How does a Keogh plan differ from other retirement plans?

Although there are similarities, there are also important differences between Keogh plans and other retirement plans for the self-employed:

- Keogh plans provide a higher limit for tax-deductible contributions than several other plan types, including traditional IRAs and Roth IRAs.

- Keogh plans come with more administrative paperwork and higher costs than other plan types. This can include initial setup fees associated with the creation of your plan documents that can add up to several thousand dollars, as well as annual administration fees

- Anyone with earned income can contribute to a traditional or Roth IRA (provided they fall within income limits), but Keoghs are limited to self-employed individuals and unincorporated businesses

Pros and cons of having a Keogh plan

Keogh plans provide flexibility in how they are structured, with a choice of a defined benefit plan or one of several types of defined contribution plans including a profit-sharing plan or money purchase plan. They also enable higher tax-deductible contributions, so highly compensated individuals may prefer them to other alternatives.

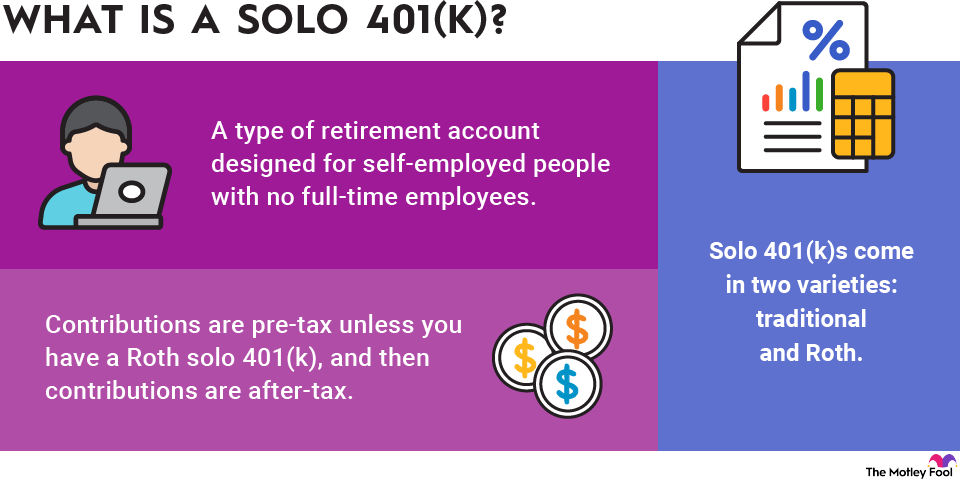

However, the major downside of a Keogh plan is the substantial administrative burden, including the requirement to file an annual Form 5500 with the IRS, and the costs of establishing and maintaining a plan can be higher. Before determining a Keogh plan is right for you, you should consider a SEP-IRA, SIMPLE IRA, Solo 401(k) or traditional or Roth IRA.