457(b) contribution limits

The standard contribution limit for a 457(b) plan is $23,500 in 2025 and $24,500 in 2026. This limit includes both employee and employer contributions.

Participants ages 50 and older may be allowed to make catch-up contributions. The standard catch-up contribution for 2025 is $7,500, but this limit increases to $8,000 in 2026, bringing the total limit for some to $31,000 in 2025, or $32,500 in 2026. Under the Secure Act 2.0, workers between the ages of 60 and 63 can make an extra catch-up contribution, bringing their maximum contribution to $34,750 in 2025 and $35,750 in 2026.

Certain 457(b) plans may allow for a special catch-up contribution. Your 457(b) plan may permit participants in their last three years before retirement to contribute either twice the standard contribution limit or the standard contribution limit plus the amount of the standard limit that the participant didn’t contribute in prior years, whichever is less. Participants who elect to contribute up to the special catch-up limit are also not eligible for the standard catch-up contribution.

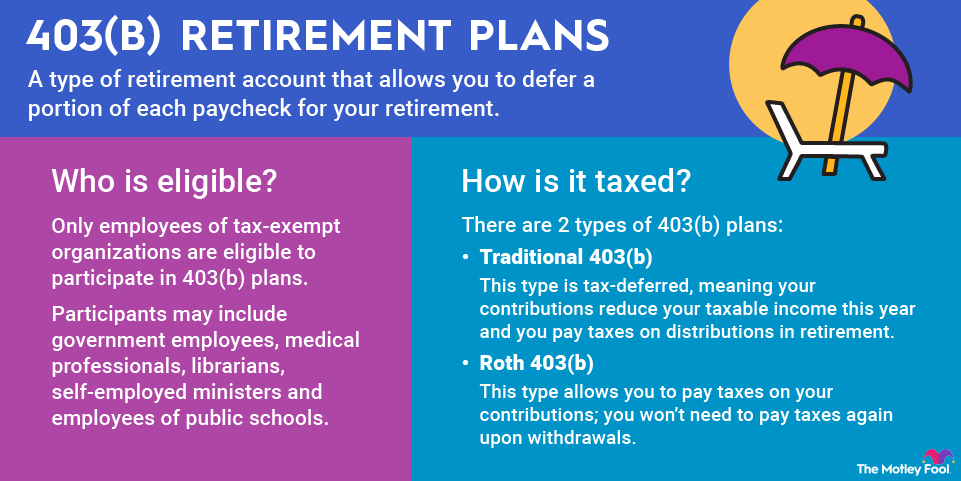

Importantly, 457 plan contribution limits are not reduced by contributions to other employer-sponsored retirement plans. So if an employer offers both a 457 and another type of retirement plan, such as a 401(k) or 403(b), then employees can contribute the maximum permissible amount to both accounts in the same year.