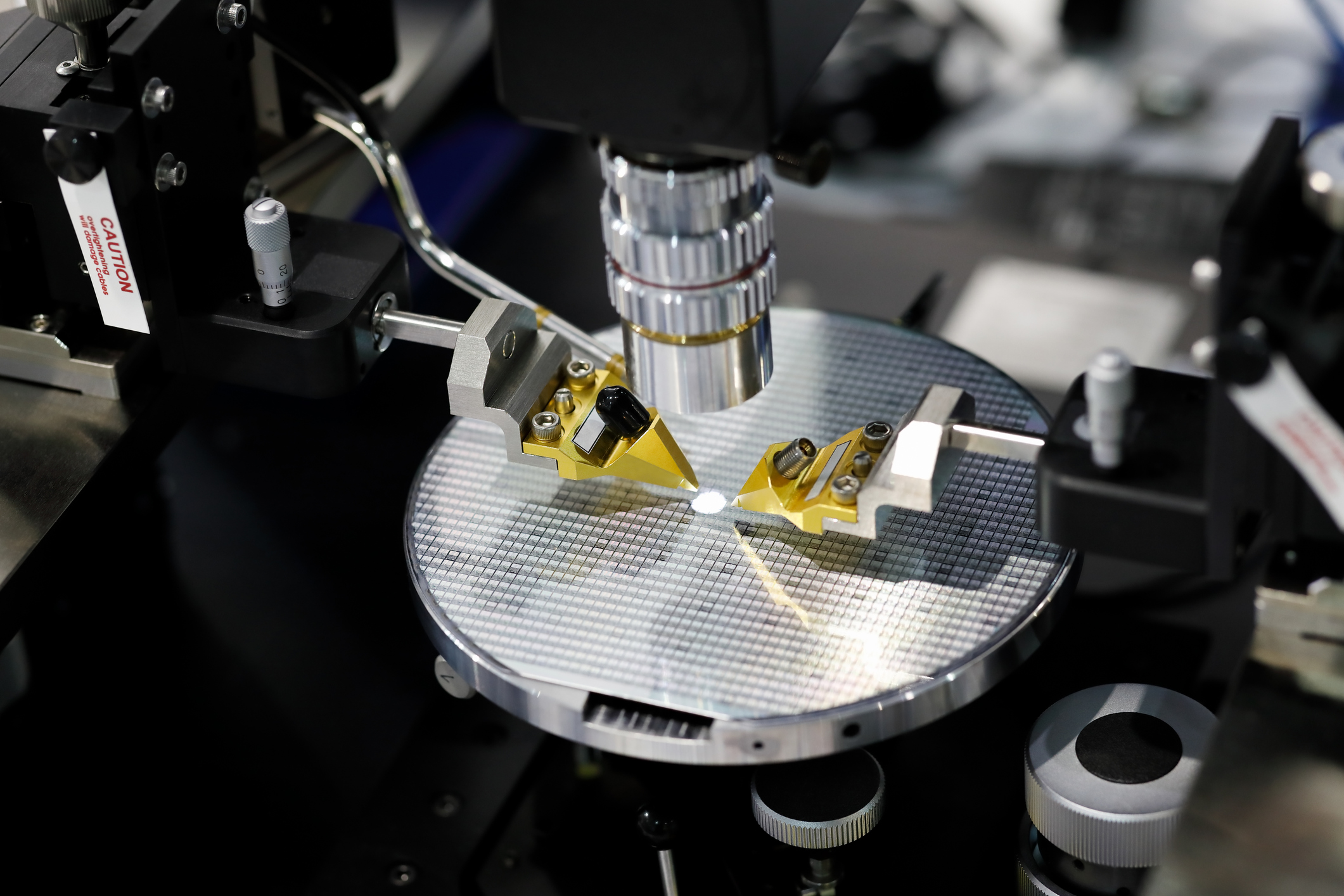

VanEck Semiconductor ETF (SMH -0.68%) enables investors to invest in the global semiconductor sector. Semiconductors (also known as chips or semis) are crucial for the modern world as they're in computers, smartphones, appliances, gaming hardware, and medical equipment. Specialized chips are also vital to new technologies, like artificial intelligence (AI).

