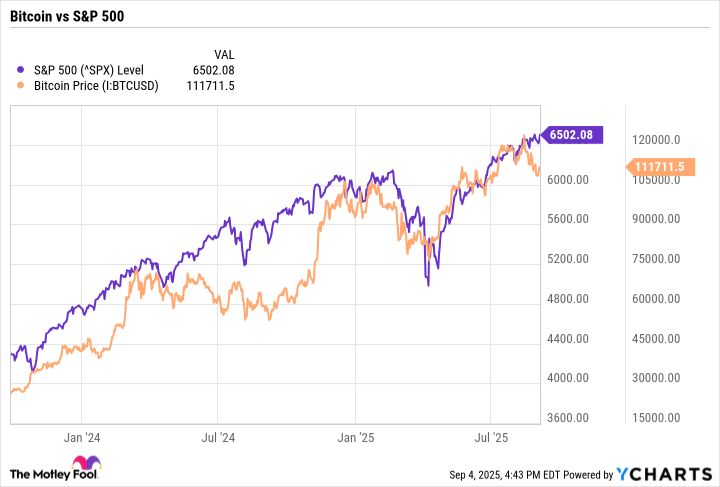

Cryptocurrency investors are rarely bored. The leading crypto names often crash or skyrocket due to economic pressures or crypto-specific news. In 2024, for example, investors finally got their hands on exchange-traded funds (ETFs) based on Bitcoin (BTC -1.56%) and Ethereum (ETH -5.68%) prices, and almost a fifth Bitcoin halving fell in March 2025. It's important to note that the price of Bitcoin didn't completely halve, but still fell by 29%.

However, the positive crypto-market momentum of 2021 was already old news in 2025, as were the bearish trends of 2022. Across these volatile years, cryptocurrencies (namely Bitcoin) continued to follow broader market trends, amplifying the gains and drops of the S&P 500 index in each swing.

As we look towards the future, we may start getting answers to some important questions that have remained unanswered so far, setting the course for cryptocurrencies and their investors for the long run. Here's what to expect from the future of cryptocurrencies.

Short-term crypto market predictions

It's impossible to say exactly what will happen to the cryptocurrency market in the next few years. There are still more questions than answers. But by keeping an eye on a few overarching crypto themes, you will be able to make better investing decisions as the market evolves.

You should pay particular attention to a handful of crucial details:

- Crypto regulation in the U.S. and abroad

- Mass-market adoption of cryptocurrency payments and decentralized finance

- Market adoption of cryptocurrency ETFs based on Bitcoin, Ethereum, and perhaps other digital currencies

- Countries adopting Bitcoin or other cryptocurrencies as legal tender

As these issues develop and are resolved, the long-term future of the cryptocurrency sector will take shape, but only time will tell.

Why cryptocurrency could be the future of money

In one best-case scenario for the long haul, regulators worldwide might come together on a global framework for crypto regulation. However, that looks unlikely today since international views of crypto range from "Bitcoin is an official currency" in El Salvador to "Crypto is totally illegal" in China. Global unity on the issue seems unlikely in the short term.

Crypto regulations are moving forward on a federal level, though. In July 2025, President Trump signed the GENIUS Act, providing consumer protections and guidelines on stablecoins, but as of September 2025, this act has only been introduced into Congress and is not yet considered law.

Moreover, the introduction of spot Bitcoin ETFs and similar Ethereum funds invited both institutional investors and crypto-skeptic individuals to the blockchain market.

And don't forget that Ripple Labs had a hallmark courtroom lawsuit over the Securities and Exchange Commission (SEC) in the summer of 2024 dismissed. In turn, this ruling added some precedent-setting context to the crypto sector, changing the way these digital assets are viewed in the eyes of the law.

SEC (Securities and Exchange Commission)

Legal and regulatory clarity is accumulating in the crypto space, but this process still has a long way to go. With highly knowledgeable people setting the tone for future regulations, there's hope that a workable system can be developed for investors, consumers, cryptocurrency businesses, and traditional banks.

Informed regulators will understand crucial and meaningful issues, such as the differences between a value storage system like Bitcoin and a sophisticated ledger with smart contracts like Ethereum.

