The marijuana industry is expected to expand at a compound annual growth rate of 34% through 2030, and many investors are seeking to profit. As states and entire countries decriminalize or legalize cannabis and/or its components, there are growing opportunities for entrepreneurs and existing companies. This is especially true with the U.S. Drug Enforcement Administration (DEA) moving to reclassify marijuana from a Schedule 1 controlled substance (no accepted medical use and a high potential for abuse) to Schedule 3 (drugs that have moderate to low potential for physical and psychological dependence).

As with any nascent industry, there are also plenty of investment risks. Whether you're a first-time investor or a seasoned veteran, it pays to understand how this industry works. This guide will get you up to speed quickly and includes our picks for the top marijuana stocks.

Best marijuana stocks for 2025

1. Green Thumb Industries

OTC: GTBIF

Key Data Points

Green Thumb (GTBIF -3.21%) ranks among the largest cannabis companies in the U.S. It operates more than 100 retail cannabis dispensaries and 20 manufacturing facilities across 14 states.

The company has been profitable on an annual basis since 2020. It continues to deliver revenue growth and maintains a strong balance sheet even with headwinds in the economy and the cannabis industry. Green Thumb should have plenty of growth potential over the long term as the U.S. cannabis market expands.

For now, Green Thumb's shares can only be bought and sold on over-the-counter (OTC) markets in the U.S. However, if federal cannabis restrictions are lifted, the stock could be listed on major U.S. stock exchanges. This would almost certainly be a huge catalyst for Green Thumb.

Over-the-Counter (OTC)

2. Trulieve Cannabis

Trulieve Cannabis (TCNNF -2.42%) is the largest cannabis retailer in the U.S. It operates over 230 retail cannabis stores in nine states, with 15 processing facilities in six states.

The company dominates the market in its home state of Florida. It also claims market-leading positions in Arizona and Pennsylvania. Support for legalizing recreational marijuana failed to achieve the required 60% threshold in Florida's 2024 elections. However, with almost 56% of the state's voters favoring legalization, Trulieve could still have a significant growth opportunity if the state legalizes recreational marijuana in the future.

Like Green Thumb, Trulieve's shares can currently only be traded on OTC markets in the U.S. The stock will likely be a big winner if federal marijuana reforms allow U.S. stock exchanges to list the shares of cannabis companies that operate in the U.S.

3. Innovative Industrial Properties

NYSE: IIPR

Key Data Points

U.S. cannabis companies can't easily secure capital from banks or financial institutions since marijuana remains illegal at the federal level. Innovative Industrial Properties (IIP) (IIPR -1.44%) helps solve the cash shortage for growing marijuana companies. It buys properties owned by U.S. medical cannabis operators and leases the properties back to them. The sale to IIP provides the cannabis operator with much-needed cash, and the lease agreements create a steady revenue stream for IIP.

Innovative Industrial Properties has grown significantly in recent years and now owns more than 100 properties in 19 states. The company continues to generate solid revenue and earnings powered by its sale-leaseback business model, even with some of its tenants facing financial challenges. Because IIP is organized as a real estate investment trust (REIT), it returns at least 90% of its taxable income to shareholders.

In some ways, IIP wouldn't benefit as much from federal cannabis reform as other companies. Its shares already trade on the New York Stock Exchange (NYSE). If traditional banking services were available to U.S. cannabis operators, IIP could face increased competition. However, federal reforms would likely cause the U.S. cannabis market to expand -- which should work in IIP's favor.

Revenue

4. Quest Diagnostics

NYSE: DGX

Key Data Points

Quest Diagnostics (DGX -0.91%) might be a surprising pick to include in a list of marijuana stocks. It's one of the world's largest providers of laboratory testing services.

How does Quest tie in with the cannabis industry? The widespread legalization of marijuana in states across the U.S. is driving increasing demand for drug testing in the workplace. Quest offers drug testing services and is certified by the U.S. Department of Health and Human Services for federally mandated drug testing of workers in some safety-sensitive fields.

Quest could be an attractive stock for more risk-averse investors who want to profit from the legalization of cannabis. It has a long track record of success and is consistently profitable.

5. Turning Point Brands

NYSE: TPB

Key Data Points

Turning Point Brands (TPB +2.19%) is a leading supplier of smoking accessories and oral tobacco. Its products include Zig-Zag rolling papers, Clipper lighters, and Stoker's and Beechnut tobacco products.

The company has significant growth opportunities due to the legalization of cannabis in the U.S. Turning Point Brands estimates an addressable market of around $200 million in the alternative market for headshops and cannabis dispensaries.

Marijuana stocks overview

Let's cover some of the basics you need to know before investing in marijuana stocks.

- The marijuana industry is divided into three broad categories. Marijuana growers and retailers cultivate and package cannabis products and sell them to consumers. Biotechnology companies develop and market cannabis-based pharmaceutical drugs. Ancillary marijuana businesses provide products and services to cannabis companies without touching the plant.

- Cannabis can be medical or recreational. Medical cannabis patients use cannabis or cannabis extracts to treat health conditions and have recommendations or cannabis prescriptions from physicians. Recreational cannabis users purchase marijuana or cannabis extracts purely for enjoyment and must be 18 or older and living in a jurisdiction where recreational use of the plant is legal.