NASDAQ: SMH

Key Data Points

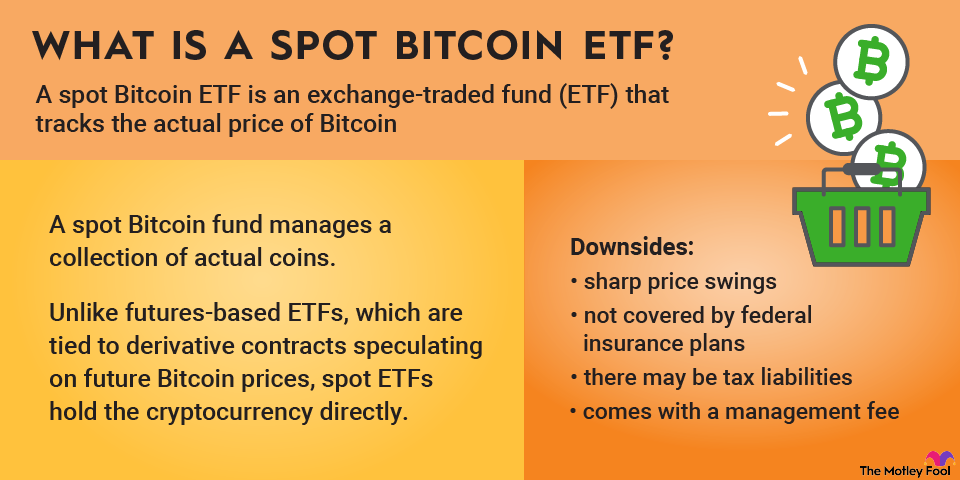

According to PwC, the global semiconductor market will reach more than $1 trillion by 2030, up from over $600 billion in 2024. This sector-focused exchange-traded fund (ETF) enables investors to zero in on this opportunity through a single fund investment.

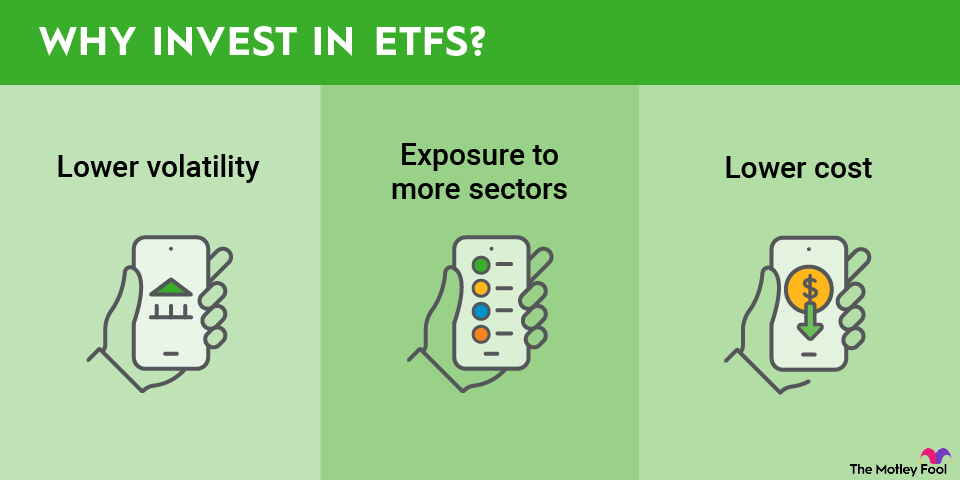

Exchange-Traded Fund (ETF)

This guide will teach you everything you need to know about investing in the VanEck Semiconductor ETF and how to invest in ETFs for beginners.

What Is VanEck Semiconductor ETF?

VanEck Semiconductor ETF is a sector ETF focused on semiconductor stocks. It aims to track the performance of the MVIS US Listed Semiconductor 25 Index, which seeks to follow the overall performance of companies involved in semiconductor production and equipment.

