There's no other retirement savings vehicle quite like the Roth IRA. The Roth IRA rewards those willing to accept deferred gratification since it doesn't give you an upfront tax break but rather a tax-free treatment of your income and gains as long as you keep your investments inside the account. Roth IRAs are also flexible, giving you greater access to your money than traditional retirement accounts.

However, there are a couple of important rules that govern Roth IRAs. In particular, the five-year rule is a set of guidelines that determine the penalty-free and tax-free eligibility of your Roth IRA withdrawals.

What is the Roth IRA five-year rule?

What is the Roth IRA five-year rule?

The Roth IRA five-year rule is a catch-all for three rules that apply to Roth IRAs. If you're not mindful of these rules, you could face penalties and taxes on your withdrawals. The three rules, in brief, are:

- You cannot withdraw earnings from your Roth account within five years of your first contribution to a Roth IRA.

- You cannot withdraw any funds converted to a Roth IRA within five years unless you're over age 59 1/2.

- If you inherited a Roth IRA prior to 2020, you must deplete the funds by the end of the fifth year following the original owner's death unless you're taking required minimum distributions (RMDs).

1. Your first contribution

The first five-year rule states that you must wait five years after your first contribution to a Roth IRA to withdraw your earnings tax-free. The five-year period starts on the first day of the tax year for which you contributed to any Roth IRA, not necessarily the one you're withdrawing from.

So, if you contribute to a Roth IRA for the first time in early 2025 but the contribution is for the 2024 tax year, the five years will end on Jan. 1, 2029.

If you don't meet the five-year rule, that doesn't mean all of your withdrawals will be taxed. You can still withdraw the amounts you contributed without being taxed because the money you put in was an after-tax contribution. Only the growth of the account is potentially subject to income tax.

However, this rule comes as a shock to some people because it supersedes the well-known rule that you must wait until age 59 1/2 to take retirement account withdrawals without taxes and penalties. That means, even if you're older than 59 1/2 when you withdraw, some of your withdrawal could be included in taxable income, thanks to this five-year rule.

You won't owe the 10% penalty in that case. But you will still owe tax on any withdrawals above the amount contributed.

2. Roth conversions

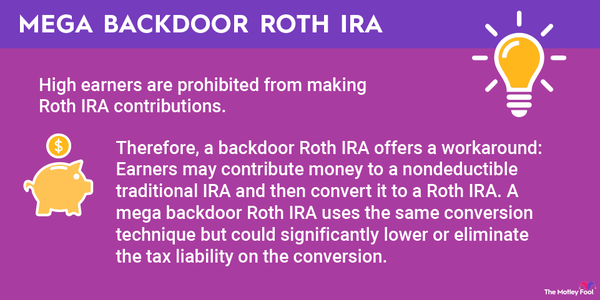

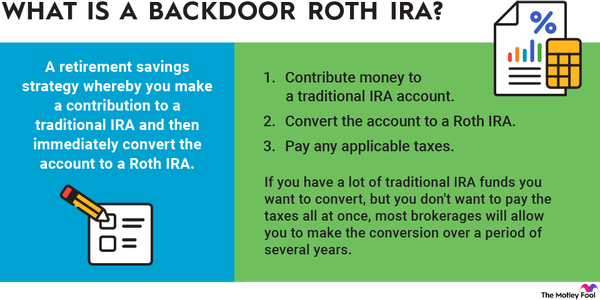

There's also a separate five-year rule that applies only to those who convert other types of retirement accounts into Roth IRAs. The idea of this rule is to prevent people from using Roth conversions to get penalty-free access to their traditional retirement accounts before age 59 1/2. The rule doesn't apply if you're over that age.

This five-year rule also starts the clock on January 1 of the year you do the conversion. As a result, those who convert late in the year have to wait only a bit longer than four years before taking withdrawals.

However, this five-year rule is different in that it applies separately to each Roth conversion you do. Each new conversion starts its own five-year clock, and you'll need to account for multiple conversions to make sure you don't take out too much money too soon.

Note that the five-year rule applies equally to Roth conversions for both pre-tax and after-tax funds in a traditional IRA. That means if you're using the backdoor Roth IRA strategy every year, your "Roth contributions" are really conversions, and you can't withdraw them for five years without penalty.

3. Inherited IRAs

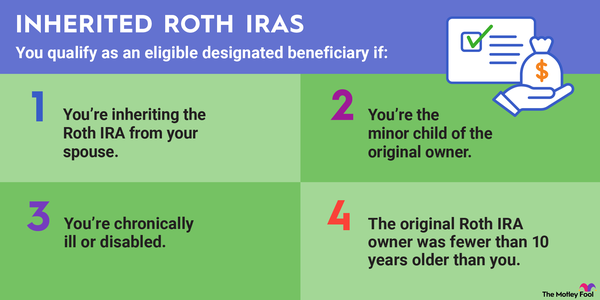

If you inherit a Roth IRA from someone other than your spouse, you have a couple of options for withdrawing the funds. You have 10 years to deplete the inherited IRA, but RMDs may be necessary.

