Tesla (TSLA -1.92%) and the company's investors have high hopes for so-called "robotaxis," self-driving vehicles that are able to turn a depreciating asset into a profit center by sending your vehicle out to ferry passengers around town when not in use. But so far, the reality has not lived up to expectations.

Tesla CEO Elon Musk had hoped to have 1 million robotaxis on the road by the end of 2020, but good luck trying to flag down a driverless Tesla for a lift any time soon. And although Tesla continues to roll out updates to its "Autopilot" system, it is still very much a driver-assist system, and not a fully autonomous experience. Musk in announcing the latest software update urged customers to "please be paranoid" and not hand over too much responsibility to the vehicle.

The delays are not unexpected, as true high-tech self-driving is a really complicated challenge. And so far no company has been able to figure it out completely. But Tesla is hardly alone in working on the problem, and some of its rivals appear to be making at least as much, if not more, progress.

Here's why three Fool contributors are paying close attention to the autonomous efforts of Intel (INTC -2.40%), Ford Motor Company (F 0.66%), and General Motors (GM -0.17%).

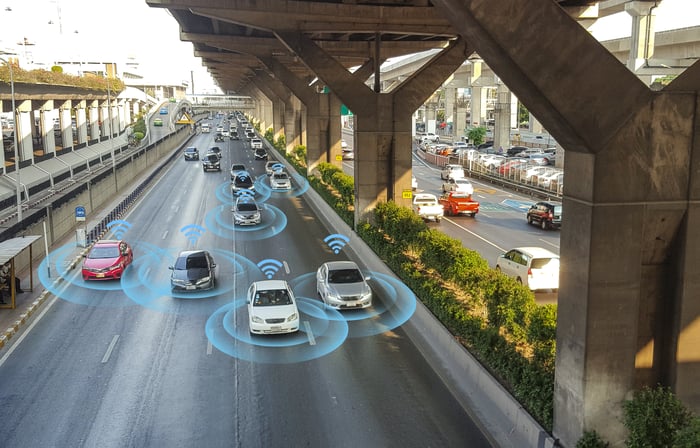

Image source: Getty Images.

"Mobileye Inside" could power the autonomous revolution

Lou Whiteman (Intel): In the early days of Tesla's quest for robotaxis the electric vehicle manufacturer leaned heavily on chipmaker Mobileye, which makes hardware and software for smart cars. That partnership evaporated over time, and Mobileye in 2017 was acquired by Intel, but the company has not slowed its pursuit of autonomous driving.

Mobileye, with support from Intel's ample financial resources, has partnerships with more than two dozen automakers and its driver assist tech installed in more than 60 million vehicles worldwide. Most of the use today is in driver-assist technology designed to make vehicles safer, and not true autonomous driving, but each new tool is a stepping stone toward the robotaxi of the future.

Investors should get a better idea of the strength of Mobileye's autonomous tech in the next 18 months. The company has a partnership with Chinese automaker NIO (NIO -5.00%) to roll out a fleet of robotaxis in Israel in 2022. It is also working with electric delivery van start-up Udelv to deploy self-driving vans starting in 2023.

In working with so many vehicle manufacturers, Mobileye is mimicking the highly successful "Intel Inside" strategy its parent deployed in the early days of the personal computing revolution. Mobileye is both a brand in and of itself and also piggybacks on the strength of its automaker partner's brand and expertise, hopefully in time establishing the "Mobileye" logo on a vehicle as a seal of quality similar to how the Intel sticker is viewed on a personal computer or laptop.

It's been a long time since Intel was viewed as a growth stock, and indeed Intel shares have trailed the S&P 500 by nearly 40 percentage points over the past five years. But the company under new CEO Pat Gelsinger is attempting to rebuild itself around some of its most promising businesses and brands.

Mobileye has the potential to be a big part of what is next for Intel. Investors who are interested in autonomous should pay close attention to the progress made by this self-driving pioneer in the years to come.

Tesla talks a lot about self-driving taxis, but this "dinosaur" is actually about to deploy them

John Rosevear (Ford Motor Company): In case you missed it, Ford, self-driving start-up Argo AI, and ride-hailing giant Lyft (LYFT -3.35%) announced on Wednesday that they will together launch a self-driving taxi service by the end of 2021.

This announcement came as a surprise -- and while there's a big qualifier here, it does establish that Ford and Argo AI, in which Ford has a substantial stake, are nearly ready to enter the robotaxi wars for real.

As is probably obvious, the service will use Ford vehicles (specifically, Escape hybrids), Argo's Level 4 self-driving hardware and software stack, and Lyft's ride-hailing network to provide Lyft users with the option of trying a taxi that drives itself. The plan is to launch in Miami before year-end, and in Austin next year, with a goal of having at least 1,000 of the self-driving taxis deployed over the next five years.

The new robotaxi service will use Ford Escape Hybrids, equipped with Argo AI's proprietary lidar and software, operating on Lyft's ride-hailing networks. Image source: Ford Motor Company.

As part of the deal, Lyft will receive a 2.5% stake in Argo as partial payment for the licensing and data-access agreements. As for Ford, in addition to the vehicles, the Blue Oval will run the depot stations that will fuel, service, and clean the robotaxi fleets. (This -- self-driving fleet management -- is a potentially lucrative new business that Ford has been talking about since 2016.)

I mentioned that there's a big qualifier: the vehicles will have human safety drivers, at least for now and likely (the partners think) until 2023. That might seem like cheating, but consider: Having a human behind the wheel -- but not touching it -- will help convince non-tech-savvy customers that this new technology is safe.

Taken together, it's a much more conservative plan than the Tesla approach of throwing "beta" software out to retail customers to test on public roads while hoping that nobody dies. I'm sure some Tesla fans will sneer accordingly.

But it's the kind of plan that auto investors should expect from Ford, a company that knows how to win customers' trust over decades, and from the experienced and sober-minded scientists at Argo.

Tesla's better at making headlines -- but GM's better at making cars

Rich Smith (General Motors): Two years ago, Elon Musk said he was "confident" that Tesla would have more than 1 million autonomous robotaxis on American roads by 2020 (then qualified his statement with the admission that "sometimes I am not on time"). I don't see Musk's electric car rival General Motors building a whole lot of robotaxis either, but GM does have one thing that Tesla doesn't: a contract to build robotaxis for a customer.

And one other thing: permission to operate robotaxis in California.

This year has been a big one for robotaxi news -- and for General Motors. In June, GM's "Cruise" autonomous driving subsidiary received the California Public Utilities Commission's first-ever license to carry passengers in fully autonomous vehicles with no driver present. The company also announced that it is expanding its investment in electric and autonomous vehicles, aiming to spend a total of $35 billion developing these technologies through 2025, and to develop at least 30 new EVs for sale.

GM and Cruise have confirmed that they will launch a self-driving taxi service in Dubai in 2023. Image source: General Motors.

One of the first of that number will be the Cruise Origin, an autonomous electric vehicle developed especially for Cruise. Analysts have described the Cruise Origin as offering riders a "shared and social" space and being "more like a living room than a passenger car. Passengers face each other, more like a bus..." And of course, the bus driver is a robot.

Cruise Origin is so good, in fact, that in April, it helped GM win a contract from the Dubai Roads and Transport Authority to begin deploying autonomous taxis in 2023. By 2030, GM expects to have 4,000 Cruise vehicles operating autonomously in Dubai.

Whether they'll meet any autonomous Teslas on their routes remains to be seen.