Types of risk tolerance

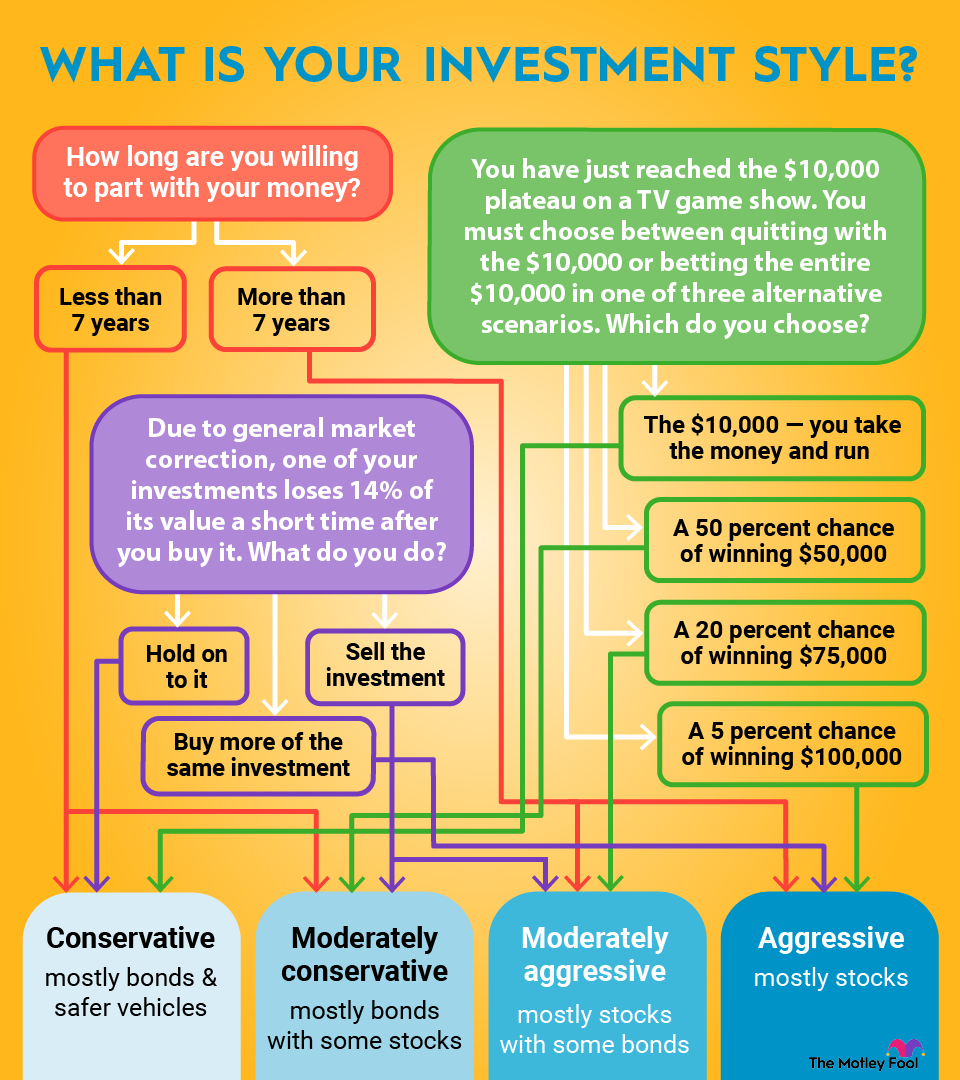

Risk tolerance is roughly grouped into three categories:

High risk tolerance

People who can tolerate a lot of risk, often called aggressive investors, take big chances but also often see big payoffs. These people might choose a lot of start-ups with high growth potential, cryptocurrencies, or other highly risky assets because they can handle the emotional rollercoaster that comes with them.

Moderate risk tolerance

Many people fall into the moderate risk tolerance category. They can handle some risk, but they balance that risk with safety, so they know that if their risky assets fall through the floor, they will still be fine. They have moderate expectations, buy a variety of different asset classes, and may experiment with lots of different investment types.

Low risk tolerance

Investors with low risk tolerance can't afford or bear to lose much or any money. This isn't a flaw; it's often a function of a stage of life. Retirees, for example, can't really risk their nest eggs, as they have fewer opportunities to replace that money and should be very cautious. They might choose to invest in index funds, certificates of deposit (CDs), or large-cap stocks.