More than one-third of Americans have an individual retirement account (IRA). In case you're not among them, we'll discuss how to open an IRA, the different types of IRAs, and whether an IRA is right for you.

How to open an IRA

Retirement planning can be complicated enough. You may have income from Social Security, a 401(k) or pension plan, and investments in retirement. Think of an IRA as another layer of financial security for your retirement portfolio.

An individual retirement account is simply an investment account that allows you to build up a retirement nest egg and either make pre-tax contributions or tax-free withdrawals, depending on the type of IRA you choose and when you withdraw the money. They're similar to many employers' 401(k) plans, but they give you much more freedom to chart your own retirement planning adventure.

Here's how to open an IRA in five easy steps.

Step 1: Decide how you want to be guided

Some investors are content to use an online robo-advisor that can walk them through the process, while others prefer a human to answer very specific questions.

Step 2: Figure out where you want to open your IRA

A brokerage is the most common place to set up an account, although most banks, credit unions, mutual fund providers, and other investment companies can help you. Most institutions offering IRAs allow you to set one up online. You'll want to ask about fees. Some providers charge setup, transaction, or monthly maintenance fees.

Step 3: Choose the type of IRA you want

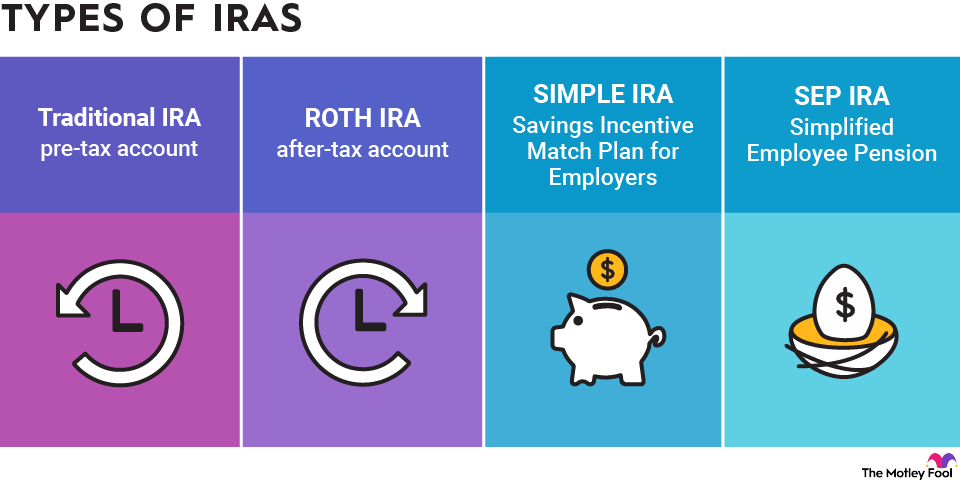

Your choice will be based on your personal investing preferences and unique financial situation, current and future. There are currently four types of IRAs:

- Traditional IRA: Deposits may be tax-free, depending on your income and whether you're covered by a workplace plan, but withdrawals are taxed.

- Roth IRA: Deposits are taxed, but withdrawals are tax-free once you're 59 1/2 and you've had the account for at least five years. However, you can take tax- and penalty-free withdrawals of contributions (but not earnings) at any time.

- SIMPLE IRA: These are designed for small businesses without an existing retirement plan.

- Simplified employee pension plan (SEP-IRA): This IRA allows employers to make contributions to an IRA for themselves and their employees.

Although most IRAs give you almost unlimited freedom of investment choices, the IRS sets annual IRA contribution limits that vary depending on the type of retirement account and your age.

Step 4: Decide how much you want to invest

The ideal amount is the maximum allowed with your specific type of IRA, deposited early in the year to allow compounding more time to work its magic. Unfortunately, we can't all do that. Try to set up an automatic weekly, biweekly, or monthly contribution that doesn't prevent you from paying off high-interest credit cards and loans or from maintaining an emergency fund.

Step 5: Open your IRA

Again, most financial institutions can walk you through the process from their website. It's also possible to walk into a bank, credit union, or brokerage and ask for help setting up a retirement account. As a general rule, financial institutions are only too happy to help you with your deposit.

You shouldn't need much in the way of identification; a Social Security number and government-issued identification are usually enough. If you're transferring money from an account to a bank or brokerage offering the IRA, you'll also need your relevant banking information, including bank routing and account numbers.

Pros and cons of different IRAs

Let's break down the advantages and disadvantages of the four major types of IRAs.

Traditional IRA

The biggest benefit of a traditional IRA is that if you qualify to deduct your contributions, taxes are applied only when you make withdrawals. And since taxes aren't being applied (yet), your money has more opportunity to grow via the miracle of compound earnings. It's worth noting that many people retire in a lower tax bracket than when they were working, resulting in a minimal tax bill during retirement.

If you're younger than 50, you can contribute $7,000 annually in 2025 and $7,500 in 2026. If you're older, the contribution limit jumps to $8,000 in 2025 and $8,600 in 2026. You can also convert your traditional account to a Roth IRA, but you'll owe taxes on the converted amount. (You can't, however, convert a Roth IRA to a traditional IRA.)

