns industrial properties and essential retail locations should perform the best during a downturn.

What REITs does Warren Buffett own?

As of late 2025, Warren Buffett's company, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), didn't own shares in any REITs.

Are REITs a good way to diversify?

REITs are a good way to diversify your portfolio. They can help investors hedge against inflation, reduce risk, lower their market volatility, and enhance their returns.

Are diversified REITs suitable for new investors?

Diversified REITs can be suitable for new investors. Because they own a diversified portfolio of real estate, they can provide investors with broader exposure to the sector than property-specific REITs. This enables them to provide new investors with greater diversification.