The franchise business model has long been a popular one, and franchising is an easy way to develop a business. Once you have a successful concept, you can outsource the work of opening new stores to franchisees, who replicate that concept as the franchise owners.

This creates a win-win situation for both parties: The franchisees get the benefits of a well-known brand, a blueprint for operating a business, and ongoing support. The franchisors get to collect franchise fees, including royalties on sales and money to fund advertising.

If you're not interested in running your own small business, one of the best ways to get exposure to this industry is by investing in franchise stocks or the stocks of publicly traded franchise companies. Franchising is a popular business model among fast-food restaurants and is also common for hotels, gyms, travel planning services, and commercial cleaners. At scale, franchise stocks tend to generate high profit margins because franchisors have relatively low fixed costs and collect recurring revenue from royalties.

Let's take a look at some of the best available publicly traded franchise stocks today.

List of publicly traded franchise companies

Below is a list of some of the most popular non-restaurant franchise companies.

1. Planet Fitness

Planet Fitness was a model of excellence before the COVID-19 pandemic, as the company steadily expanded across the country. Its low-cost model, with monthly membership prices starting at $15, helped to ensure consistent demand.

Since its 2015 initial public offering (IPO), the stock price is up around 600%. The stock steadily gained in its early years but has traded mostly sideways in the years after the pandemic. Its valuation may have gotten ahead of the business, and the work-from-home transition could also be a challenge for the company. However, Planet Fitness is still delivering solid growth on the top and bottom lines, with same-store sales up 6.9% in the third quarter of 2025.

The company now has about 2,800 locations, and it expects to expand to 5,000 gyms or more, giving Planet Fitness plenty of room to grow. With a high-margin business and a budget-priced product, the gym stock looks like a good long-term bet.

2. Marriott International

Marriott became the world's largest hotel chain in 2015 with its acquisition of Starwood Hotels & Resorts, making it also one of the biggest franchisors in the world.

Hotel chains were hit hard by the pandemic, but Marriott's stock has rebounded well, thanks to the post-pandemic travel boom. Additionally, one of the strengths of the franchise model is that it insulates the franchisor from economic downturns or black swan events like the pandemic by removing many of the fixed costs that operators are obliged to pay.

Marriott delivered strong results in 2024, with revenue up 6% to $25.1 billion and a 3% drop in operating income to $3.86 billion, and it maintained similar growth in 2025, demonstrating the model of consistency that franchises can provide.

If you're looking for stocks in the travel industry, hotel franchisors like Marriott can be a safer option than alternatives like airlines and cruise lines, which have higher fixed costs.

3. Snap-on Tools

NYSE: SNA

Key Data Points

Snap-on Tools calls itself the world's No. 1 tool brand. Franchisees sell its products from mobile stores, which are essentially trucks branded as Snap-on Tools stores.

Snap-on has delivered steady growth over its history. The need for tools won't go away and is closely tied to economic growth. Its net sales fell 0.5% in 2024 to $4.71 billion, but the company still posted an operating profit margin of 23%, which is a reflection of the strength of the franchise model and does not include franchisee financing, a lucrative business for Snap-On. In November 2025, Snap-on raised its dividend 14% to $2.44 a share, showing confidence in the business despite the current macroeconomic uncertainty. That also marked its 16th annual dividend increase in a row.

The company's brand and its wide range of tools and equipment have made the stock a historical outperformer. Its business model should continue to deliver solid results since there is always a market for its products, even in a weakening economy.

4. RE/MAX Holdings

The housing market has struggled since the pandemic ended, which dragged down shares of RE/MAX and almost every other real estate stock. However, that sets up an opportunity when mortgage rates come down, though that's taking longer than some had hoped.

The company is the world leader in residential real estate sales by transactions and is well positioned to capitalize on the recovery. Today, the brand has more than 147,000 agents in almost 9,000 offices across 110 countries and territories.

After a decline during the 2007-10 housing bust, the business grew steadily over the next decade, though the post-pandemic housing slump squeezed the business.

The company was once a rewarding dividend stock, but it suspended its dividend in November 2023 in response to the challenging housing market and a litigation settlement.

Publicly traded restaurant franchises

Restaurants are the best-known type of franchise business. Below are some of the best restaurant franchise stocks.

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| McDonald's (NYSE:MCD) | $227.5 billion | 2.24% | Hotels, Restaurants and Leisure |

| Wingstop (NASDAQ:WING) | $7.6 billion | 0.41% | Hotels, Restaurants and Leisure |

| Domino's Pizza (NASDAQ:DPZ) | $13.6 billion | 1.74% | Hotels, Restaurants and Leisure |

1. McDonald's

NYSE: MCD

Key Data Points

The fast-food giant has more than 43,000 locations around the world, with the vast majority -- more than 90% -- owned by franchisees. A few years ago, McDonald's converted many of the company's restaurants in China and other international markets into franchises, giving the company even more of an "asset-light" model, freeing it of the fixed costs of running those restaurants. McDonald's also owns much of the real estate on which its franchise restaurants are built, allowing the company to collect rent from franchisees.

