Cryptocurrencies have become a hot investment that is gaining mainstream adoption. Markets for digital currencies such as Bitcoin (BTC -0.80%) were virtually unheard of in 2012, but they have since grown into a massive industry.

The cryptocurrency sector reached a market value of $3 trillion in the fall of 2021 and has continued to rise to a total market cap of roughly $3.9 trillion. The sudden surge in value and rapid evolution created immense wealth for early crypto investors.

Everyone wants to know which token will become the next Bitcoin or Ethereum (ETH -0.78%). With thousands of active cryptocurrencies on the market, investing in technologies linking the digital blockchain space with society could be even more lucrative. And there is no shortage of innovative companies and investment vehicles trying to bridge the gap between the two.

Cardano (ADA)

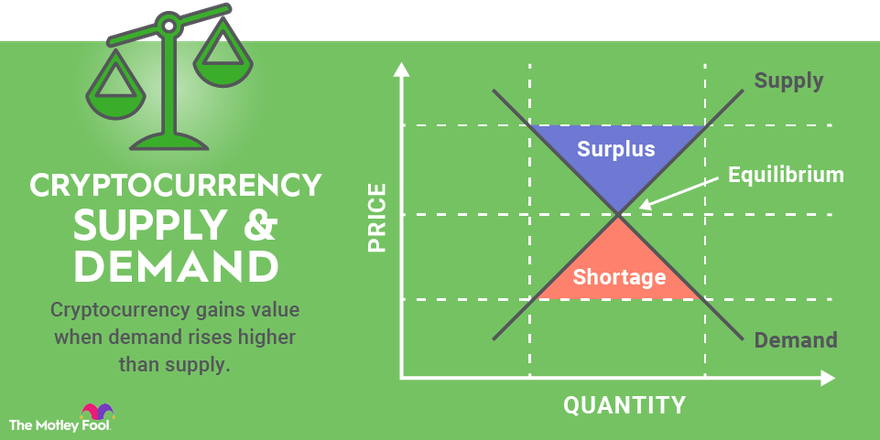

[Cryptocurrency] is a new asset class, but like real estate, there's only so much Earth. So it's defined, and therefore this moving price of the commodity is just how much, within this finite class of a commodity, this new asset class, how much people value it or want it.

3. Canaan and Hut 8 Mining

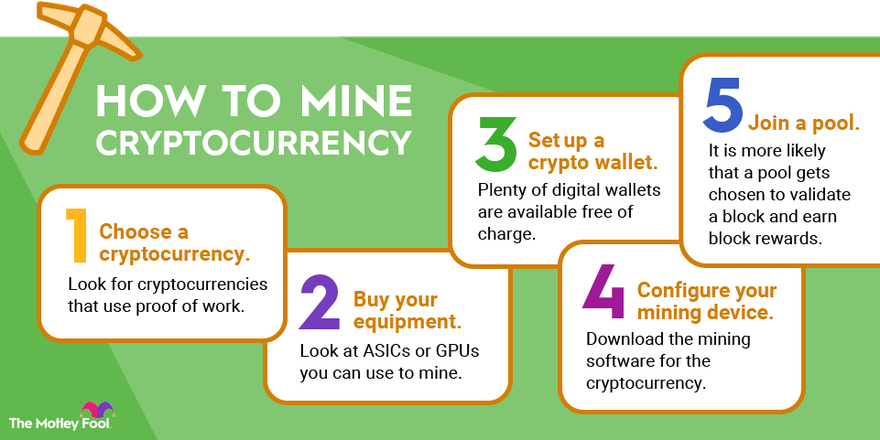

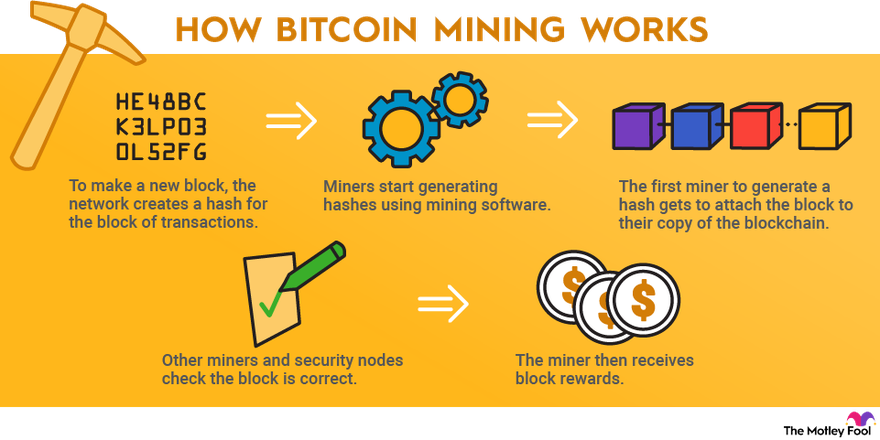

Bitcoin mining has changed dramatically over the past few years. These days, companies such as Canaan (CAN -5.60%) design high-powered, application-specific integrated circuit (ASIC) machines specifically for the purpose of brute-force guessing correct hashes for proof-of-work cryptocurrencies. Canaan's next-generation Avalon ASICs can make tens of trillions of guesses every second for the right hash to validate blocks on the Bitcoin network, which is millions of times more powerful than AMD (AMD -0.06%) and Nvidia's (NVDA +2.92%) latest graphics processing units (GPUs). Sales have been skyrocketing due to the device's affordability and relatively low energy consumption, meaning greater profits for miners.

One of the most popular Bitcoin mining stocks is MARA Holdings (MARA -2.67%). The Florida-based company commands a sizable minority stake in the overall Bitcoin network, and it generates very strong cash flows compared to revenue. Instead of selling the Bitcoin it mines on the market, the company formerly known as Marathon Digital Holdings records its mining rewards in the form of digital assets rather than selling the coins to generate dollar-based results.

Investors can be assured that environmental concerns regarding the practice won't hold the company back since it relies on renewable energy sources and can lease its electricity back to local utilities as needed.

Bitcoin Cash (BCH)

6. CME Group

CME Group (CME +0.85%) operates the world's largest financial derivatives exchange, allowing investors to trade futures, which bet on the future price of an asset, and options, which grant investors the option to sell or buy an asset in the future at a predetermined price. CME Group's exchange trades a diverse assortment of assets, including agricultural and mining products, energy, stocks, and currencies. It's the latter that makes CME Group a crypto stock.

At the end of 2017, CME established the first market for Bitcoin futures. At the start of 2020, the company created a market for options on Bitcoin futures. By March 2022, Ether (units of the crypto platform Ethereum) also had futures available on the exchange. Both Ether and Bitcoin futures were joined by micro futures this year, based on smaller slices of the underlying cryptocurrencies.

Establishing a full-featured exchange for derivatives of the best-known cryptocurrencies has given Bitcoin and Ethereum some extra legitimacy and provided a way for digital currency owners (both individuals and a growing list of businesses that accept cryptocurrencies as payment) to mitigate risk from changes in cryptocurrency prices. Cryptocurrency derivatives are still a small market for CME Group, but adding more exchanges for crypto assets in the future is possible -- and even likely.