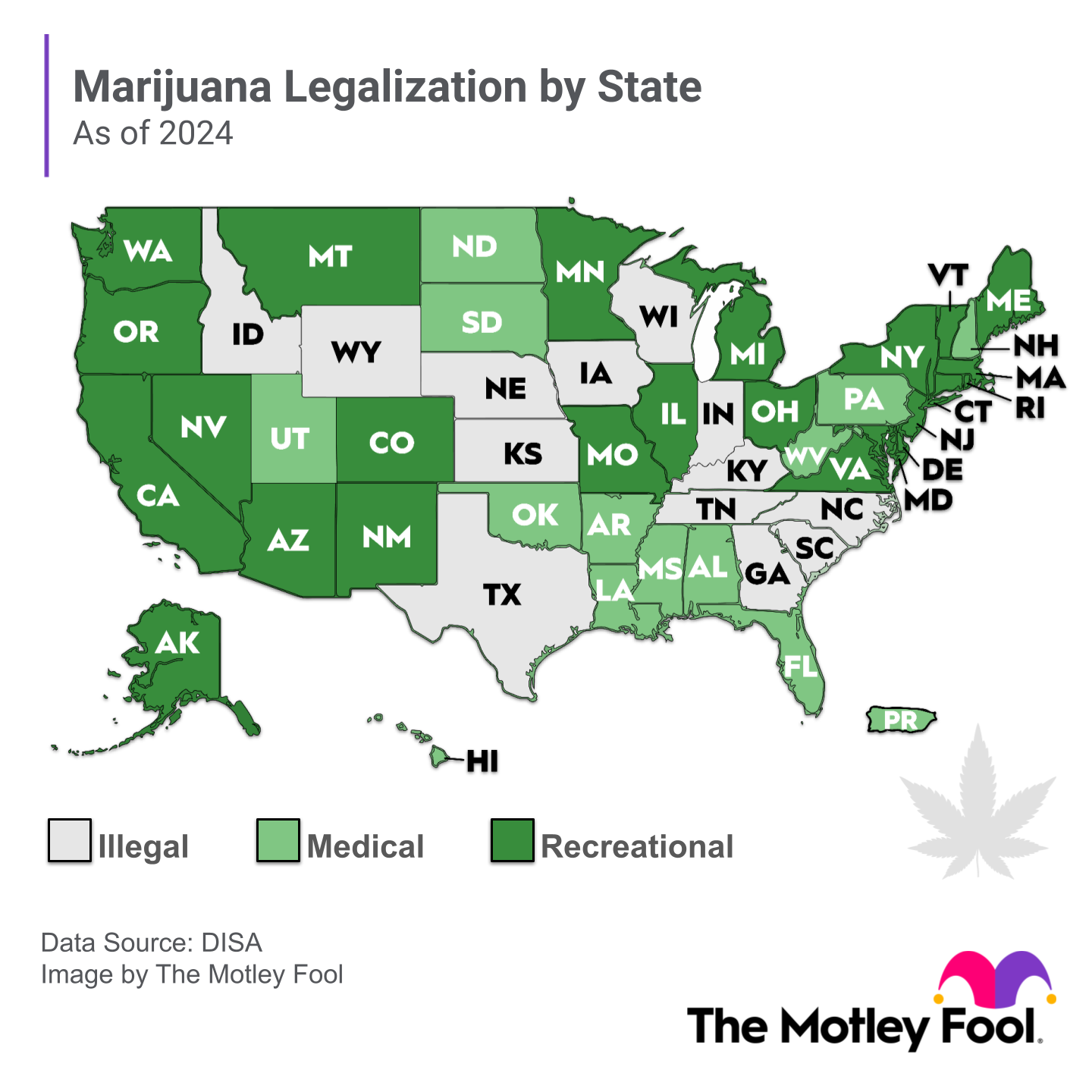

- Geography matters. Medical cannabis is legal in many more countries than recreational cannabis. In the U.S., cannabis remains illegal at the federal level. However, a growing number of states have legalized medical and/or recreational cannabis. And -- as mentioned earlier -- steps are underway to reschedule marijuana. The rapid growth of the U.S. cannabis market is translating into impressive growth by U.S.-based cannabis companies, while marijuana companies in Canada -- where the plant is already fully legal nationwide -- are expanding more slowly. Canada is one of the global legal markets where supply is outpacing demand and leading to falling cannabis prices.

Pros and cons of investing in marijuana stocks

The positive aspects of investing in marijuana stocks include:

- The global cannabis industry is still in its early stages and has significant upside potential even without the federal legalization of marijuana in the U.S.

- U.S. federal legalization of marijuana would likely provide a major catalyst for marijuana stocks.

- Marijuana stocks could offer investors an asset that doesn't always track with the broader stock market and, therefore, provide additional diversification.

However, potential negatives associated with investing in marijuana stocks include:

- Significant regulatory uncertainty exists with marijuana, especially at the federal level in the U.S.

- Marijuana stocks can be highly volatile.

- U.S. marijuana companies can have limited access to traditional financial services.

How to invest in marijuana stocks

The following are key steps to take to invest in marijuana stocks:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Related investing topics

Should you buy marijuana stocks?

Just because there's a trendy new sector with lots of press and potential growth doesn't mean you need to invest in it. If you buy broad-based index funds, you're covered no matter which sectors of the stock market do well. Conservative investors who prefer lower risk are likely better off avoiding investing in marijuana stocks.

Some marijuana stocks can be highly volatile. This highlights why using margin to buy these stocks should be avoided.

Aggressive investors with high risk tolerances, though, will probably find a lot to like about marijuana stocks. The cannabis industry is still in its early stages. The market opportunities are enormous, especially as more U.S. states legalize cannabis. Investing in these stocks is a high-risk but potentially high-reward proposition.