A business development company (BDC) is a specific corporate structure for companies that provide capital to smaller and midsize companies, as well as distressed businesses in need of capital. Publicly traded BDCs can be compelling investments, as they give investors of any level of wealth access to strategies like investing in private equity and distressed debt, which are more often associated with the well-heeled.

In addition, BDCs appeal to investors seeking a source of income or a good dividend yield. Because of their structure, they are required to distribute 90% of taxable income to shareholders each year. The downside is that the BDC doesn't retain much of its earnings, so these large distributions can fluctuate from year to year.

What is a BDC?

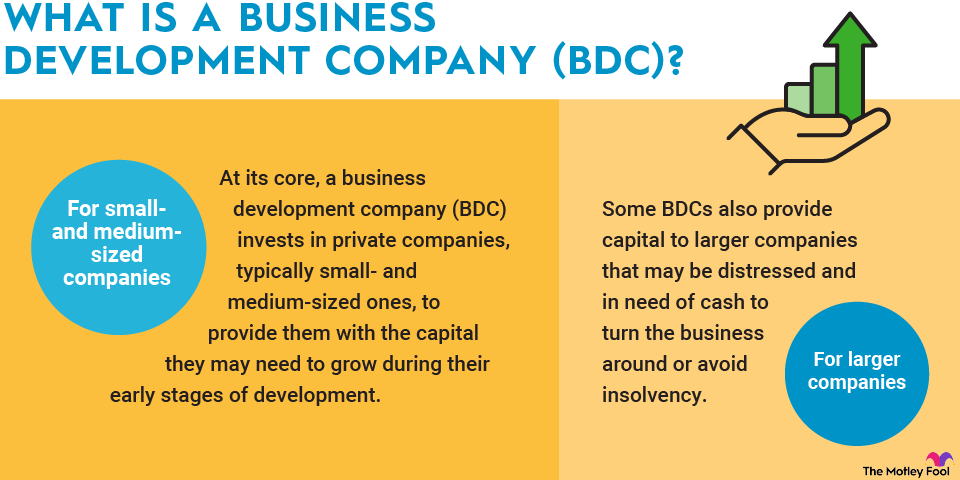

At its core, a business development company (BDC) invests in private companies, typically small- and medium-sized ones, to provide them with the capital they may need to grow during their early stages of development. Some BDCs also provide capital to larger companies that may be distressed and in need of cash to turn the business around or avoid insolvency.

The capital that a BDC provides may be structured as debt, often secured by the business or particular assets it owns. Alternatively, it can be issued as equity or as debt that can be converted to an equity investment. Depending on the size and condition of the business, these strategies are often unattainable to individual investors. They can be structured to reduce the risk of loss for the BDC and its investors, even in the case of a business failure.

A BDC's offerings and/or shares are registered with and regulated by the SEC, subject to many of the regulations applicable to registered investment companies. BDCs are a type of closed-end fund, meaning they invest the money raised during their IPO and don't take in new money from investors.

A BDC must be a U.S. company. Additionally, it must invest at least 70% of its assets in U.S. companies with a market value of less than $250 million. In addition to capital, BDCs also provide assistance in the form of expertise in managing their companies as well.

Pros and cons of investing in a BDC

As mentioned above, BDCs can be very compelling income investments. Because they pay no income tax so long as they distribute 90% of their taxable income, the average BDC pays a very high dividend yield compared to the majority of dividend-paying stocks.

Another benefit of BDCs for retail investors is they are highly liquid; it's easy to buy and sell shares on securities exchanges. By contrast, typical private equity and venture capital investments require your funds to be locked up for many years at a time.

Lastly, there's a diversification benefit. So long as the BDC you invest in owns a diverse portfolio of investments, it's a nice way to spread your capital across multiple opportunities and risks at one time.

However, there are downsides, too. Those dividends can sometimes come at the cost of lower stock price appreciation. Most BDCs must distribute 90% of income, meaning they have far less retained earnings to reinvest and grow the value of the enterprise. And since most BDCs don't pay income tax, their distributions are not qualified. That means you will likely pay more in taxes on the distributions you get from the BDCs you own.