The 10-year rule applies only to Roth IRAs inherited from someone who died after 2019, per the SECURE Act rules. For Roth IRAs inherited from someone who died in 2019 or earlier, the pre-SECURE Act rules apply.

In the latter case, the 10-year rule is a five-year rule, meaning the account must be depleted by the end of the fifth year unless the beneficiary is taking annual distributions based on their life expectancy.

Inherited IRAs are also subject to the first-contribution five-year rule. So, if it's been less than five years since the owner's initial contribution to a Roth IRA, the earnings are subject to taxes. Keep that in mind if you want to withdraw a lump sum early.

Penalties for breaking the rule

Penalties for breaking the five-year rule

- Your first contribution: Withdrawing funds from a Roth IRA less than five years after your first contribution requires account holders to pay taxes on the earnings portion of the withdrawals. However, Roth IRA withdrawals prioritize contributions before earnings. That means you may be able to make the withdrawal less than five years after your initial contribution, but still tax-free if you have enough cumulative contributions to cover the amount.

- Roth conversions: If you withdraw money from a converted Roth IRA within the first five years after the conversion, you'll have to pay a 10% penalty on any withdrawals. That includes withdrawals of the amount you initially converted, even though you've already paid taxes on that amount. However, you can still use other exceptions to the 10% penalty rules in a Roth conversion situation. In particular, if you're older than 59 1/2, the age exception applies, and you can immediately take withdrawals without worrying about the penalty.

- Inherited IRAs: If you fail to withdraw 100% of the funds from an inherited IRA by the end of the fifth year following the owner's death (for IRAs inherited from someone who died in 2019 or earlier) or the 10th year (if the death occurred in 2020 or later), the remaining balance is subject to a 25% penalty. The penalty is reduced to 10% if corrected within two years.

Exceptions to the rules

Exceptions to the five-year rules

Unfortunately, there's no way around establishing a Roth IRA for five years before you can withdraw earnings tax-free. However, the IRS does provide a list of exceptions to the five-year rule on Roth conversions and the early withdrawal penalty.

First-time home purchases

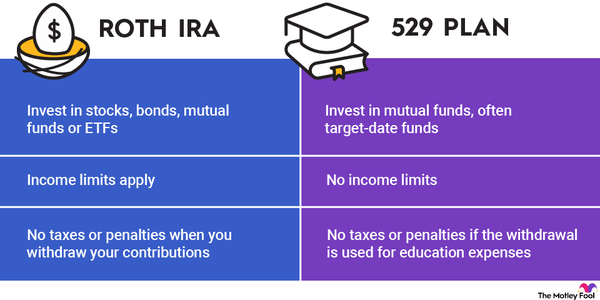

Investors can withdraw up to $10,000 from their Roth IRA earnings for a first-time home purchase. The IRS defines a first-time homebuyer as anyone who has not owned a principal residence in the past two years. You can also use the funds to help a family member buy their first home.

Qualified higher education expenses

You can use your Roth IRA to pay for higher education expenses for yourself, a spouse, a child, or a grandchild. Qualifying expenses include tuition, fees, books, and room and board.

Medical expenses

If you lose your job and health insurance, you can use funds from your Roth IRA to pay for your insurance premiums while you're unemployed. Additionally, if you have unreimbursed medical expenses exceeding 7.5% of your adjusted gross income, you can cover them with funds from Roth conversions without worrying about the five-year rule.

Related investing topics

Don't let the five-year rule bite you

Even with these rules, Roth IRAs are a great way to save for retirement. All it takes is a little awareness of the pitfalls of running afoul of the five-year rule, and you'll be able to avoid any adverse consequences for your retirement savings strategy.

FAQs

Roth IRA Five-Year Rule FAQs

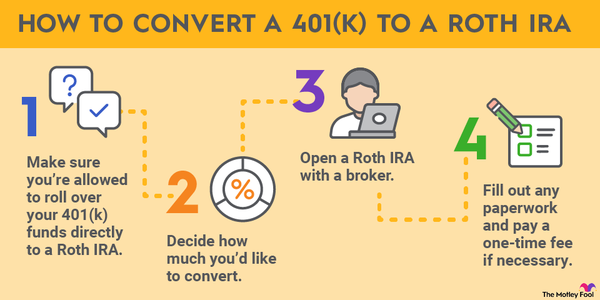

Does rolling a Roth 401k to a Roth IRA restart the 5-year rule?

If you've already established the Roth IRA five or more years ago with an initial contribution, you don't have to wait five years from rolling over a Roth 401(k) to withdraw funds. If you've never had a Roth IRA before, you'll start a new five-year clock upon establishing one with the Roth 401(k) rollover.

Can I cash out my Roth IRA?

You can always cash out your Roth IRA, but doing so before retirement isn't advisable. You may be subject to taxes and penalties on at least a portion of your withdrawal if you're younger than age 59 1/2 and/or you fail the five-year rule.

Can I withdraw money from my Roth IRA and put it back?

Technically, you can withdraw funds from your Roth IRA and put them back in without penalty or taxes as long as you return the funds within 60 days. This acts as an IRA rollover, and you may only do so once in any 12-month rolling period. If you fail to return the money within 60 days, you may be subject to taxes or penalties, and you won't be able to return the funds.