Office real estate investment trusts (REITs) own, manage, develop, and rent office space leased to various tenants. These properties range from skyscrapers in the largest U.S. cities to sprawling office campuses in the suburbs. This real estate is crucial for companies that use offices to support their operations.

Here's a closer look at office REITs, including how they work, their advantages and risks, and some top office REITs to consider in 2026.

Understanding office REITs

Most office REITs focus on a specific property type, tenant, or location. Some concentrate on multi-tenant office buildings in central business districts. Office space in these areas tends to remain in high demand, enabling these office REITs to maintain high occupancy levels and benefit from steadily rising rental rates.

Other office REITs focus on large office campuses. They'll often lease whole buildings to a single tenant under long-term triple net leases.

There are also office REITs that concentrate on specialized office properties to support the needs of a specific tenant type. These properties can include highly secure buildings for government agencies, creative space for technology and media companies, or specialized lab space for life sciences companies.

Many office buildings earn additional revenue from parking fees, while some large skyscrapers feature an observatory that generates ticket sale revenue. Additionally, many office buildings lease retail space to shops and restaurants.

Advantages of investing in office REITs

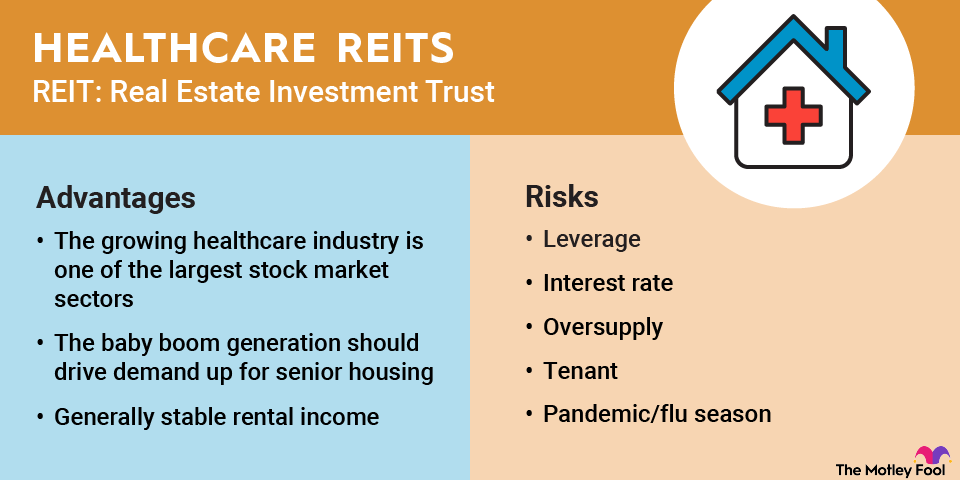

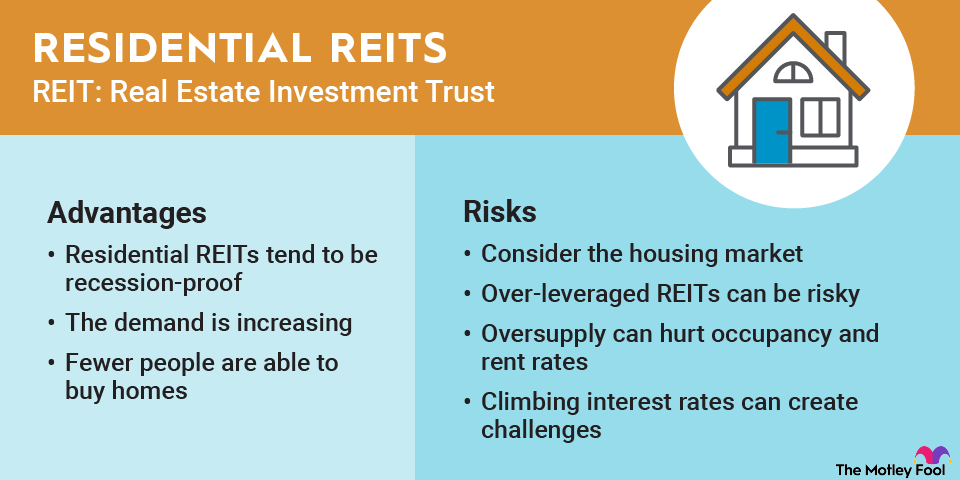

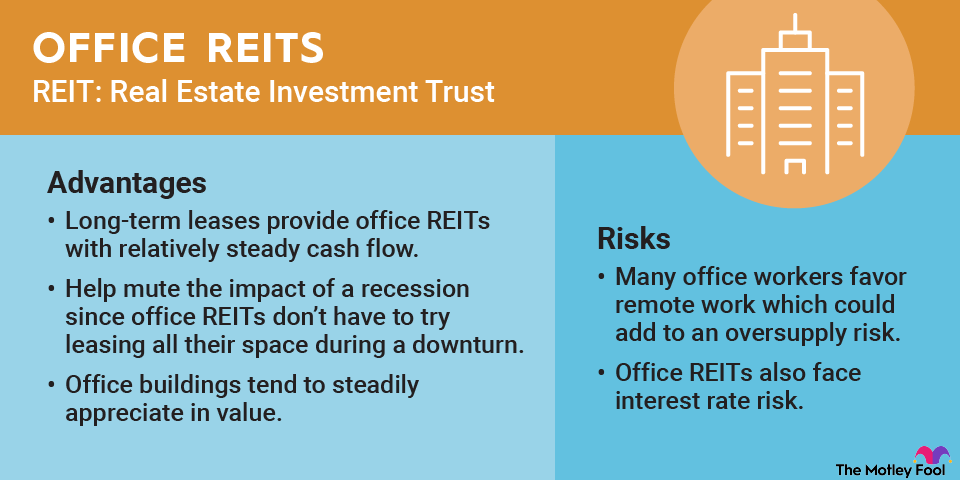

Office REITs have several positive investment characteristics. Some benefits of investing in the sector include:

