NYSE: CCL

Key Data Points

The company's unique portfolio of brands caters to a diverse range of customer segments:

- Single market mainstream: Carnival (U.S.), Aida (Germany), P&O Cruises (U.K.), P&O Cruises (Australia).

- Regional market mainstream: Costa (Italy, France, and Spain).

- Premium: Holland America Line (midsize ships) and Princess (large ships).

- Luxury: Cunard.

- Ultra luxury: Seabourn.

You might be among those with an upcoming cruise booked on one of Carnival's brands. That might have you interested in investing in the cruise stock. Here's a step-by-step guide on how to invest in its shares and some things to consider before buying.

How to buy Carnival Cruise Lines stock

You need to take a few steps before buying shares in Carnival (or any other stock). Here's a step-by-step guide to adding the cruise stock to your portfolio.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Stock Ticker

Should I invest in Carnival Cruise Lines?

It's vital to do your research before buying a stock. It could make you decide against buying shares or confirm your investment thesis. Here are some reasons why you might want to buy shares of Carnival:

- You're a fan of cruising and Carnival's brands.

- You believe the company will benefit from growing demand for cruising, which will increase its profitability in the long term.

- You understand that shares could be volatile as Carnival navigates a potential future recession.

- You know the risks of investing in Carnival, including that the company is working toward paying down the boatload of debt it took on to stay afloat during the pandemic.

- You don't need dividend income from your investment.

- You want to enjoy the company's shareholder benefit of a $50-$250 onboard credit (for sailings through the end of 2025) for those who hold at least 100 shares.

On the other hand, here are some factors to consider that might make you decide that Carnival stock isn't the right investment for your situation:

- You aren't all that interested in cruising.

- You're close to or in retirement and need dividend income.

- You are concerned about the company's balance sheet, which could continue to weigh down its shares.

- You're worried about a recession, which could cause shares of Carnival to sink if demand cools off.

Is Carnival Cruise Lines profitable?

Profitability is the most critical factor determining whether a company can grow shareholder value over the long term. Typically, a company's stock price rises along with its earnings.

After sinking following the COVID-19 pandemic, Carnival's revenue and profitability have recovered in recent years due to strong demand. The company's revenues hit an all-time high of $25 billion in 2025, a 15% increase from the prior year. The company also posted record adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) ($6.1 billion, a 40% increase) and operating income ($3.6 billion, an 80% increase). Meanwhile, its net income was $1.9 billion for the year.

The company foresees continued profit improvement in the coming years. For 2025, it expects its adjusted EBITDA to rise 10% to $6.7 billion while its adjusted net income will climb more than 30%. Driving that growth is continued strong demand for cruises and the company's SEA change strategy -- setting three-year financial and sustainability targets -- to boost its earnings. Carnival is also investing in expanding its fleet, which will see it add an average of one new ship per year over the next several years to grow its capacity.

Does Carnival Cruise Lines pay a dividend?

Carnival made dividend payments until early 2020. However, the company suspended its dividend in March 2020 to conserve cash because of the pandemic's impact on its operations. Before that, Carnival and its predecessors had paid quarterly dividends since 2001.

As of mid-2025, Carnival had yet to reinstate a dividend. The company said in its 2024 annual report that it doesn't plan to pay dividends for at least the next couple of years. Its primary focus is on shoring up its balance sheet and investing in expanding its fleet.

Exchange-Traded Fund (ETF)

Will Carnival Cruise Lines stock split?

Carnival has had two stock splits in its history. It completed 2-for-1 stock splits on December 14, 1994, and June 12, 1998.

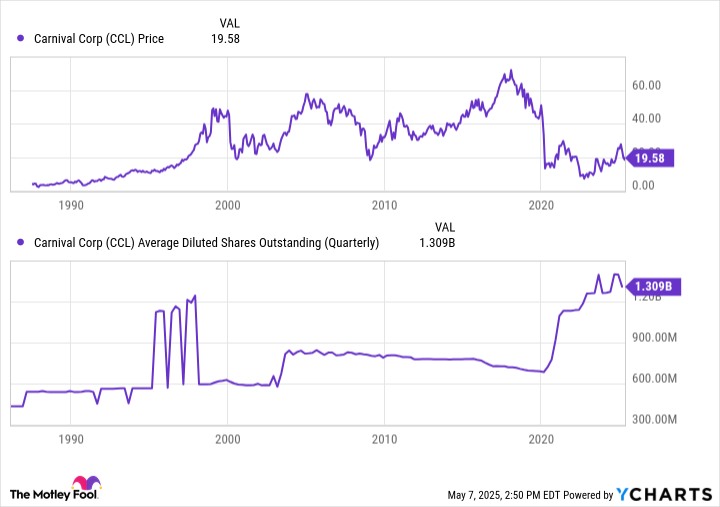

As of mid-2025, Carnival didn't have an upcoming stock split on the calendar. It seems unlikely that the company will split its stock again in the foreseeable future. Shares were down more than 70% from their all-time high before the pandemic, due in part to a significant rise in outstanding shares as it issued stock to stay afloat:

Carnival could complete a reverse stock split to help reduce its outstanding share count.

The bottom line on Carnival Cruise Lines

Carnival hit rough seas during the pandemic, forcing it to take on a boatload of debt and issue lots of stock to stay afloat. These factors caused its share price to sink.

However, the company is righting the ship by reducing its debt and improving profitability. While it likely won't be smooth sailing ahead for the cruise ship company since a recession could affect demand, it's in an excellent position to capitalize on growing demand for travel. It could be a compelling long-term investment for those who understand and are comfortable with the risks