Although not nearly as common as they once were, dual-purpose funds still exist and, for some investors, fill an important function in portfolios. They were much more popular in the 1970s and 1980s but have largely fallen out of favor due to restructured tax laws. However, they still exist, so it's important to understand these investment vehicles.

What is a dual-purpose fund?

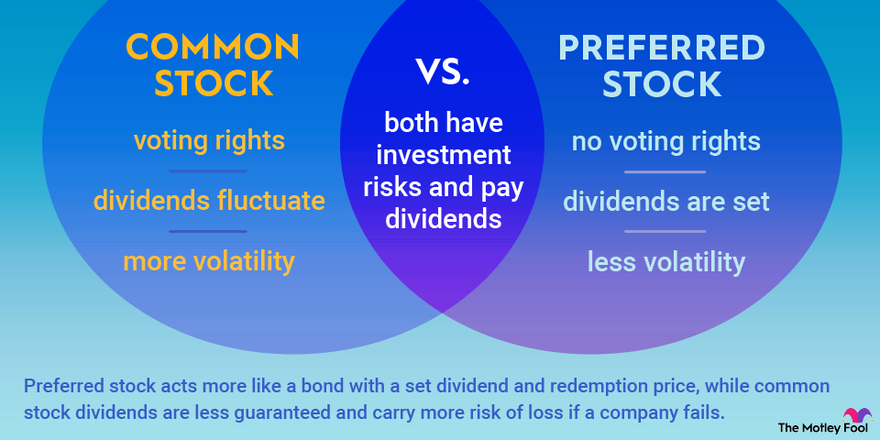

A dual-purpose fund is a type of mutual fund that holds two types of shares in a company or companies -- preferred shares and common shares. Investors can choose the share class they want to put their money into, focusing on either dividend or interest income or on capital gains. Once the dual-purpose fund is established, it makes no more investments, and a future liquidation date is set.

When it comes time to liquidate the fund, holders of preferred stock are paid the face value of their stocks, and holders of the common stock split the remainder. If the dual-purpose fund was successful, the common stockholders would make more money from their stocks than they paid; if not, they could experience substantial losses.

Closed-end funds versus open-end funds

A dual-purpose fund is a type of closed-end fund, which is a far less common asset today. In a closed-end fund, shares are issued only once, regardless of how many people may later become interested in the fund. If someone wants to buy into the fund once it's closed, they must buy the shares from someone who wants to exit the investment. They are also bought and sold on a stock exchange.

An open-end fund, on the other hand, issues new shares whenever someone wants to buy into it and buys them back when they become available. So, in that way, an open-end fund loses some of its scarcity because anyone can buy in at any time, even if no shares are available.

Who invests in a dual-purpose fund?

By their very nature, dual-purpose funds attract two different kinds of investors. First, they appeal to investors who like dividends and interest payments -- these tend to be longer-term investors looking for steady returns. They want a stable vehicle for their money and may be close to retirement or already retired and trying to manage their cash flow.

Dual-purpose funds also appeal to investors who like to take chances with their money and seek higher returns from common stock holdings. The common stock portion of the dual-purpose fund can be incredibly profitable if its stocks grow in value while the fund exists, but owners will receive no additional income from their investments.

If the stocks don't perform well, they stand to lose a great deal of money. These investors tend to be younger, have more time to make up for losses, or simply have some extra cash to experiment with that they can afford to lose.

How do you make money with a dual-purpose fund?

Making money with a dual-purpose fund depends largely on who you are as an investor and which part of the fund you buy.

Conservative dividend investors can choose to buy the fund's preferred stocks and draw interest or dividends from it for the life of the fund. When the fund is liquidated on a set date, the initial investment is returned, less any fees. So, the income, in this case, comes from a truly passive investing strategy.

Related investing topics

More aggressive stock investors employ something more akin to a growth mindset. Since the common stocks in the dual-purpose fund don't have other benefits, like dividends, they're counting on making all their money at the end of the investment.

So, if they buy into the fund at $10 per share, for example, they're hoping that across the fund's lifespan, the stocks inside will gain considerable value and, perhaps, be worth $20 per share or even $200 per share.

After the conservative investors are paid, common stockholders split the remainder, hopefully at a considerable profit. However, there's always a risk that a dual-purpose fund will lose money. Since it liquidates on a given date planned far in advance, it's impossible to predict the market conditions on that specific date, and it can't simply wait to sell at a more favorable time, given the structure of the fund.