If you're an active participant in a workplace retirement plan, your income must fall below a certain amount to deduct your contributions. Because you'll owe taxes and potential penalties (if you're younger than 59 1/2) on withdrawals, it's difficult to use a traditional IRA for emergencies.

Finally, required minimum distributions (RMDs) must begin by age 73, or you'll be penalized. Under the Secure Act 2.0 rules, the RMD age will increase to 75 in 2033.

Roth IRA

One of the biggest advantages of a Roth IRA is its tax structure. Since you're funding it with income that's already been taxed, withdrawals -- and any growth in the account -- are tax-free. And since you've already paid taxes, distributions from a Roth IRA won't affect your adjusted gross income. You can also contribute to a Roth IRA even if you're participating in a qualified retirement plan.

You can withdraw Roth IRA contributions at any time without owing taxes or a penalty. But you'll owe taxes and penalties if you eat into the account's earnings before age 59 1/2 or when the account isn't at least five years old.

The most obvious disadvantage of a Roth IRA is that your contributions aren't tax-deductible. Your ability to contribute to a Roth IRA also depends on certain income limits.

Tax Deduction

A Roth IRA can also be problematic when it comes to state income taxes, which must be paid in the year that the contributions were earned. This can be particularly annoying when relocating from a state with a high tax rate to one with a lower state income tax rate.

SIMPLE IRA

The Savings Incentive Match Plan for Employees Individual Retirement Account (SIMPLE IRA) was designed as an IRA for small businesses and self-employed workers. Similar to more well-known plans, such as a 401(k), the SIMPLE IRA offers employers with fewer than 100 workers a simpler administrative route to helping their workers save for retirement.

The SIMPLE IRA's biggest selling points are its tax advantages and simple administration. Employees aren't required to make contributions if one is offered, and workers can make direct rollovers from an IRA, 401(k), or similar plan. If the business grows to include more than 100 employees, it can continue offering a SIMPLE IRA for two years.

Contribution limits are also greater than those for standard traditional or Roth IRAs. Workers younger than 50 can contribute as much as $16,500 (2025) or $17,000 (2026). However, in some circumstances, like if the business employs 25 or fewer people, higher limits of $17,600 (2025) and $18,100 (2026) apply.

Employees 50 to 59 or older than 64 can add catch-up contributions of $3,500 (2025) or $4,000 (2026). Workers between the ages of 60 and 63 can make $5,250 in catch-up contributions in both 2025 and 2026.

For self-employed workers, the SIMPLE IRA offers much less red tape and hassle while keeping the tax advantages of an IRA -- with higher contribution limits than traditional or Roth IRAs, to boot.

Not all small businesses are likely to love SIMPLE IRAs, though. The employer can either match employee contributions up to 3% or contribute a flat 2% compensation for workers who make more than $5,000.

SEP-IRA

A Simplified Employee Pension (SEP) IRA has a few key wrinkles that make it different from other retirement accounts. It's created by an employer that benefits from tax breaks by making employee contributions.

One of the biggest advantages involves annual contribution limits. Employers can contribute as much as 25% of a worker's salary, or $70,000 in 2025 and $72,000 in 2026.

There's no favoritism, as employers are required to contribute the same percentage of income for all employees. However, only the first $280,000 of income in 2025 and $290,000 in 2026 can be used to calculate a SEP IRA contribution.

From an employer's perspective, the SEP-IRA allows them to respond to changing business conditions. Contribution amounts can vary from year to year as long as they're equal for all employees.

However, the SEP-IRA has a few downsides. Workers can't contribute to the plan through salary deferrals. Employers must include all eligible employees who have worked for the company for three of the last five years. Catch-up contributions for older employees aren't allowed.

Rolling over your IRA

For better or worse, fewer of us work at the same place for our entire careers. Many of us, however, have defined-contribution retirement plans, such as a 401(k). It's usually possible to keep that money in the same account when you leave a job, but why would you want to? Instead, you can roll over the money into a new account, whether a new employer sponsors it or it is one you set up yourself.

About the only complication involved in rolling over an IRA (or another retirement account) is the IRS rule that the money must be transferred within 60 days of leaving your job or closing an account. Otherwise, it will be treated as a distribution, which means it's subject to taxes and penalties.

Beyond that, it's simple and doesn't result in new taxes: Call your employer or financial institution and request a "trustee-to-trustee" transfer to the new provider.

Related investing topics

Is an IRA right for you?

It's almost always a good idea to open an IRA if -- like most of us -- you'd like a comfortable retirement. Saving for retirement should be a priority, but as with any investment decision, you'll first want to make sure your high-interest credit cards and loans are paid down and you've created a rainy-day fund for emergency expenses, such as a major medical bill or job loss.

However, once you've got your financial house in order, the question isn't whether or when to open an IRA. It is nearly always beneficial, and the best time is always now. The only major question is what type of IRA you want to open to ensure your retirement is well financed.