Investing in the stock market can often feel like riding a roller coaster -- thrilling yet potentially unsettling. In this adventurous landscape, some stocks promise a steadier ride. That's where widow and orphan stocks come in. These ultimate blue chip investments are the market's version of comfort food. They might not spice up your portfolio, but they surely bring a sense of security to the table.

What are widow and orphan stocks?

Widow and orphan stocks refer to shares in companies known for their stability and reliable dividend payments. The names might sound gloomy, but the essence is far from it. They are termed so because they are deemed safe enough for a widow or an orphan to invest in. In other words, you can benefit from these ultra-reliable holdings for many years, even if you simply inherited the stock without knowing anything about investing.

These stocks are typically from established companies with a long track record of consistent performance and a history of weathering economic downturns. This stock idea also suggests a generous dividend yield, setting the proverbial widow or orphan up for reliable income in the long run.

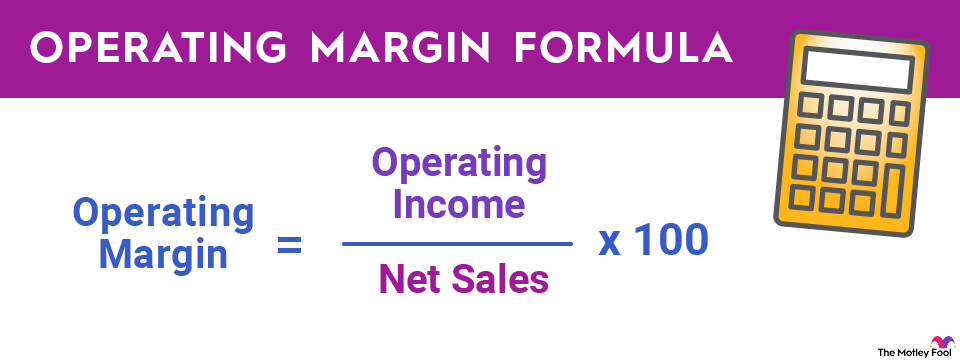

Dividend Yield

Widow and orphan stocks are the tortoises in a market full of hares -- steady and reliable, if not flashy. In the modern market, widow and orphan stock might refer to slow-and-steady value stocks like Johnson & Johnson (JNJ +0.10%) or Procter & Gamble (PG -0.97%), not volatile growth kings such as Nvidia (NVDA +2.53%) and Tesla (TSLA +0.69%). Widow and orphan stocks may not beat the market, but they're likely to deliver steady returns for many years or even decades to come.

Should you own widow and orphan stocks?

Widow and orphan stocks are a lot like having a steady job in an economy full of gig economy hustles. They bring solid predictability and less volatility to your stock portfolio. No, you don't have to be an actual widow or orphan to enjoy the benefits of these stocks -- unshakable stability with strong cash payouts can help anyone succeed on Wall Street.

In an era where market fluctuations can be as unpredictable as weather forecasts, these stocks are your financial umbrella, providing shelter from economic downpours.

Moreover, their history of consistent dividend payments can act as a source of regular income for investors, much like a paycheck. The dividend yield often tends to be higher than what you might find in more volatile stocks, making them a favorite among retirees or those looking for a steady income stream.

What you can do with widow and orphan stocks

Investing in widow and orphan stocks can be an effective way to preserve capital and receive a regular income, acting as a cushion against the market's whims. However, remember that no investment is entirely risk-free. It's essential to do your homework and dig a little into the company's history, its past performance during economic downturns, and its dividend-paying track record before making a decision.

Diversifying your portfolio by including a mix of widow and orphan stocks along with a selection of more growth-oriented stocks can be a prudent strategy. This way, you balance the scales between stability and growth, ensuring your financial portfolio has a well-rounded base.

Related investing topics

Trick play: The best widow and orphan stocks might not be stocks at all

If you're not ready to pick the stocks that could benefit your heirs for decades after you're gone, there's an easy way to get the benefits of rock-solid stocks with even lower market risks. You might consider a low-cost index fund, which lets you ride the stock market's general long-term gains without tying your fortunes to the long-term performance of any particular company or stock.

Let's imagine setting up a portfolio for your future heirs in 1925, referring to the Dow Jones Industrial Average (^DJI +0.66%) index as a source of investment ideas with solid long-term prospects. This Dow Jones Industrial Average only held 20 stocks back then, expanding to 30 in 1928, but most of those industry titans have fallen away over time.

The railroad equipment, sugar refining, and giants of that time, for example, faded out over the next four decades. Leading retailers like Woolworth's and Sears had more staying power but succumbed to changing consumer tastes in the end. Only six of those 20 giants survived as investable businesses over the next hundred years. And in that small group, only Dow (DD +1.08%) held on to its Dow Industrials membership for a full century (with a couple of name changes along the way).

Index funds weren't a thing in the early 1900s, but if you found some other way to match the Dow Jones Industrial Average, you'd have a ton of cash today. The Dow value stood at 2,200 in early 1925, rising to nearly 36,000 in the summer of 2023. The list of Dow components changed dramatically, the market experienced several crashes and recessions, and anybody who picked the correct long-term survivors from the Dow members of 1925 should thank their lucky stars.