The fast-food giant has been challenged by weak consumer discretionary spending like other restaurant chains, but it's been a steady winner throughout its history, and that's unlikely to change given its name recognition, prime locations, and marketing muscle.

2. Wingstop

NASDAQ: WING

Key Data Points

NASDAQ: DPZ

Key Data Points

You might be surprised to learn that Domino's has been one of the best-performing stocks on the market since the 2008-09 financial crisis, with its share price up more than 7,000% from the bottom. A successful turnaround plan that included reformulating the company's pizza recipe helped to drive the company's growth during the decade, and its strength in delivery has made it popular during the pandemic.

Domino's also has an appealing concept for franchisees. It offers a low-cost initial investment and a simple menu that combines with the global popularity of pizza delivery to make Domino's appealing to many entrepreneurs.

While the stock's gains have slowed since the boom in the 2010s, comparable sales have continued to move higher, showing the underlying strength in the business.

Benefits and risks of investing in franchise stocks

Like any other sector, there are both benefits and risks to investing in franchise stocks. Let's take a look at a few of them.

Benefits:

- The franchise business model helps insulate stocks from the performance of frontline businesses. Franchises can grow profits even when franchisee sales are declining.

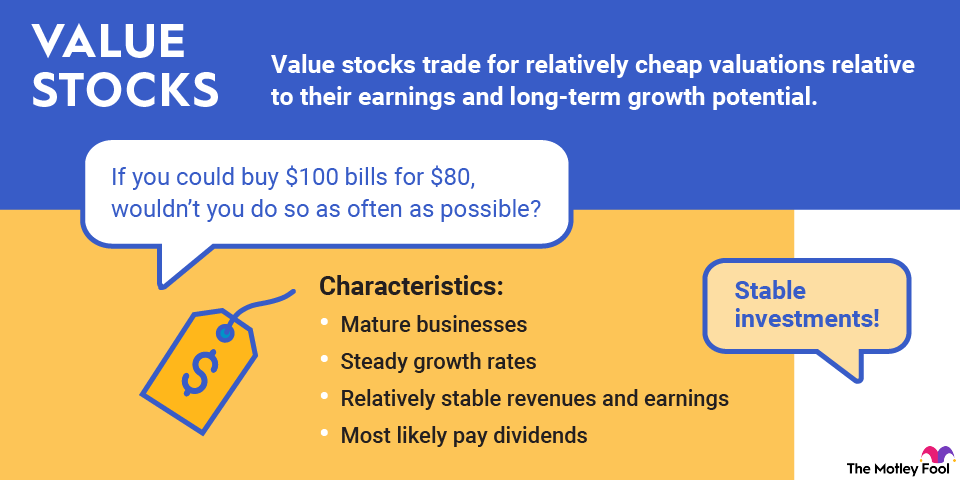

- Franchise stocks are generally established businesses with proven business models, making them less risky.

- Franchise stocks tend to be profitable and pay risks.

- Franchise stocks generally pay dividends.

Risks:

- The franchise model sometimes sacrifices growth for stability, so franchise stocks aren't usually high-growth.

- Although the business model offers some stability, franchise businesses are still subject to industry and macro-level headwinds. A well-run franchise won't overcome bad business dynamics.

- A franchise can suffer reputational risk for something that happens at the franchisee level. A successful franchise stock must protect its reputation.

Related investing topics

How to invest in franchise stocks

If you're looking to buy a franchise stock, the process is easy. Just follow the steps below.

1. Open your brokerage app: Log in to your brokerage account where you handle your investments.

2. Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

3. Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

4. Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

5. Submit your order: Confirm the details and submit your buy order.

6. Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Are franchise stocks right for you?

Franchise stocks aren't easy to pigeonhole since they hail from a wide range of sectors, including restaurants, retail, and travel.

However, publicly traded franchise companies tend to have a few things in common. They are high-margin businesses since the franchise model shifts the risks and fixed costs to the franchise owner, and they tend to have well-known, valuable brands, which create competitive advantages.

Because the franchise model works best with well-known brands, these companies tend to be mature businesses, although there are some exceptions. Many franchise companies are also dividend-paying stocks, a sign of a business with reliable profits.

Overall, this business model offers a number of advantages, including high margins, the ability to rapidly expand, and low fixed costs. If you're looking for a combination of growth and reliable profits that are recession-resistant, then franchise stocks likely deserve a place in your portfolio.