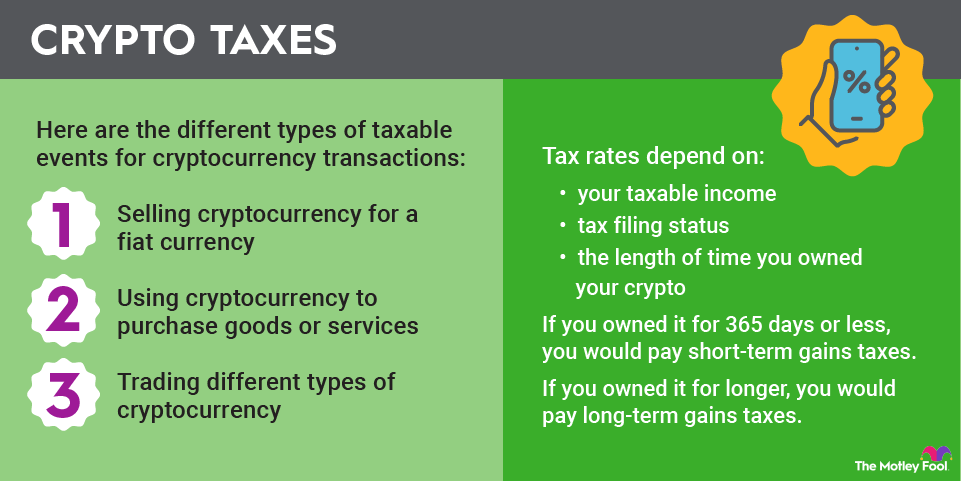

As government entities work out a legal framework and taxation system, cryptocurrencies could find their way into the digital wallets of U.S. consumers on a large scale. Although Bitcoin became legal tender in El Salvador in 2021, the U.S. isn't likely to follow suit anytime soon.

However, many retailers are likely to start accepting payments in cash-like digital currencies, such as Bitcoin, Litecoin (LTC -0.46%), or the clone of a clone of Bitcoin known as Dogecoin (DOGE -1.47%). Ripple is already a successful platform for international payments, and its use may rise over time.

Increased use of crypto should spur regulatory agencies and politicians to take faster action. Blockchain systems should also benefit from widespread usage.

The processes will percolate through the crypto market over the next few years. Investors can't stand uncertainty, so even an overly strict regulatory framework will likely be an improvement over today's ramshackle oversight.

Why cryptocurrency may not be the future of money

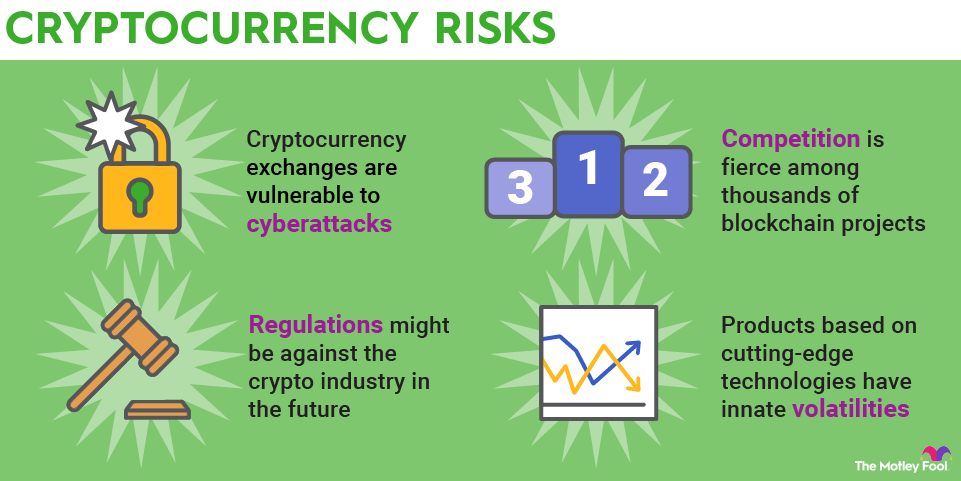

A crypto future could be delayed in several ways:

- Policymakers may drag their feet and fail to reach a sensible regulatory framework anytime soon.

- They could decide that currencies such as Bitcoin and Litecoin only serve illegal activities and bad actors and that none of that activity belongs on U.S. soil.

- Retailers might balk at the unpredictable value of digital currencies and insist on traditional cash or credit card transactions instead.

- A sudden rash of security breaches, failing technology platforms, and other threats to the security of blockchain-based payment systems could undermine public trust in digital currencies. For example, algorithmic stablecoins got a bad rap after the collapse of TerraUSD (USDT -0.00%) in 2022.

- Quantum computing threatens to undermine the cryptographic security of blockchain networks and cryptocurrencies. Crypto developers need to find quantum-safe encryption alternatives before the development of effective quantum computing systems goes too far.

Under any combination of these circumstances, the digital currency revolution could be delayed by several years.

Related crypto topics

Final thoughts on the future of crypto

These risks might sound hypothetical, but they are very real. In the end, the cryptocurrency community must get along with regulators worldwide. Failing to do so could throw massive roadblocks in front of the digital currency sector's progress.

That's why you shouldn't bet the farm on Bitcoin, Ethereum, or crypto in general. This market tends to move in mysterious and unpredictable ways, skyrocketing one year and crashing down in the next. Informed investors want to build a diversified portfolio for the long run that can withstand dramatic setbacks in any particular sector.