S&P 500 (SNPINDEX:^GSPC) index funds are passive investments that allow investors to match the performance of the S&P 500, an index featuring the 500 largest publicly traded companies in the U.S. They're ideal for investors who want to earn returns in line with the broader market but don't want to own individual stocks. Read on to learn more about these popular funds.

Three best S&P 500 index funds

Three best S&P 500 index funds for 2025

These three major S&P 500 index funds are extremely similar in composition since each tracks the performance of the same index:

- Fidelity 500 Index Fund (NASDAQMUTUALFUND:FXAI.X)

- Schwab S&P 500 Index Fund (NASDAQMUTUALFUND:SWPP.X)

- Vanguard 500 Index Fund Admiral Shares (NASDAQMUTUALFUND:VFIA.X)

All three are very low-cost ways to invest in the 500 companies comprising the S&P 500 index. Fidelity has the lowest costs, with a 0.015% expense ratio. Schwab's is only slightly higher at 0.02%, while the Vanguard 500 Index Fund Admiral Shares has a 0.04% expense ratio.

Expense Ratio

Fidelity and Schwab offer their index funds with no minimum investment, making them very accessible to beginning investors. Vanguard has a relatively low minimum investment of $3,000.

Vanguard also offers an exchange-traded fund (ETF) focused on investing in the 500 companies that comprise the S&P 500 index. The Vanguard S&P 500 ETF (VOO 0.42%) has a low minimum investment of one share (around $590 as of mid-August 2025) and a low expense ratio of 0.03%. This index-fund-like product trades on a major stock exchange, allowing investors to buy and sell as they would a stock.

Each S&P 500 index fund has very closely replicated the index's performance:

| Index or Fund | 1-Year Total Return | 3-Year Total Return | 5-Year Total Return |

|---|---|---|---|

| S&P 500 Index | 17.65% | 56.72% | 106.1% |

| Vanguard 500 Index Admiral Shares | 17.60% | 56.52% | 105.7% |

| Schwab S&P 500 Index Fund | 17.62% | 56.56% | 105.8% |

| Fidelity 500 Index Fund | 17.63% | 56.67% | 106.0% |

Negligible differences exist between the performances of the S&P 500 and each of these three index funds that track it. The S&P 500 outperformed each fund slightly, as would be expected when accounting for each fund's expense ratio.

At the S&P 500's rate of return, a $10,000 investment made five years ago would have grown to $17,650 by mid-August 2025. For comparison, a $10,000 investment in the Fidelity 500 index fund would have grown to $17,630 over the same five-year period, with slight variations due to fees and tracking.

With any of these three funds, you can expect your investment to deliver a virtually identical performance to the S&P 500, minus fees. Given its lower expense ratio, Fidelity's S&P 500 index fund will likely continue to slightly outperform the funds from Schwab and Vanguard over the longer term.

Why they are popular

Why are they popular?

An index fund is designed to mirror the performance of a stock index. An S&P 500 index fund invests in each of the 500 companies in the S&P 500. It doesn't try to outperform the index. Instead, it uses the index as its benchmark and aims to replicate its performance as closely as possible.

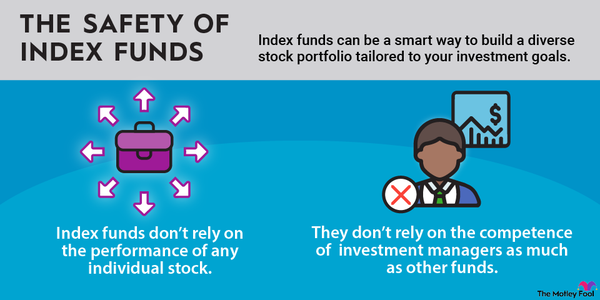

S&P 500 funds are the most popular type of index fund by far. However, index funds can be based on practically any financial market, investing strategy, or stock market sector. Index funds are popular with investors for a number of reasons. They offer easy portfolio diversification, with some funds providing broad exposure to hundreds or even thousands of stocks and bonds.

Bonds

You don't risk losing all your money if one company collapses, as you could with individual investments. However, you also don't have as much upside potential for the astronomical returns that can result from picking a single huge winner.

Index funds are passively managed, meaning you're not paying someone to actively pick and choose investments. Passively managed funds result in a lower expense ratio due to having lower investment management fees than actively managed funds.

Your money will track the market's performance

Historically, the S&P 500's annual returns have been in the range of 9% to 10%. In some years, the index will lose value. For example, during the Great Recession, the S&P 500 lost about half its value. Meanwhile, the index experienced a bear market starting in early 2022 and had declined by more than 20% from its peak by the fall.

However, the index rallied by 24% in 2023. On Nov. 11, 2024, the index crossed 6,000 for the first time. The index rose by another 23% in 2024. Despite a major sell-off in March and April, largely due to concerns about tariffs and higher-than-expected inflation, the S&P 500 was up about 10% year to date as of August 2025.

