Many children work in some fashion before they reach age 18. The income they earn makes them eligible to contribute to a Roth IRA, which can be an extremely smart move for teenagers. Yet financial institutions typically can't let minors open a Roth IRA on their own. Fortunately, many institutions will let parents act as a custodian on a custodial Roth IRA for the benefit of their children. Let's look at some of the rules involved.

Can I open a Roth IRA for my child?

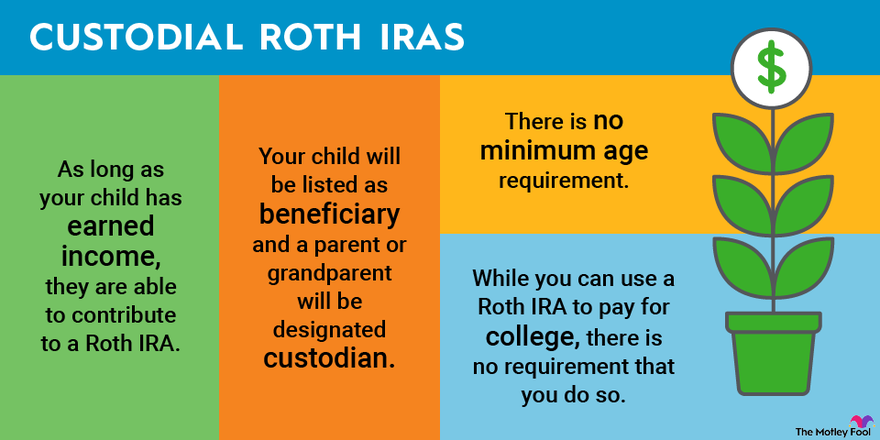

Yes. As long as your child has earned income, they are able to contribute to a Roth IRA. The Roth IRA contribution limit for 2024 and 2025 is the lesser of $7,000 or your child's total compensation for the year.

For example, if your child earns $3,000 mowing lawns in 2025, they'd be eligible to contribute up to $3,000 to a Roth IRA. If your child earns $7,000 or more, their contributions would be capped at $7,000 for the year.

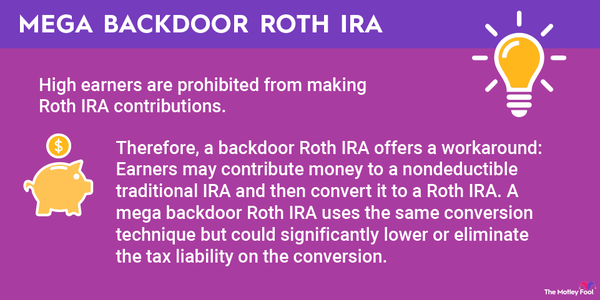

While it likely won't apply in most cases, adjusted gross income for the child must be below the thresholds above, for which Roth IRAs aren't allowed. Eligibility to contribute to a Roth IRA for single filers in 2024 starts to phase out at $146,000 and completely phases out at $161,000. In 2025, the phaseout begins at $150,000, and those with incomes above $165,000 aren't eligible to directly fund a Roth IRA.

There isn't any minimum age requirement, but again, the child must have earned income in some fashion. While you can use a Roth IRA to pay for college, there isn't any requirement that you do so. In fact, it's generally better to use investment accounts for their intended purpose. After all, IRA does stand for individual retirement account.

What is a custodial Roth IRA and how does it work?

A custodial Roth IRA functions in much the same way as a standard Roth IRA. However, in the case of the custodial Roth, your child will be listed as beneficiary and a parent or grandparent will be designated as custodian. These accounts afford Roth IRA benefits to your child at an early age. Primarily, this means your child can begin early to benefit from tax-free compounding.

Let's review how a Roth IRA works. You make contributions in the current year on an after-tax basis. In other words, funds contributed to a Roth are considered post-tax money. Once the money has been deposited to your Roth IRA, you're able to invest and accrue capital gains and dividends. Your Roth IRA withdrawals are entirely tax-free in retirement as long as you meet a number of requirements.

A custodial Roth IRA works the same way but instead will reflect the contributions of a minor child with earned income. In a typical case, a child can contribute up to $7,000 of their earned income to a Roth IRA in both 2024 and 2025, and it will function precisely the same as a standard Roth. However, until the child is 18, the account will require a named custodian -- typically a parent -- to monitor the account and invest the money.

Once the child turns 18 (or 21 in some states), the account will be transferred to his or her name in its entirety, and it will function like a regular Roth IRA. The child can then unilaterally make transactions on the account. Parents must therefore be comfortable that the child will honor the intent of setting up a Roth IRA rather than simply taking the money out when they turn 18.

