Opening an IRA -- and particularly a Roth IRA -- for your children could be an extremely wise financial move. In addition to helping them get a head start on retirement saving, a Roth IRA can be a great way to teach them the basics of investing and help them save for emergencies or college expenses in a tax-advantaged way.

There are a few things you need to know before you open a Roth IRA for your child. You need to make sure your child meets the requirements to contribute to a Roth IRA (even if you're going to contribute on their behalf), know the reasons you might want to consider doing so, and know how to go about actually opening and contributing to an account.

Should I open an IRA for my kids?

If you have minor children, saving for their retirement might seem like a strange idea. But it's not as crazy as it might seem. The earlier a retirement account is started, the more long-term compounding power the money will have.

Let's say you make a $1,000 contribution to your Roth IRA when you're 40. By the time you're 65 and presumably getting set to retire, you can reasonably expect that $1,000 investment to have grown into about $5,400, assuming an annualized 7% growth rate. On the other hand, if your child is 15, that $1,000 could grow to nearly $30,000 by the time they reach that age.

And this is actually a rather conservative rate of return. The S&P 500 has historically generated average returns in the 10% ballpark over long periods.

Taking it a step further, let's say your child is 15 and you contribute the annual maximum to their IRA -- which is $7,000 for both 2024 and 2025. Based on the long-term total return of the S&P 500, this investment could grow to a staggering $821,000 by the time they turn 65. And this is just one year's contribution. Imagine if you max out your kid's Roth IRA contribution for a few years in a row.

Should I open a Roth IRA for my kids?

Now to answer the question: Why a Roth IRA?

A Roth IRA is an after-tax retirement account. That means you don't get a tax deduction for your contributions, but qualified Roth IRA withdrawals will be 100% tax-free.

Here's the key point. Children are generally in the lowest tax brackets (often with no taxable income even if they work part-time) and therefore don't really miss out by not being able to deduct their contributions. To be clear, minors who earn income can contribute to a traditional IRA if they want to, but the tax structure of a Roth IRA typically makes far more sense.

In addition, there are some other good reasons to consider a Roth IRA for your kids. Just to name a few:

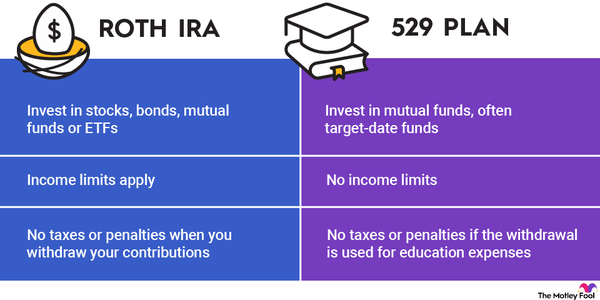

- Roth IRA contributions (but not investment earnings) can be withdrawn at any time without penalty. So a Roth IRA can be a great emergency fund for your kids, in addition to a great retirement savings vehicle.

- IRA funds can be used for college expenses penalty-free. So a Roth IRA can help your kids (or even their kids) pay for college.

- Up to $10,000 in investment earnings from an IRA can be withdrawn tax- and penalty-free for a first-time home purchase. This is in addition to the ability to withdraw any contributions.

Can I open a Roth IRA for my kids?

So far we've discussed why you might want to contribute to a Roth IRA for your kids. But whether parents can contribute to a Roth IRA for a minor is another issue.

There are a couple of basic requirements that need to be met before Americans can contribute to a Roth IRA:

- First, the minor's income needs to be below a certain limit. As you can probably imagine, this is typically not an issue for children. But for the 2024 tax year, the IRS income limit to make a Roth IRA contribution is $161,000 for single tax filers. The limit will increase to $165,000 in 2025. (Note: You can make Roth IRA contributions for each tax year until the tax deadline. In other words, 2024 contributions can be made until April 15, 2025.)

- Second, the annual contribution limit for a minor's Roth IRA in 2024 and 2025 is $7,000, or their total earned income for the year, whichever is lower. Earned income means money from a job or a business you actively participate in -- not interest income, dividends, or other passive sources. This is the requirement that is typically the roadblock for children, especially those without jobs.

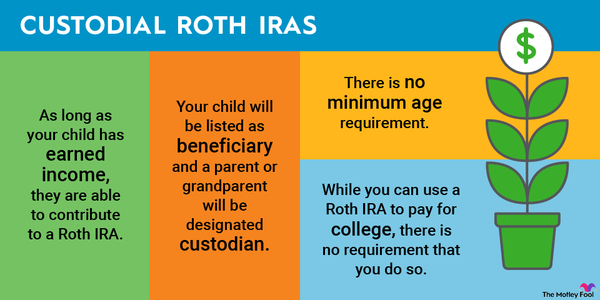

It's important to emphasize that it doesn't necessarily need to be your child's money that is contributed; in other words, as long as your child has enough earned income to justify it, there's no reason you can't make a Roth IRA contribution on your kid's behalf or match some of the money he or she contributes.

What if my child doesn't meet the income requirement?

One of the requirements, as previously mentioned, is earned income. But that does not mean your child necessarily needs to have formal employment. Self-employment income also qualifies as long as it's reported to the IRS.

For example, if your 14-year-old child earns $1,000 mowing lawns in the summer, this income could potentially be used as the basis for qualifying for IRA contributions. Other potential qualifying income sources are babysitting and even chores they do for pay. (Note: I am not a tax professional, and if you're worried about the legality of counting your child's income for IRA purposes, be sure to consult one.)

One caveat is that if you use self-employment income as a basis for qualification, your child may also have to pay self-employment tax on his or her reported income. Even if this is the case, the long-term benefits of Roth IRA investment at such a young age can more than offset this expense. And, according to the IRS, if your kid earns more than $400 for the year, he or she should be reporting self-employment income anyway.

How do I open a Roth IRA for my kids?

If you're ready to take the next steps, find a brokerage that offers Roth IRAs and fill out an account application. You may need to serve as custodian of the account until your child turns 18 since brokerages generally don't allow minors to open their own accounts. At least one broker, Fidelity, has introduced a kid-focused Roth IRA product to make the process as easy as possible for parents, but others are happy to offer Roth IRAs for minors as well.