What are the most volatile stocks on the market today? You might be surprised. The stocks that have exhibited the highest volatility in recent months won't necessarily be the ones with the most volatility going forward. In this article, we'll define exactly what stock market volatility is, identify the types of stocks with especially high volatility in 2025, and discuss whether or not volatile stocks are right for you.

Overview

Understanding stock market volatility

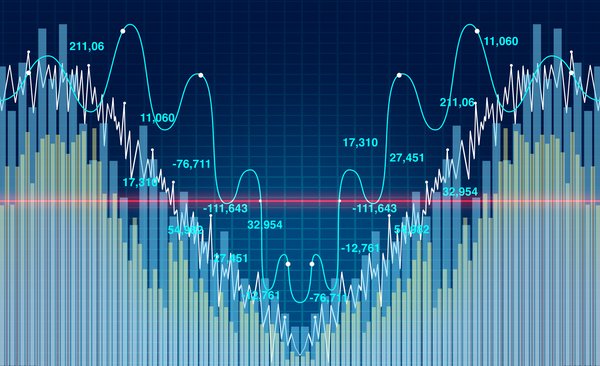

All stocks move up and down over time. Stock volatility refers to how much they rise or fall within a specified period. Generally speaking, the more volatile a stock is, the riskier it is. However, that's not always the case.

Stock Market Volatility

There are several ways to measure stock volatility. Below are three of the most common methods used:

- Beta. This measures the volatility of a given stock or group of stocks compared to the overall stock market (usually represented by the S&P 500). It's calculated by dividing the covariance (how much two data points vary) of the return on an individual stock or group of stocks and the return over the overall market by the variance of the return of the overall market. Many financial websites provide individual stocks' beta coefficients, so you don't have to crunch the numbers yourself. A beta coefficient of more than 1.0 indicates that a stock tends to be more volatile than the overall market, while a coefficient of less than 1.0 indicates that the stock tends to be less volatile than the overall market.

- Implied volatility. This measures how much the market expects that a stock will change over a period of time. It is derived from options prices using a complicated mathematical formula called the Black-Scholes model. Stocks with higher implied volatility are more volatile than those with lower implied volatility.

- Standard deviation. This measures how much a stock varies from its average or mean value over a period of time. It's calculated by obtaining the square root of the sum of the stock's variance from its average divided by the number of data points. The higher the standard deviation, the more volatile the stock.

Stock volatility can be caused by multiple factors. Some of the most important ones include investors' emotions, geopolitical events, macroeconomic trends, and issues affecting individual businesses.

Five types

Five types of high-volatility stocks

Certain stock market sectors can exhibit higher levels of volatility than others. However, the sectors that are highly volatile during one period could rank among the less volatile ones during another period.

State Street (STT 1.31%) Global Advisors, which operates several exchange-traded funds (ETFs), including the SPDR S&P 500 ETF Trust (SPY -0.03%), published the volatility of each S&P 500 sector in May 2025. Below is a list of the five highest-volatility stock sectors based on the company's volatility composite score.

1. Healthcare

The healthcare sector includes biotech, pharmaceuticals, medical technology, and health insurance companies. The sector also includes healthcare providers such as hospitals, dental clinics, physician clinics, assisted living facilities, and skilled nursing facilities.

Volatility in the healthcare sector is typically lower than in most other sectors. That wasn't the case in mid-2025, though. Factors contributing to the higher volatility included a tight labor market, inflationary pressures, and the Trump administration's polices (notably, threatened tariffs on pharmaceutical imports and a planned implementation of most-favored nation drug pricing, which would set drug prices in the U.S. based on the lowest price paid by other developed countries.)

UnitedHealth Group (UNH 4.54%) has been an especially volatile healthcare stock through the first half of 2025. The giant health insurer suspended its full-year guidance in May because of higher-than-expected Medicare Advantage costs. Its former CEO, Andrew Witty, stepped down unexpectedly. The Wall Street Journal also reported that the U.S. Department of Justice launched a criminal investigation into alleged Medicare fraud by UnitedHealth Group.

2. Materials

The materials sector includes companies that produce, process, and distribute raw materials such as minerals, oil, gas, and steel. Like industrials stocks, materials stocks can be volatile because they're closely connected with the overall economy.

Volatility in the materials sector can stem from factors including economic cycles, commodity price fluctuations, and supply chain disruptions. In 2024, falling commodity prices contributed to the increased volatility in the sector. The high volatility for the materials sector continued in 2025, in part due to worries about the Trump administration's trade policies.

Shares of mining company Freeport-McMoRan (FCX 1.58%) have been especially volatile this year. The stock experienced multiple big price swings, with a five-year beta that was unsurprisingly high at 1.63.

3. Consumer staples

Consumer staples stocks usually aren't exceptionally volatile. Consumer staples include the kinds of products people use regularly, such as food and beverages, household products, and personal care products.

But consumer staples ranked as the third-most volatile sector through mid-2025, according to State Street. Rising inflation, which drives companies' costs higher and can push customers to look for less expensive alternatives, can create positive volatility for some consumer staples stocks.

For example, shares of food and beverage giant Coca-Cola (KO 1.27%) have soared in 2025. Coca-Cola usually isn't volatile, though -- its five-year beta is a low 0.41.

Buy-and-Hold Strategy

4. Consumer discretionary

In contrast to the consumer staples sector, the consumer discretionary sector includes businesses that sell products and services that aren't essential to customers. This sector tends to perform well when the economy is strong but falters when the economy is weak.

As you might expect, concerns about tariffs have affected consumer discretionary stocks in 2025. Amazon (AMZN 0.61%) ranks as the largest company in the consumer discretionary sector based on market cap. The prospects of high tariffs on Chinese imports have especially caused investors to worry about Amazon's e-commerce profits.

5. Energy

The energy sector is often volatile because of constantly changing oil and gas prices. This sector includes all companies involved in the extraction, refining, or production of fuels used for energy, such as oil, gas, and coal.

Oilfield services company Haliburton (HAL 3.88%) has been an especially volatile energy stock through early 2025. Its shares fell due to lower oil prices and the corresponding weakness in North American drilling.

Related investing topics

Should you invest?

Are volatile stocks right for you?

If you're a cautious investor who can't stand the thought of seeing the stocks you buy swinging wildly up and down, you'll probably be best avoiding highly volatile stocks. However, as we've seen, even some normally stable sectors can be more volatile at times.

On the other hand, aggressive investors who aren't risk-averse might prefer the excitement that highly volatile stocks offer. Higher volatility can often bring greater returns.

One way to reduce your risk when buying stocks, especially those with higher volatility, is to follow a buy-and-hold strategy. Some stocks that are exceptionally volatile over the short term won't be nearly as volatile over the long term.

It's also important to build a diversified portfolio that includes stocks that span a wide variety of sectors and industries. This approach increases your chances of long-term success.

Finally, manage your position sizes in highly volatile stocks. The number of shares that you buy can make a big difference in how much risk you take on.