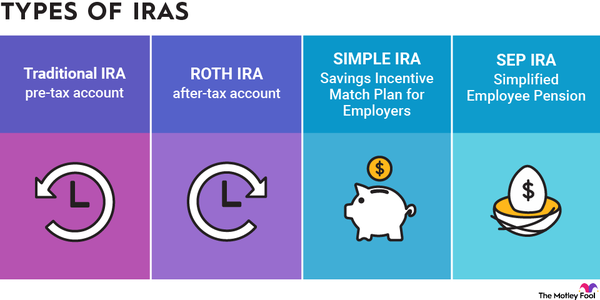

Depending on your situation, the benefits of a traditional IRA might be worth more to you than the benefits of a Roth IRA. It's worth taking a bit of time to decide between the two. To help you out, here is a guide to the main benefits of IRA investing and traditional IRAs in particular.

The main benefits of a traditional IRA are the tax deduction for contributions, the tax-deferred investment compounding, and the ability to invest in virtually any stock, bond, or mutual fund you want.

Benefits of having an IRA

First, let's briefly look at the benefits of having an individual retirement account, or IRA.

IRAs (of all types) enjoy certain tax advantages that can make them excellent places to save and invest for retirement. In a nutshell, while investments like stocks, mutual funds, and ETFs are held in an IRA, they are exempt from taxation.

For example, if you own a stock in a standard brokerage account and you get a dividend, that dividend is considered taxable income. If you own the same stock in an IRA and it pays you a dividend, it is not included in your taxable income. The same is true if you sell an investment you hold in an IRA at a profit. Even if you invest $5,000 in a stock and it eventually rises to $1 million in value, the IRS can't touch a cent as long as the money remains in your IRA.

Example of IRA tax advantages

This can make a big difference when it comes to long-term compounding. Consider this simplified example:

You deposit $1,000 into a traditional brokerage account and invest in a stock you like. In five years, the stock is worth $3,000, so you sell. If you're in the 15% capital gains tax bracket, you'd owe $300 in federal income tax on the profit, leaving you $2,700 to reinvest. Now, let's say that investment triples in another five years, giving you an account value of $8,100. You'd owe another $810 in capital gains tax on this sale, giving you an ending value of $7,290.

Meanwhile, the same investments in an IRA would be worth more at the end. You would have been able to reinvest the full $3,000 in proceeds from the first, and the second would have grown to $9,000. And no capital gains tax would be due if you left the money in the account.

Obviously, this is a simplified example. You generally don't invest in just one stock, for instance. But the point is that investing in an IRA can help your retirement nest egg grow faster than it otherwise would be able to.

Benefits of an IRA vs. a 401(k)

There are also some big advantages to using an IRA as opposed to a 401(k).

- An IRA allows you to invest in virtually any stocks, bonds, mutual funds, or ETFs you want, as opposed to limiting you to a small menu of investments.

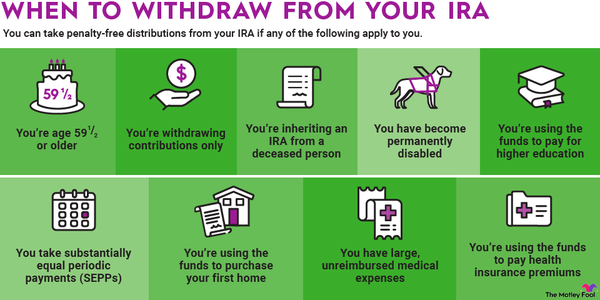

- An IRA has some early-withdrawal exceptions that don't apply to a 401(k), such as the ability to take money out to pay for college or to use toward a first-time home purchase.

Traditional IRA tax benefits

The tax structure of a traditional IRA is its main difference from a Roth IRA, and it can be a great benefit for people looking to reduce their taxable income right away.

A traditional IRA is known as a tax-deferred account. This means that the money you contribute to a traditional IRA can be tax-deductible in the year the contributions are made, if you qualify.

So do you qualify for the traditional IRA tax deduction? If you (and your spouse, if applicable) don't have a retirement plan available through your employer, you can take advantage of the deduction no matter how much you make. On the other hand, if you have a retirement plan at work, the ability to take the deduction is income-limited.

With that in mind, here are the traditional IRA deduction income limits for the 2024 tax year:

| Tax Filing Status in 2024 | Your 2024 AGI Must Be Lower Than This for a Full Deduction | Your 2024 AGI Must Be Lower Than This for a Partial Deduction |

|---|---|---|

| Single or head of household | $77,000 | $87,000 |

| Married filing jointly | $123,000 | $143,000 |

| Married filing separately | $0 | $10,000 |

For 2025 contribution and deduction purposes, here are the adjusted gross income (AGI) thresholds:

| Tax Filing Status in 2025 | Your 2025 AGI Must Be Lower Than This for a Full Deduction | Your 2025 AGI Must Be Lower Than This for a Partial Deduction |

|---|---|---|

| Single or head of household | $79,000 | $89,000 |

| Married filing jointly | $126,000 | $146,000 |

| Married filing separately | $0 | $10,000 |

If you're married and your spouse has an employer-sponsored retirement plan, but you don't, the 2024 AGI limits are $230,000 for a full deduction and $240,000 for a partial deduction, assuming you file a joint tax return. For the 2025 tax year, these AGI thresholds are $236,000 and $246,000, respectively.

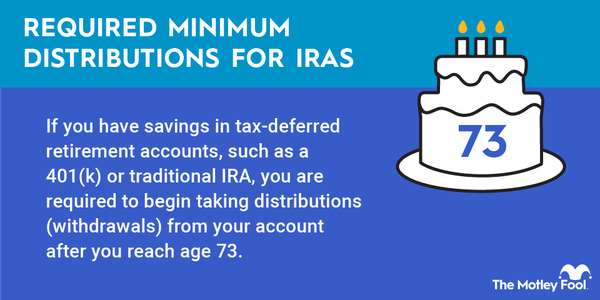

The potential downside is that while your traditional IRA contributions can be tax-deductible, withdrawals from a traditional IRA are considered taxable income at whatever your then-current marginal tax rate, or tax bracket, ends up being.

Related retirement topics

Foolish bottom line

The biggest question to ask yourself when trying to decide if a traditional IRA or Roth IRA is best for you (from a tax perspective, at least) is when you want your tax benefit -- now or after you retire. Remember, Roth IRA contributions aren't deductible, but qualified withdrawals are tax-free. If you're in a relatively low tax bracket now, you're probably going to save more money in the long run with a Roth IRA.

But if you're in a moderate-to-high tax bracket right now, and qualify for the traditional IRA tax deduction, the immediate tax savings of traditional IRA contributions could be the better way to go.

The Motley Fool has a disclosure policy.