Real estate investment trusts (REITs) play a vital role in the healthcare industry. Healthcare REITs operate many of the specialized facilities that healthcare systems and other health-related institutions need to deliver the best care for patients.

Here's a closer look at healthcare REITs. We'll consider whether these REITs are good investments and explore some attractive healthcare REIT options that investors should consider.

Understanding healthcare REITs

Healthcare REITs own, operate, manage, acquire, and develop healthcare-related real estate. These facilities include senior living communities, hospitals, medical offices, outpatient facilities, life science innovation and research properties, and skilled nursing facilities.

Most healthcare REITs make money by leasing space in their facilities to tenants, such as healthcare systems, primarily under triple-net leases. This lease structure requires the tenant to cover maintenance, real estate taxes, and building insurance. The structure provides REITs with a very predictable stream of rental income, making them ideal stocks to invest in during a recession.

Some healthcare REITs also operate the facilities they own, such as senior living communities. They typically hire a third-party manager who earns a fee for managing the property's day-to-day operations. The REIT generates net operating income (NOI) from the fees paid on behalf of patients for their housing and any services provided. The income can vary due to fluctuations in occupancy levels and rates.

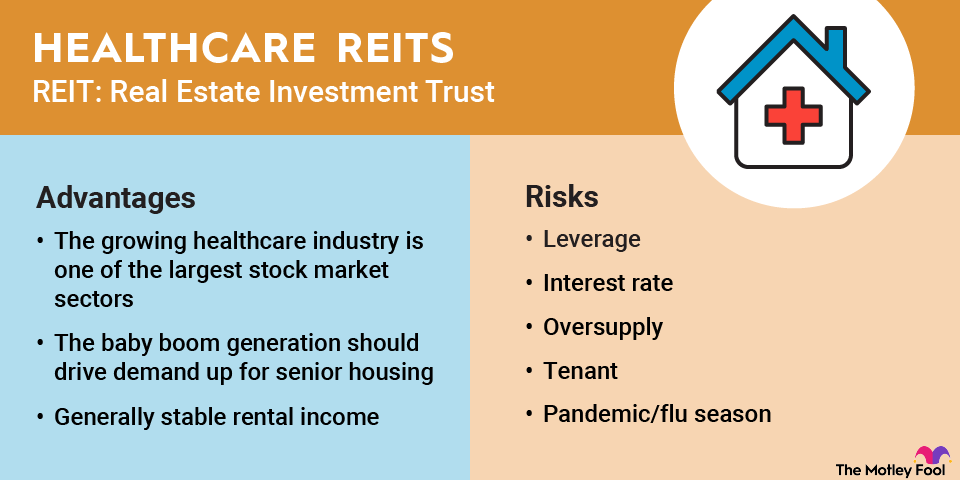

Advantages of investing in healthcare REITs

Healthcare REITs benefit from several notable catalysts, including:

- A massive and growing industry: Healthcare is one of the largest stock market sectors. Healthcare spending in the U.S. is on track to reach a staggering $6.8 trillion by 2030, up from $4.9 trillion in 2023.

- Demographics: The aging of the Baby Boomer generation is a major driver of rising healthcare real estate demand. The U.S. population of people aged 80 years or older is on track to hit 18 million by 2030, representing a 30% increase from the current level. As a result, companies will need to build more senior housing properties, skilled nursing facilities, and other related real estate to support the aging population.

- Generally stable income: Most mealthcare properties produce stable rental income backed by long-term leases.

Risks of investing in healthcare REITs

While healthcare REITs are less risky than other healthcare stocks due to their generally stable rental income, they're not without risk. Here are some of the risks they face:

- Leverage risk: REITs borrow heavily to acquire and develop real estate. The debt reduces their financial flexibility during economic recessions.

- Interest rate risk: REITs are highly sensitive to changes in interest rates. Higher rates increase their cost of debt, given the sector's use of leverage. In addition, higher interest rates give income-focused investors more investment options, such as government and corporate bonds, that offer an attractive income yield, which can weigh on REIT stock prices.

- Oversupply risk: Healthcare REITs must align their development plans with demand. Given the highly specialized nature of most healthcare facilities, REITs need to be careful not to build too much, as excess supply may sit vacant.

- Tenant risk: Healthcare REITs rely on their tenants to pay rent and effectively manage senior living facilities. However, healthcare margins are relatively thin, which can cause operators to run into financial trouble if they're not vigilant. That can affect rental receipts and force a healthcare REIT to find a new tenant for their facility if an operator can't meet its financial obligations.