Where can I open a custodial Roth IRA?

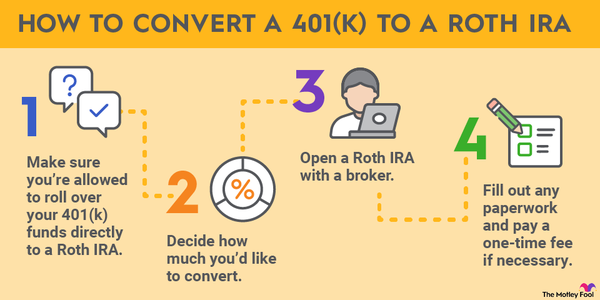

Many online discount brokers -- think Charles Schwab, Fidelity, and E*TRADE from Morgan Stanley -- offer custodial accounts. You shouldn't pay a recurring custodial fee for opening an account. Thankfully, this has become standard business practice with most online brokers, many of which you'll find on our page outlining the best Roth IRAs. Opening an IRA online is a simple process that shouldn't take more than 30 minutes, even for beginning investors.

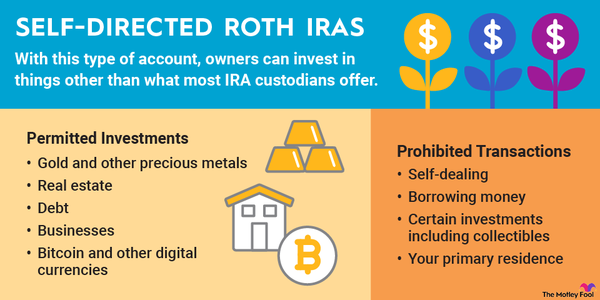

If you were to open a self-directed Roth IRA -- one that may offer access to alternative investments or real estate -- there may be additional fees involved. Since the passage of the 2018 Tax Cuts and Jobs Act, these custodial fees are no longer tax-deductible as investment expenses, so be careful! Fees are often analogous to guaranteed negative returns, so make sure to keep any optional fees to a minimum.

Why open a custodial Roth IRA?

From a purely financial standpoint, the most valuable asset a young person has is time. With more time for money to grow tax-free, compounding takes hold sooner, and the account holder will be left with a higher balance at retirement.

Say you open a custodial Roth IRA for your child. They earn $5,000 annually from their job delivering newspapers. Imagine you contribute the entire amount to a Roth IRA on their behalf, starting at age 15. Due to your intelligent guidance, they continue that behavior through adulthood until retirement at 65. Also assume they don't save a penny in any other retirement account along the way.

| Starting Age | Annual Contribution | Assumed Annual Return | Assumed Retirement Age | Ending Balance |

|---|---|---|---|---|

| 15 | $5,000 | 8% | 65 | $2,868,851 |

| 25 | $5,000 | 8% | 65 | $1,295,283 |

| 35 | $5,000 | 8% | 65 | $516,416 |

As you'll note from the chart above, the difference between starting early and late is enormous. The only action required on the part of the account holder -- whether it's you or your child -- is to consistently deposit $5,000 every year and to invest the entire amount. Apart from that, the only thing left to do is leave it alone.

Opening a Roth IRA on your child's behalf is one of the most impactful and beneficial things you can do to set them up for a secure financial future. Even at lower annual contribution amounts, starting early makes all the difference.

Rules for a custodial Roth IRA

In addition to the typical rules, custodial Roth IRAs involve some additional restrictions. Even though the custodian is the legal owner of the account, the Roth IRA must be managed for the benefit of the minor child. The custodian therefore can't commingle money from his or her own retirement accounts, and any withdrawals must be used for the minor child's benefit rather than the custodian's own personal gain. The custodian also can't take the money back at a later date.

Also note that because it's a Roth IRA we're dealing with, the child's income may need to be declared as taxable self-employment income in the year it is earned. It's best to consult with a tax advisor to determine any potential liability. Even if the child owes tax, contributing to a Roth IRA is definitely worthwhile.

Finally, bear in mind that because it's unusual for minor children to have retirement accounts, some financial institutions won't necessarily have the resources in place to handle a Roth IRA for kids. Waiting until the last minute to try to set up a custodial Roth IRA is a bad idea, and it's smart to contact your financial institution early to make sure they have any necessary paperwork and procedures in place.

Despite the additional work involved, helping your child by setting up a custodial Roth IRA can be a great way to get an early start on retirement saving. It can also teach children more about financial matters generally and give them investing experience that will help them throughout their lives.

Related Retirement Topics

The Motley Fool has a disclosure policy.