The result of paying out most of its earnings while still pursuing growth means most BDCs have a lot of debt as a percentage of assets. This means rising debt expense as they must refinance debt as it matures. This environment means potential risk and opportunity for BDCs now. Since interest rates have moved sharply higher, BDCs can potentially strike more lucrative new deals, but they could also be handcuffed by existing agreements that tie up their capital. And if portfolio companies struggle to repay their debts, a BDC could end up owning its assets and disposing of them at a loss.

Another potential issue with BDCs is fees. Just like with an open-ended fund like a mutual fund or ETF, the manager of the BDC will charge fees to cover its expenses, and these fees can be significant. According to Closed-End Fund Advisors, the 48 average publicly traded BDC had an expense ratio of 14.28% as of July 2023. In other words, access to these lucrative strategies comes with a significant cost.

Expense Ratio

What to know about investing in a BDC

Because business development companies pay out almost all of their taxable income and use a lot of debt to fund deals, investors need to be familiar with their balance sheets and capital structures. It's important to know their interest rate on debt, when debt is maturing, and how much of a discount to current market rates it may be paying. This is especially true if it must refinance cheap debt at higher rates, while still earning subpar yields on existing debt from portfolio companies.

It's also really important to understand the strategy of the BDCs you are interested in. Some focus on specific sorts of companies or sectors or industries. The majority of the largest BDCs focus on debt opportunities and less equity. Make sure that the strategy the BDC's management takes aligns with you as an investor.

Lastly, make sure you know how a BDC's management is compensated. Does the manager get an outsize portion of returns above a certain threshold? It's not uncommon for the BDC's manager to take a "2 and 20" fee structure, meaning 2% of assets and 20% of profits earned. These fees come right off the top, before you get anything at all.

Many BDCs are entities created by a larger company. For instance, FS KKR Capital Corp (FSK -1.44%) was formed in a merger of entities managed by privately held FS Investments and a subsidiary of KKR & Co. (KKR -0.45%) and Blackstone Secured Lending Fund (BXSL -0.84%) is managed by Blackstone (BX -3.57%), the largest alternative asset manager on earth.

Lastly, valuation matters. With BDCs, net asset value (NAV) is a useful way to find fair value. NAV is the value of the underlying assets that a business development company owns. Shares may trade for a discount or a premium to NAV, and there are reasons why you would want to pay more or less than NAV, depending on the market value of those assets. A BDC that made a risky investment in a business that goes poorly may be worth less than NAV. Conversely, a wildly successful investment could cause it to be worth a premium. Either way, NAV is a useful starting point to valuation.

The largest publicly traded business development companies (BDCs)

According to Closed-End Fund Advisors, there were 48 publicly traded BDCs as of July 11, 2023. While a few of them have been around for many years, the vast majority came into existence or went public 2004 and later.

For the most part, these remain relatively small, with an average market capitalization of $5.8 billion. The largest focus on debt, carrying an average market cap of $6.5 billion, compared to a tiny $40.6 million market cap for equity-focused BDCs.

Of this group, here are the six largest, by total assets.

BDC Name | Trailing Dividend Yield | Total Assets | Market Cap |

|---|---|---|---|

Ares Capital Corp (NYSE:ARCC) | 8.7% | $21.8B | $10.5B |

Blackstone Secured Lending Fund (NYSE:BXSL) | 9.5% | $9.85B | $4.4B |

Blue Owl Capital Corp (NYSE:OBDC) | 9.6% | $13.7B | $5.4B |

FS KKR Capital Corp (NYSE:FSK) | 13.4% | $16.1B | $5.5B |

Main Street Capital Corp (NYSE:MAIN) | 7.6% | $4.3B | $3.25B |

Prospect Capital Corp (NYSE:PSEC) | 10.2% | $7.7B | $2.6B |