The S&P 500 index has a solid history of such rebounds. Over the long term, the index has always recovered. A 20-year investment has never resulted in a loss in the S&P 500's history.

You will keep more of your investment profits in your pocket

S&P 500 index funds are low-cost investments. While active managers are likely to match or even beat the market's performance over time, their fees eat away at your returns. Because they're passive investments with low fees, S&P 500 index funds deliver returns that mirror the index's returns over the long term.

You'll be investing in 500 of the most profitable companies in the U.S.

The corporations represented in the S&P 500 are subject to stringent listing criteria. To join the index, a company must have a $20.5 billion market capitalization, and the sum of its past four quarters' earnings must be positive.

Each company must also get approval from an index committee. The S&P 500's largest holdings include Apple (AAPL 0.36%), Nvidia (NVDA 0.43%), Microsoft (MSFT 0.37%), Amazon (AMZN 0.57%), and Meta (META -2.32%).

You can put your investment decisions on autopilot

The S&P 500 has a flawless track record of delivering profits over long holding periods, allowing you to invest without worrying as much about stock market fluctuations. You also don't have to research or follow individual companies.

You can simply budget a certain amount and automatically invest it on a regular schedule. This practice is known as dollar-cost averaging. Even if you pick individual stocks, S&P 500 funds are a good foundation for your investment portfolio since you're guaranteed the returns of the stock market.

Be wary of leveraged funds

Be wary of leveraged S&P 500 index funds

Be wary of leveraged funds advertised as S&P 500 ETFs. Leveraged ETFs use borrowed money and/or derivative securities to amplify investment returns or to bet against the index. For example, a 2x-leveraged S&P 500 ETF is intended to return twice the index's daily performance. So, if the index rises by 2%, the ETF's value rises by 4%. If the index falls by 3%, the ETF loses 6%.

Related investing topics

These leveraged products are intended to be day-trading instruments and have an inherent downside bias over the long term. In other words, a 2x-leveraged S&P 500 ETF will not return twice the index's performance over the long term.

Investing in S&P 500 index funds is one of the safest ways to build wealth over time. But leveraged ETFs -- even those tracking the S&P 500 -- are highly risky and don't belong in a long-term portfolio.

FAQ

S&P 500 index funds FAQ

Which is the best S&P 500 index fund?

All S&P 500 index funds strive to match the returns of the S&P 500 index minus fees. Since fees are the difference maker in returns, the Fidelity 500 Index Fund stands out as the best-performing S&P 500 index fund. It has the lowest expense ratio of the top funds, so its returns are slightly higher than those of other top S&P 500 index funds.

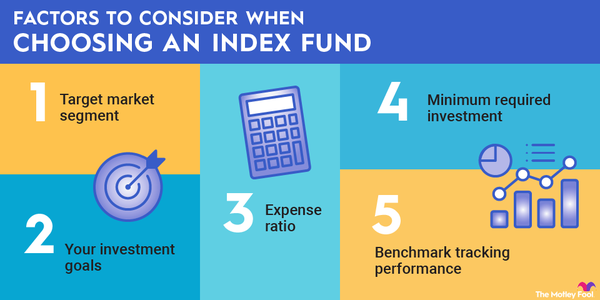

How do I choose an S&P 500 index fund?

Because the underlying investment is the same for any S&P 500 index fund, you'll get very similar returns with any fund you choose. To choose a fund, look for one with low fees and one that doesn't require a large minimum investment.

Which index funds give the best returns?

S&P 500 index funds have some of the most consistently strong returns over long holding periods. Over the last 30 years, the S&P 500 has delivered an average compound annual growth rate of slightly more than 10%, assuming dividend reinvestment. That has outpaced many other investments, like cash, bonds, and gold.

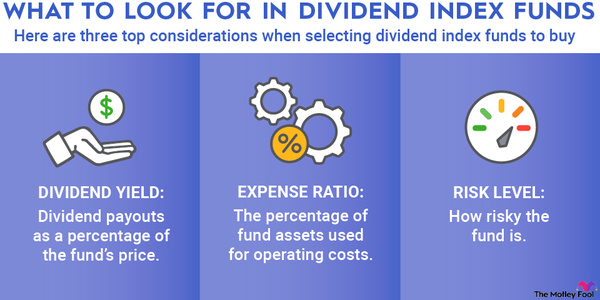

What index is better than the S&P 500?

The answer depends on your investment goals. For example, if you're seeking high growth and are willing to accept more risk, you might want to invest in a fund that tracks the tech-heavy Nasdaq-100 index.

If you're seeking income-producing investments, you could buy an index fund that tracks the S&P 500 High Dividend index. The index tracks the performance of 80 companies in the S&P 500 and has a long track record of paying above-average dividends.

Is the S&P 500 ETF a good investment?

There are several S&P 500 ETFs. Like the index funds discussed in this article, they each use the S&P 500 index as their benchmark. Historically, funds that track the S&P 500 index have been good investments in the long term.