If you think taxes aren't likely to be lower by the time you retire, you'll want to learn how to open a Roth IRA. A Roth Individual Retirement Account (IRA) is a retirement account that lets you make tax-free withdrawals. There's no such thing as a free lunch, of course; your contributions are taxed before they're deposited into an IRA instead of when they're withdrawn.

What is a Roth IRA?

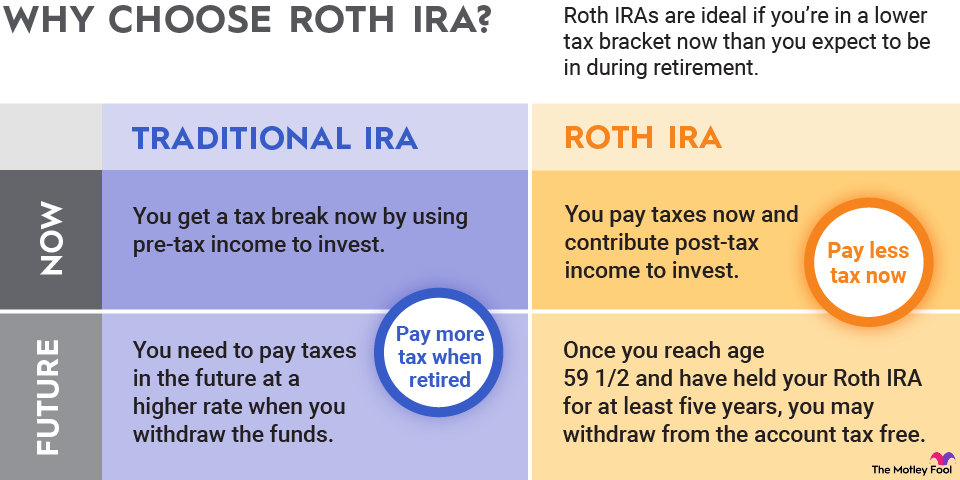

A Roth IRA is simply an individual retirement account (IRA) that taxes your contributions when you deposit them rather than when you withdraw them. One of the main Roth IRA advantages is that if you tax rate increases by the time you retire, you'll get a break. You'll also receive potentially unlimited tax-free growth.

The main disadvantage is that there's no upfront tax break. If you only have a limited amount to invest, your after-tax deposits may be smaller, so your investments may not accumulate as rapidly as they would with a traditional IRA.

Steps to open a Roth IRA

To open a Roth IRA, follow these steps:

1. Determine your eligibility

The first step to opening a Roth IRA is finding out if you're eligible. The criteria for Roth IRA eligibility are fairly straightforward and based on whether you earn less than the annual Roth IRA income limits. Generally speaking, you can open a Roth IRA and contribute the maximum amount in 2026 if you're single and your modified gross adjusted income (MAGI) is less than $153,000, or if you're married and filing jointly, your combined income is less than $242,000. You can make reduced contributions at incomes above these thresholds, but you'll be ineligible to directly contribute to a Roth IRA at incomes above $168,000 for single filers and $252,000 for married couples filing jointly.

2. Decide where to open your account

Assuming you're eligible, your next step should be determining where to open your account. If you're a hands-on investor, you can open a Roth at an online broker and choose your own retirement planning adventure from funds or other investments that they offer. If you're a "set-it-and-forget-it" type of investor, your best bet is a robo-advisor, an automated service that will build and keep a diversified portfolio that requires little of your time.

Either way, you should be sure to check on fees and commissions. A robo-advisor will generally offer services for less than a full-service brokerage.

3. Gather necessary documents

Opening a Roth IRA requires little paperwork. You'll need some form of government-issued identification, your Social Security number, and banking information, such as routing and account numbers.

4. Pick your investments

One of the biggest benefits of a Roth IRA is the ability to choose your own investments. You can select individual stocks, bonds, mutual funds, exchange-traded funds (ETFs), or any combination (as long as your provider offers them). As with any other investment decision, your choices will depend on your risk tolerance.

5. Set up a contribution schedule

Finally, you'll want to consider the amounts and frequency of deposits to your account. Two disadvantages are the Roth IRA income limits and low contribution limits.

Single Filers (MAGI) | Married Filing Jointly (MAGI) | Married Filing Separately (MAGI) | Maximum Contribution for individuals under age 50 | Maximum Contribution for individuals age 50 and older |

|---|---|---|---|---|

under $153,000 | under $242,000 | $0 | $7,500 | $8,600 |

$154,500 | $243,000 | $1,000 | $6,750 | $7,640 |

$156,000 | $244,000 | $2,000 | $6,000 | $6,880 |

$157,500 | $245,000 | $3,000 | $5,250 | $6,020 |

$159,000 | $246,000 | $4,000 | $4,500 | $5,160 |

$160,500 | $247,000 | $5,000 | $3,750 | $4,300 |

$162,000 | $248,000 | $6,000 | $3,000 | $3,440 |

$163,500 | $249,000 | $7,000 | $2,250 | $2,580 |

$165,000 | $250,000 | $8,000 | $1,500 | $1,720 |

$166,500 | $251,000 | $9,000 | $750 | $860 |

$168,000 & over | $252,000 & over | $10,000 & over | $0 | $0 |

What to do after you've opened your account

Opening a Roth IRA involves relatively little maintenance for most investors. You'll want to review your statements regularly to ensure there aren't any surprises, and you may want to rebalance your portfolio periodically.

Consider how your IRA meshes with any other retirement plans. For example, if you also have a conservative employer-sponsored 401(k) plan, you might use an IRA for a high-risk, high-reward opportunity, such as emerging markets or growth stocks.

Be sure to name a beneficiary so your account will pass directly to the person you name and avoid probate. Check with your financial advisor to get an idea of the rules surrounding inherited IRAs.

Important things to consider when opening a Roth IRA

Besides the opportunity to increase your investment without taxes, Roth IRAs offer a few other benefits. You can withdraw your contributions at any time without taxes or penalties. However, penalty-free withdrawals of earnings don't begin until you've reached age 59 ½ and you've had the account for five years. Taking money from a Roth IRA also won't affect your retirement income for tax purposes.

You can contribute to both a Roth IRA and a workplace retirement account, like a 401(k). And perhaps most importantly, you can choose investments ranging from mutual funds and exchange-traded funds (ETFs) to individual stocks and bonds.

Anyone who inherits your Roth IRA won't have to pay federal income tax on withdrawals (again, if it's been open for five years).

Related investing topics

Bottom line

The best time to start a Roth IRA may have been yesterday, but today is a good choice, too, now that you know how a Roth IRA works. As with any other investment decision, make sure your savings won't cut into your ability to pay down high-interest credit cards and loans, as well as pay for basic necessities.

If you're concerned that taxes may increase and you want the ability to make your own investment decisions, a Roth IRA can be a key part of your retirement nest egg.