Investors understandably want to know how to invest in Rippling stock. The company specializes in cloud-based enterprise software and is taking the small and medium-sized business world by storm. Founded in 2016, it's already soared to a $16.8 billion valuation.

Rather than focus on doing just one thing well, Rippling is solving an interesting combination of problems. The company's software handles three main tasks: payroll, human resources (HR), and information technology (IT).

IPO

When will Rippling IPO?

Rippling hasn't announced an IPO yet, so it's not on the IPO calendar. Rumors suggest it's gearing up for an IPO in 2025, but there's no way to be sure exactly when Rippling might go public.

Typically, companies choose to wait until they reach sufficient size since the expenses associated with being a public company can be prohibitive for small businesses. However, Rippling is probably already big enough to be a public company for reasons that will be evident in a moment.

Start-up companies (like Rippling) also ordinarily wait until the business can demonstrate two things: a predictable pattern of growth, outcompeting key rivals, and a viable path toward profitability. Companies that can't demonstrate these two things may not enjoy a successful IPO.

Is Rippling profitable?

We can't definitively say whether Rippling is a profitable company. The company hasn't gone public, so some of the most useful information isn't publicly available. But here's some of the financial information we know and can glean about this business.

- First, it's clear that Rippling is a high-growth company. According to Sarca's market reporting, Rippling grew over 52% YoY to a total revenue of roughly $570 million.

- Second, Rippling is a subscription-based business. And its latest funding round suggests it's already generating a whopping $350 million in annual recurring revenue.

- Third, Rippling is also a well-funded business. According to TechCrunch, it has raised $1.4 billion in funding as of its Series F round.

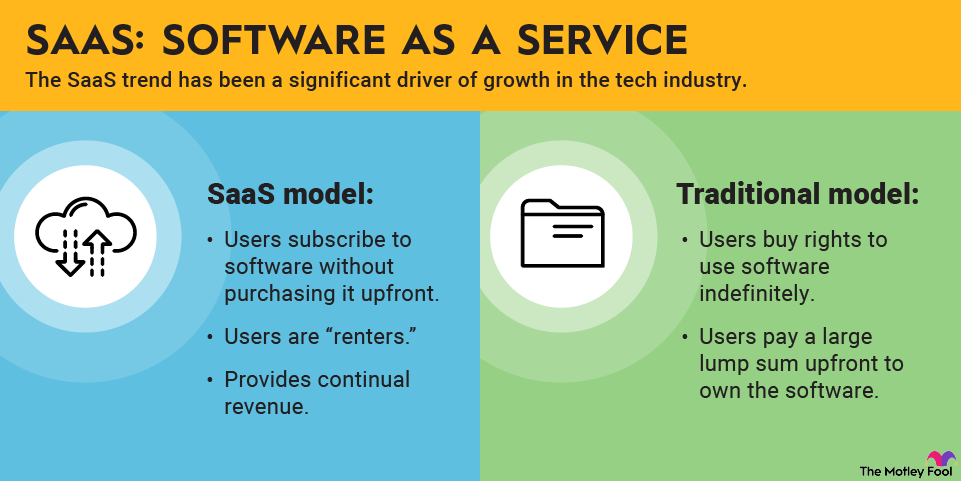

Software-as-a-service (SaaS) businesses like Rippling typically have very high gross profit margins. So, it's likely earning an outsize gross profit. It's probable that Rippling is growing a high-margin revenue stream very fast. But it's still likely losing money on a net basis because that's normal for an enterprise software company at this stage.

After all, Rippling's institutional investors want to see the company spend money to grow at an outsized rate -- that's why they're giving it money in the first place. So, companies at this stage are unlikely to hold back on growth to boost profits.

To invest in these alternatives, simply follow these steps:

- Open your brokerage account: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should I invest in Rippling?

When a company goes public through an IPO process, the registration documents are packed full of useful information. This can help investors decide whether to invest in the company. In this case, however, plenty of information is still lacking, so it's hard to say whether it will be a good investment.

Investing is also personal. And a high-growth software start-up might not be a good option for every kind of investor.

That said, investors can think about Rippling in terms of risk and reward. For example, studies have shown that many of the best stock performers are high-growth companies. Growing at a triple-digit pace and well funded for future growth, Rippling could be a rewarding opportunity.

Related investing topics

The bottom line on Rippling

Rippling is an exciting start-up that is growing fast, executing well, and well well-funded for the future. Unfortunately, retail investors don't have good options for investing in the company today. But it's one to keep an eye out for because it will probably go public in the not-so-distant future.

FAQ

Investing in Rippling FAQ

About the Author

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Salesforce and Zoom Communications. The Motley Fool recommends Asana. The Motley Fool has a disclosure policy.