- Durable rental income: Most office tenants sign long-term leases (five to 10+ years). These long-term leases provide office REITs with relatively steady cash flow. They also help mute the impact of a recession since office REITs don't have to lease all their space during a market downturn.

- Steady demand: Demand for office space has been relatively stable over the long term. While many companies have adopted a hybrid model that allows their employees to work from home more often, they continue to lease space in offices. They believe having employees together in an office setting can increase collaboration, coordination, and productivity.

- Institutional demand: Given their stability and durability, office buildings tend to be in high demand by institutional investors, such as pension funds. They often acquire office buildings from REITs or buy entire REITs, which boosts valuations across the sector.

Risks of investing in office REITs

Investing in office REITs isn't without risk. Here's a look at several of the risk factors investors need to keep in mind before buying shares of an office REIT:

- Uncertain future: There's still a lot of uncertainty about what the future holds for offices due to the increase in remote and hybrid work. This headwind has had the greatest impact on lower-quality office buildings and those in suburban locations.

- Oversupply: Developers usually start constructing office buildings on speculation, betting they'll secure tenants before finishing construction. If developers build too much supply, this can weigh on occupancy levels and lease rates in certain markets.

- Interest rate risk: Rising interest rates can increase interest expenses if an office REIT uses floating-rate debt or has near-term debt maturities. They can also increase the income yield on lower-risk investments such as bonds. As a result, REIT stock prices often fall when interest rates rise, as investors demand a higher dividend yield as compensation for the REIT's higher-risk profile compared to bonds.

Five top office REITs to buy in 2026

In late 2025, 20 publicly traded REITs focused on owning office properties. Here's a closer look at the five best office REITs for investors to consider:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Easterly Government Properties (NYSE:DEA) | $1.1 billion | 8.71% | Office REITs |

| Cousins Properties (NYSE:CUZ) | $4.5 billion | 4.74% | Office REITs |

| BXP (NYSE:BXP) | $10.8 billion | 4.94% | Office REITs |

| SL Green Realty (NYSE:SLG) | $3.7 billion | 5.83% | Office REITs |

| Kilroy Realty (NYSE:KRC) | $4.5 billion | 5.73% | Office REITs |

NYSE: DEA

Key Data Points

NYSE: BXP

Key Data Points

It focuses on owning properties in six major coastal gateway cities: Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, D.C. The office REIT also has a large and growing life sciences portfolio.

BXP has strategically capitalized on growth regions and sectors in recent years. It has increased its exposure to tenants in the life sciences, technology, advertising, media, and information industries.

It's a leading developer of premier workspaces. The office REIT developed $10.6 billion of properties over the past decade and a half and had another $3.7 billion in properties under development in late 2025 to drive its continued growth.

NYSE: CUZ

Key Data Points

NYSE: SLG

Key Data Points

The REIT's premier office portfolio generates fairly stable rental income. SL Green pays out a portion of that income via a monthly dividend and retains the rest to grow its office portfolio. It has developed several high-profile office buildings in recent years, including One Vanderbilt and One Madison Avenue.

5. Kilroy Realty

Kilroy Realty (KRC -1.36%) is a leading publicly traded owner and operator of Class A office and life science properties. It primarily focuses on owning properties on the West Coast (Seattle, San Diego, Los Angeles, and the Bay Area). It also owns offices in Austin, Texas.

NYSE: KRC

Key Data Points

An increasing return to the office, especially by technology companies, is benefiting Kilroy's West Coast-focused portfolio. The office REIT is also benefiting from its strategy to invest in life science properties. These drivers position the REIT to grow shareholder value in the coming years.

Factors to consider before investing in office REITs

Investors should evaluate a few things before buying shares of an office REIT, including:

- Property focus: Demand for office space has shifted since the COVID-19 pandemic due to the rise of remote and hybrid work. Many companies have upgraded their office space to Class A properties in urban city centers. As a result, rental and occupancy rates for premier properties have risen, while demand for lower-quality office buildings has fallen. Given these trends, REITs that own premium office properties have a competitive advantage over those that focus on suburban commodity office campuses.

- Financial strength: An office REIT must have a low dividend payout ratio and investment-grade balance sheet to weather the industry's headwinds.

- Development pipeline: Investors should evaluate an office REIT's development pipeline to ensure it's building pre-leased properties that can contribute immediate cash flow upon completion, rather than building on speculation.

Related investing topics

How to invest in office REITs

It's easy to add an office REIT to your portfolio. Here's a step-by-step guide on investing in office REITs:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.