Dividend stocks are shares of companies that make regular distributions to their shareholders, usually in the form of cash payments. Dividend stocks can be a useful source of income, but the best dividend stocks can also be an excellent way to build wealth over the long term.

However, not all dividend stocks are great investments, and many investors are unsure how to start their search. With that in mind, here's a list of dividend-paying stocks you might want to consider and some of the most important things to look for in the top dividend stocks.

How to buy dividend stocks

If you want to buy shares of any dividend stock, here's what you need to do.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Nine best dividend stocks

The Dividend Kings list is a great place to find top dividend stocks. These companies have paid and raised their base dividends for at least 50 consecutive years. The Dividend Achievers list, whose companies boast 10-plus straight years of dividend increases, is a trademarked property owned by Nasdaq and another great list to research. Here are nine top dividend stocks to consider buying now.

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Lowe's Companies (NYSE:LOW) | $138.6 billion | 1.90% | Specialty Retail |

| Realty Income (NYSE:O) | $52.8 billion | 5.62% | Retail REITs |

| Chevron (NYSE:CVX) | $312.5 billion | 4.41% | Oil, Gas and Consumable Fuels |

| Target (NYSE:TGT) | $46.9 billion | 4.36% | Food and Staples Retailing |

| Starbucks (NASDAQ:SBUX) | $98.6 billion | 2.83% | Hotels, Restaurants and Leisure |

| Brookfield Infrastructure (NYSE:BIPC) | $5.8 billion | 3.90% | Gas Utilities |

| Microsoft (NASDAQ:MSFT) | $3.6 trillion | 0.70% | Software |

| American Express (NYSE:AXP) | $260.5 billion | 0.87% | Consumer Finance |

| Clearway Energy (NYSE:CWEN) | $3.8 billion | 5.53% | Independent Power and Renewable Electricity Producers |

1. Lowe's

NYSE: LOW

Key Data Points

Home improvement giant Lowe's (LOW +0.26%) may not seem like a very exciting stock. And that's true -- unless you like dividend growth. The company has raised its dividend almost every year since going public in 1961 and has raised the payout by more than 300% over the trailing decade alone.

Investors worried about the housing downturn shouldn't fret. When the housing supply is tight, homes are harder to buy, and people tend to spend more to upgrade their existing homes. So any cyclical weakness in its results will likely return to growth over the long term, even if short-term shifts in consumer spending cause an overall slowdown in renovations.

2. Realty Income

NYSE: O

Key Data Points

3. Chevron

NYSE: CVX

Key Data Points

For years, Chevron (CVX -0.86%) has been a solid stock to own and a big winner for investors, especially for dividend investors. It has maintained a steady track record of generating strong cash flows and growing payouts modestly every year for 38 years and counting.

The stock price can fluctuate with oil prices, and Chevron has been part of the volatility trend afflicting many oil stocks recently. Still, Chevron has proven to be a profitable investment for dividend-seekers over the long term.

4. Target

NYSE: TGT

Key Data Points

NASDAQ: SBUX

Key Data Points

Over the past four decades, Starbucks (SBUX -3.15%) has established itself as the dominant global brand in coffee beverages.

With more than 40,000 global stores, as well as Starbucks-branded ready-to-drink beverages and packaged coffee in hundreds of thousands more locations, nobody sells -- or buys -- more coffee than this company.

6. Brookfield Infrastructure

NYSE: BIPC

Key Data Points

NASDAQ: MSFT

Key Data Points

Microsoft (MSFT +1.04%) is one of the most important software companies on the planet. Over the past decade, it has rebuilt its business to focus on recurring subscription-based revenue that keeps its customers connected and the cash flowing.

Its yield of less than 1% at recent prices hasn't put it on many dividend investors' radars. But what it hasn't paid in yield, Microsoft has absolutely delivered, with total returns of more than 3,000% since 2009 and dividends accounting for a portion of those total returns.

8. American Express

NYSE: AXP

Key Data Points

9. Clearway Energy

NYSE: CWEN

Key Data Points

Dividend investors should focus not on dividend size but on dividend yield.

