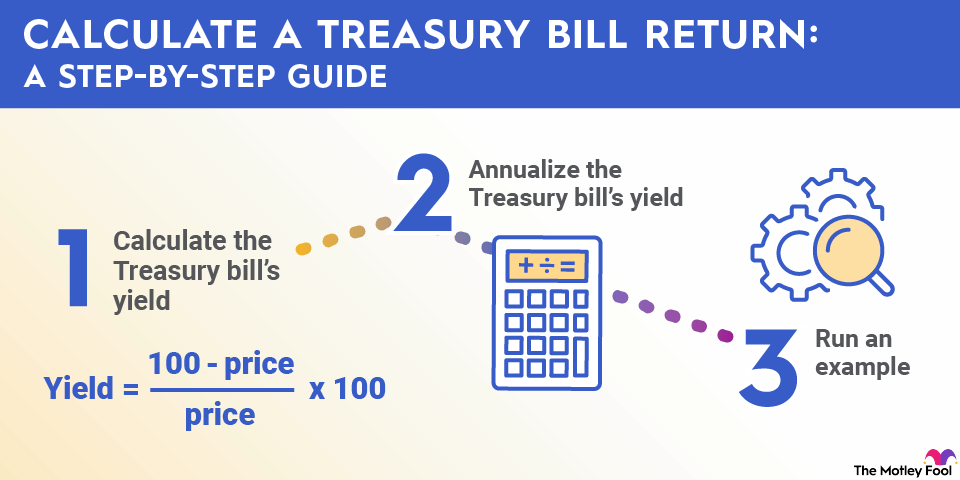

How to Calculate the Percentage Return of a Treasury Bill

Key Points

- T-bills are sold at a discount to their face value.

- They offer returns at maturity without periodic interest payments.

- With T-bill yields higher in recent years, they can be an excellent, low-risk way to put cash to work and earn a return.