- Pandemic/flu season risk: Virus outbreaks can significantly affect healthcare REITs, especially those focused on senior housing. It can cause occupancy to decline as more patients check out than are admitted.

Five healthcare REITs to consider in 2026

According to the National Association of Real Estate Investment Trusts (NAREIT), 18 publicly traded REITs focused on healthcare-related real estate as of late 2025. That gives investors interested in the sector multiple options. A few stand out for their strong growth potential, including:

| Name and ticker | Market cap | Dividend yield |

|---|---|---|

| Alexandria Real Estate Equities (NYSE:ARE) | $9.9 billion | 8.17% |

| Welltower (NYSE:WELL) | $129.2 billion | 1.50% |

| Healthpeak Properties (NYSE:DOC) | $12.2 billion | 6.95% |

| Ventas (NYSE:VTR) | $36.1 billion | 2.50% |

| Medical Properties Trust (NYSE:MPW) | $3.1 billion | 6.40% |

Here's a closer look at these top-performing healthcare REITs.

1. Alexandria Real Estate Equities

NYSE: ARE

Key Data Points

Alexandria Real Estate Equities (ARE +1.10%) pioneered the life science real estate niche. These properties provide healthcare companies with the specialized lab space they need to research and develop new therapies, medical tests, and medical devices.

The REIT owns, operates, and develops collaborative megacampus ecosystems in the Greater Boston area, the San Francisco Bay area, San Diego, Seattle, Maryland, the Research Triangle (North Carolina), and New York City.

Alexandria leases space in its best-in-class properties to a diverse and high-quality tenant base, including pharmaceutical companies, biotechnology companies, biomedical institutions, and government institutions.

The company's real estate portfolio produces stable, resilient, and long-duration cash flows. That supports the REIT's high-yielding dividend. Alexandria has grown its payout at a 4.5% annual rate over the last five years (2021-25). It generates significant excess free cash flow after paying dividends, which it uses, along with its strong balance sheet, to invest in additional world-class life science properties.

2. Welltower

NYSE: WELL

Key Data Points

Welltower (WELL +1.70%) is the world's preeminent residential wellness and healthcare infrastructure company. The REIT owns a portfolio of more than 1,500 senior and wellness housing communities across the U.S., U.K., and Canada. It also invests in outpatient medical buildings (more than 26 million square feet) to support physicians.

The healthcare REIT invests heavily in expanding its portfolio. Through mid-year, the company had announced $9.2 billion of investment activity. Notable investments included paying 4.6 billion Canadian dollars ($3.3 billion at the exchange rate in mid-2025) for a portfolio of 38 ultra-luxury senior housing communities and nine entitled development parcels in Canada. It also bought NorthStar Healthcare Income in a $900 million deal for its diversified portfolio of U.S. senior housing properties.

Welltower's heavy investments are growing its earnings, which are now supporting dividend growth. The REIT hiked its dividend payment by 10.4% in mid-2025, its second consecutive double-digit annual dividend increase.

3. Healthpeak Properties

NYSE: DOC

Key Data Points

Healthpeak Properties (DOC +2.19%) is a leading owner, operator, and developer of real estate focused on healthcare discovery and delivery. It owns almost 700 properties with about 49 million square feet of space. The REIT owns purpose-built lab campuses, high-quality outpatient medical office buildings affiliated with leading healthcare systems, and a small portfolio of senior housing properties with more than 7,000 units.

The REIT has grown its funds from operations (FFO) by 12% per share over the past three years (2021-24), driven by development projects, property performance, merger synergies, and more efficient operations. It's in a strong position to continue growing its earnings.

Healthpeak expects to deliver incremental earnings from lab development and redevelopment projects, additional synergies from its 2021 merger with Physicians Realty Trust, and rent growth across its legacy properties. The REIT also has ample financial flexibility to make acquisitions as opportunities arise.

Healthpeak Properties' strong and growing cash flows support its high-yielding dividend. It increased its payout by 2% in early 2025 and switched to a monthly payment schedule, making it an attractive option for investors seeking passive income from real estate.

4. Ventas

NYSE: VTR

Key Data Points

NYSE: MPW

Key Data Points

A unique way to invest in the healthcare sector

Healthcare REITs will be one of the beneficiaries of the healthcare sector's continued growth. These companies should continue raising rents while experiencing healthy occupancy levels as Baby Boomers age, making it an excellent sector for investors to consider.