You can inherit a Roth individual retirement account (IRA) and avoid a lengthy court process known as probate as long as the person who passed away listed you as a beneficiary and you are still alive. The distribution rules for beneficiaries can get complicated and depend on two key factors:

- Your relationship to the original account owner: The IRS lets you treat a Roth IRA from a spouse as if the funds were always yours. For non-spouses, different rules apply.

- When the original account owner died: The SECURE Act, which went into effect in 2020, changed the inherited IRA rules. If your loved one died before Dec. 31, 2019, then the old rules apply.

Probate

Distribution rules

Inherited Roth IRA distribution rules

When you inherit a Roth IRA, the money you receive gets the same tax-advantaged treatment as the original account. Because the money was contributed on an after-tax basis, you can withdraw the contributions at any time without paying tax or penalty.

The five-year rule states that as long as the account was opened at least five years ago, withdrawals of earnings are tax-free. Earnings withdrawn from Roth IRAs less than five years old are subject to income tax at your ordinary tax rate, plus a penalty.

The passage of the SECURE Act changed how the distribution time period is determined for an inherited IRA. If your loved one died in 2020 or later, then you don't have to take required minimum distributions, or RMDs, but you need to withdraw the entire amount of the IRA within 10 years.

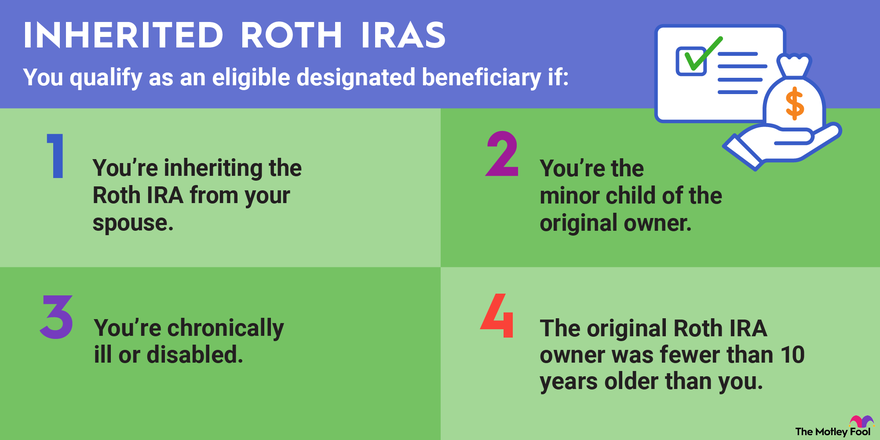

The new law prevents you from stretching out the distributions over your lifetime, which enables you to maximize the account's tax-free growth. However, the new law also creates a category of beneficiaries called "eligible designated beneficiaries" who are still allowed to stretch distributions over their life expectancies. You qualify as an eligible designated beneficiary if:

- You're inheriting the Roth IRA from your spouse. If you are the account's sole beneficiary, you can treat the account as you would your own. You do not have RMDs. However, if you open the Roth IRA as a new inherited account, you need to take RMDs but can stretch them over your lifetime.

- You're the minor child of the original owner. You can take distributions based on your life expectancy until you're 18 or the age of majority, if different, in your state. Then you have 10 years to deplete the remainder of the account. If you're enrolled in school, you can typically delay starting the 10-year withdrawal period until age 26.

- You're chronically ill or disabled.

- The original Roth IRA owner was less than 10 years older than you.

Under the old rules, which apply if your loved one passed away in 2019 or earlier, you have to take RMDs when you inherit a Roth IRA from someone who wasn't your spouse. You can stretch distributions over your lifetime using an IRS uniform life expectancy table to estimate your remaining lifespan based on your age.

For example, someone who is 40 years old in 2022 could expect to live another 45.7 years. So a 40-year-old with a $1 million inherited Roth IRA would have an RMD of $21,881, which is equal to $1 million divided by 45.7.

Inheriting from a spouse

Inheriting a Roth IRA from a spouse

Your options for inheriting a Roth IRA are different when the original account owner was your spouse. Here are your alternatives as a spousal beneficiary:

- Designate yourself as the owner of the account or transfer the account's assets into your own Roth IRA. This option is only available if you're the sole beneficiary and the assets are treated as if they were always yours. Under this option, you pay tax at your ordinary income tax rate and a 10% penalty if you withdraw any earnings before you reach age 59 1/2.

- Open an inherited IRA. Another option is to open a special account called an inherited IRA or beneficiary IRA. You cannot add funds to the account and are still required to take RMDs, but since spouses are considered as eligible designated beneficiaries, you can stretch the distributions over your lifetime. You are not penalized for withdrawing earnings before age 59 1/2, and this option may be necessary for IRAs with multiple beneficiaries.

- You can take a lump-sum distribution. Unlike with a traditional IRA, you won't be taxed if you choose to receive the IRA's funds in cash, provided that the Roth IRA has been open for at least five years. If the account has been open for less than five years, you could be taxed on any earnings upon receiving a distribution. By accepting the fund's value in cash, you lose the opportunity to continue to increase the account's value tax-free.

Inheriting from a parent

Inheriting a Roth IRA from a parent

A Roth IRA inherited from a parent is treated the same as a Roth IRA inherited from any other non-spouse. Your options are relatively limited because you aren't allowed to treat the account as if it were originally your own.

If you inherit a Roth IRA from a parent or non-spouse who died in 2020 or later, you can:

- Open an inherited IRA and withdraw all the funds within 10 years. You do not have RMDs, but the maximum allowed distribution period is 10 years.

- Open an inherited IRA and stretch RMDs over your lifetime. This is provided that you qualify as an eligible designated beneficiary.

If you inherited a Roth IRA from a parent or non-spouse who died in 2019 or earlier, you can:

- Open an inherited IRA and take RMDs. You can stretch the RMDs over your lifetime, which is a good way to maximize the money's tax-free growth.

- Open an inherited IRA and withdraw the funds within five years. RMDs aren't required if you withdraw all the money within five years.

Regardless of when your loved one died, you have the option of taking a lump-sum distribution. You do not pay income tax or a penalty regardless of your age provided the IRA has been open for at least five years.

What should you do if you've inherited a Roth IRA?

Inheriting a Roth IRA and leaving assets in the account as long as you can has the major advantage of allowing the assets to continue to grow tax-free. Gains held in an IRA are not taxed no matter how much the account increases, which is one of the biggest advantages of Roth IRAs.

It's essential that you understand and follow all the rules, though. If you fail to annually take enough money out of the account as the IRS requires, you could pay a penalty equivalent to 50% of the amount you should have withdrawn for the year.

Before you make any big decisions about your inherited Roth IRA, consider consulting with a tax advisor to make sure you comply with all the rules and maximize the growth of the money you've received.