It's the biggest ETF focused on semiconductor stocks based on assets under management (AUM) of $19 billion in mid-2025, nearly double the size of the next largest semiconductor-focused ETF. The index and this ETF track the most liquid companies in the industry based on their market capitalization and trading volumes.

Its methodology favors the largest companies in the sector, so it will assign a higher weighting to the biggest semiconductor stocks. It also holds domestic and U.S.-listed foreign companies, giving investors broader exposure to the global semiconductor market.

How to buy VanEck Semiconductor ETF

It's very easy to buy the VanEck Semiconductor ETF. Shares trade on a major stock exchange, allowing you to purchase the ETF in any brokerage account. Here's a step-by-step guide to help you add the semiconductor ETF to your portfolio:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should I invest in VanEck Semiconductor ETF?

Investing is very personal. You should pick stocks and funds that align with your risk tolerance and return objectives; not every investment will be right for your situation. With that in mind, here are some reasons you might want to invest in VanEck Semiconductor ETF:

- You're seeking a sector ETF focused on semiconductor stocks.

- You want a growth-focused ETF or mutual fund with high return potential.

- Adding this ETF would help diversify your portfolio by providing exposure to the technology and semiconductor sectors.

- You don't need much dividend income.

- You believe semiconductor stocks will outperform over the long term but don't want to be an active stock picker and manage a portfolio of stocks.

Here's why this ETF might not be right for you:

- You're concerned about the fund's concentration at the top (its three largest holdings comprise more than 40% of its net assets).

- You're seeking a fund offering broader diversification across the technology sector.

- You'd like a lower-cost ETF.

- You already own several technology or semiconductor stocks.

- You're seeking a dividend ETF that offers a higher income yield.

- You're closer to or in retirement and want lower-risk investments.

Does the VanEck Semiconductor ETF pay a dividend?

The VanEck Semiconductor ETF pays a dividend. In mid-2025, the fund had a dividend yield of about 0.6%, lower than the dividend yields of the S&P 500 index (1.4%) and Nasdaq-100 index (0.8%).

That low dividend yield is because many semiconductor companies prefer to retain most of their earnings to fund their continued expansion, like building additional semiconductor fabrication facilities. Meanwhile, if they return excess cash to investors, many semiconductor companies (and technology stocks, in general) prefer to use that money to repurchase shares rather than pay higher dividends.

ETF Expense Ratio

At 0.35%, an investor would pay about $3.50 per year in management fees for every $1,000 invested in the VanEck Semiconductor ETF. For comparison, the fee would be only $1.90 per year for a lower-cost rival fund, like the Invesco PHLX Semiconductor ETF.

Historical performance of VanEck Semiconductor ETF

The semiconductor industry has grown briskly over the years as more products have added technological features. That has helped drive strong performance for semiconductor stocks and the ETFs that track them.

Here's a snapshot of the VanEck Semiconductor ETF's returns compared to its benchmark and the S&P 500:

Fund | 1-Year | 3-Year | 5-Year | 10-Year |

|---|---|---|---|---|

VanEck

Semiconductor ETF | -5.71% | 17.04% | 30.14% | 23.90% |

Benchmark

(MVIS US Listed Semiconductor 25 Index) | -5.51% | 17.19% | 30.31% | 23.98% |

S&P 500 | 13.48% | 11.25% | 15.00% | 10.44% |

The fund's performance over the past decade has been truly remarkable. As of mid-2025, it ranked as the best-performing ETF over the past 10 years (excluding leveraged ETFs). It was one of four semiconductor ETFs in the top 10 (almost all of which were technology ETFs).

Related investing topics

The bottom line on VanEck Semiconductor ETF

VanEck Semiconductor ETF is one of several sector ETFs focused specifically on semiconductor stocks. The fast-growing semiconductor sector has produced robust returns for investors (the ETF was the best-performing non-leveraged ETF over the last 10 years). With the semiconductor sector on track to continue growing rapidly, the fund certainly warrants consideration for your portfolio.