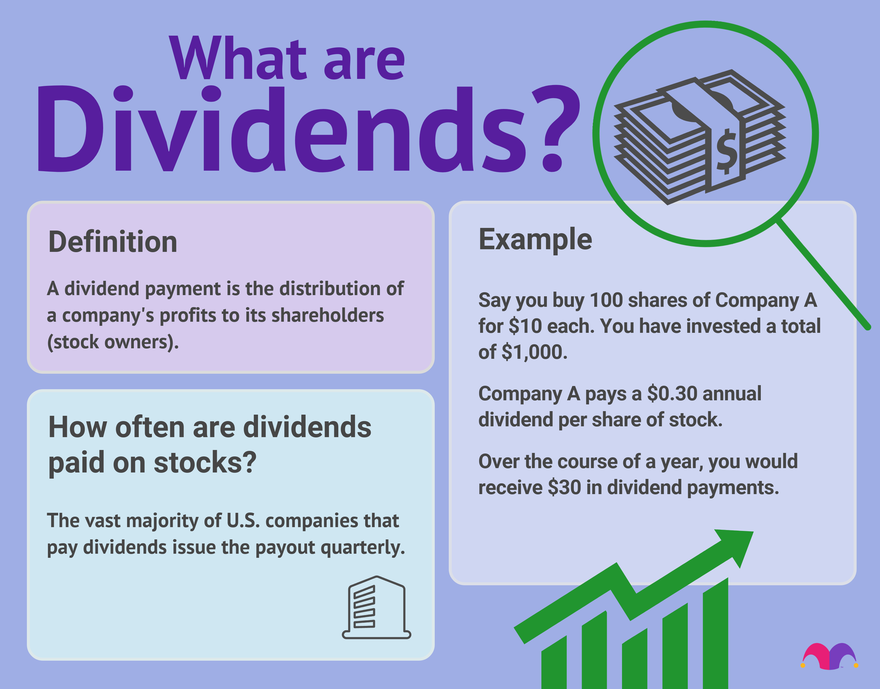

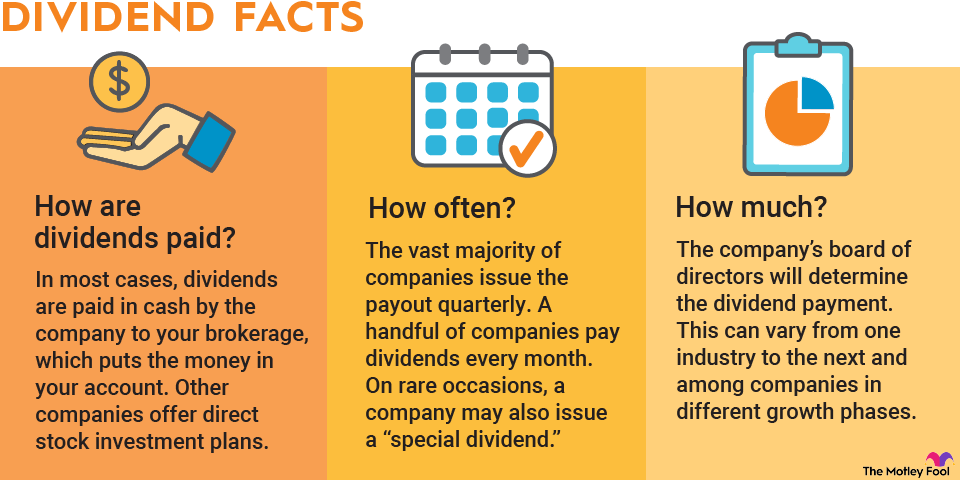

How dividends are paid to shareholders

Dividends are paid to shareholders in one of two main ways: cash or stock. Cash dividends are the most common and are typically deposited directly into a shareholder's brokerage account, sent as a physical check, or automatically reinvested into more shares through what's known as a dividend reinvestment plan (DRIP).

As the name suggests, stock dividends are paid in the form of additional shares of the company's stock.

Benefits and risks of investing in dividend stocks

There are numerous key benefits to putting cash into dividend stocks. Dividends provide regular, passive cash flow, which can be particularly attractive whether you’re a retiree or earlier on in your investing journey and simply seeking supplemental income.

Companies that pay consistent dividends tend to have stocks that are generally less volatile than non-dividend-paying growth stocks. And, reinvesting your dividends to purchase more shares can significantly boost your long-term returns through the power of compounding. This can accelerate your wealth accumulation over time.

On the flip side, there are some risks to be aware of. Companies that pay large dividends may reinvest less of their profits back into the business for expansion or research and development, which can result in slower capital appreciation compared to growth stocks.

When interest rates rise, fixed-income alternatives like bonds become more attractive. This can cause investors to sell dividend stocks and put downward pressure on their prices. Bear in mind, dividends are typically a taxable event in non-retirement accounts, even if you reinvest them through a DRIP.

How to choose dividend stocks

This article hits on a few things to avoid (e.g., focusing too much on a high yield that may be a trap) and the power of dividend growth stocks as some of the best winners. Here are some key things to look for when investing in dividend stocks.

- Identify dividend stocks that meet your criteria. You may be looking for yield, history of dividend growth, or something different.

- Research the history of earnings growth. Dividend growth is sustainable only if a company's earnings have also steadily grown at a similar or higher rate over time.

- Consider valuation. While paying a modest premium for a high-quality business can sometimes be justified, overpaying can significantly weigh on long-term returns.

- Determine position sizing. Consider how much exposure you want to a particular stock, how much income you expect it to generate, and other factors to ensure you buy an appropriate amount.

- Focus on the long term. Dividend stocks deliver best when you buy and hold them for many years. Having patience and letting exceptional managers run great companies while you just sit back and own them is how you get the best returns from dividend stocks.

Dividend stocks versus dividend funds

Dividend stocks and dividend funds are both popular ways to generate income and potentially grow your investments.

- Dividend funds, such as mutual funds and exchange-traded funds (ETFs), invest in a portfolio of multiple dividend stocks.

- Dividend funds can offer diversification and professional oversight by investment managers who carefully select the underlying stocks.

- With a dividend fund, it's important to pay attention to the expense ratio to determine how much of your investment may go toward fees.

Both types of investments can offer advantageous returns for a long-term investor with a well-diversified portfolio and a durable time horizon.

Related investing topics

Best sectors for dividend investing

Dividend investors often prefer to focus on companies in a range of sectors with stable cash flows and predictable earnings. The best sectors can offer different advantages, from high yields to steady dividend growth.

However, the right mix really does depend on your investment goals. The utilities, energy, healthcare, consumer goods, and financial sectors contain some of the top dividend-paying companies to consider.