Investors are always looking for the best returns to reach their financial goals. One strategy, built on investing in the highest-yield blue-chip stocks in the Dow Jones Industrial Average (DJ INDICES:^DJI), is the "Dogs of the Dow." In this article, we will discuss the strategy, how it works, the current components, and provide some examples.

What is Dogs of the Dow?

What is Dogs of the Dow?

"Dogs of the Dow" is an investing strategy that aims to generate better returns than the Dow while also presenting lower risk than other stock-picking strategies. Using this strategy, one invests in the 10 highest-yielding stocks in the Dow Jones Industrial Average and then reallocates the portfolio annually to the new highest-yielding Dow stocks. The term "dogs" refers to the strategy of looking for the highest-yield Dow stocks, which are typically the ones that are viewed as being out of favor with investors, or "in the doghouse."

The Dogs of the Dow strategy has gained in popularity since Michael O'Higgins' book, Beating the Dow, was first published in 1991. The idea behind this strategy is that investors can profit from the relative strength of Dow stocks and the opportunity to buy undervalued components using dividend yield as a proxy for valuation. The underlying thesis is that these "dogs" are often down for short-term reasons, and the market's overreaction has created an opportunity for contrarian investors.

To put it plainly, this is a contrarian, value stock strategy that eschews growth stocks and focuses on undervalued assets.

The 2024 Dogs of the Dow

The 2024 Dogs of the Dow

| Stock | Market Cap | Dividend Yield | Sector |

|---|---|---|---|

| Walgreens NASDAQ:WBA) | $7.69 billion | 11.22% | Consumer goods |

| Verizon (NYSE:VZ) | $181.89 billion | 6.14% | Telecommunications |

| Dow (NYSE:DOW) | $37.53 billion | 5.24% | Materials (chemicals) |

| Chevron (NYSE:CVX) | $273.08 billion | 4.36% | Energy |

| Johnson & Johnson (NYSE:JNJ) | $388.36 billion | 3.09% | Consumer goods |

| Cisco (NASDAQ:CSCO) | $214.64 billion | 2.99% | Technology |

| IBM (NYSE:IBM) | $214.61 billion | 2.85% | Technology |

| Amgen (NASDAQ:AMGN) | $173.18 billion | 2.79% | Healthcare |

| Coca-Cola (NYSE:KO) | $299.85 billion | 2.79% | Consumer goods |

| Merck (NYSE:MRK) | $279.24 billion | 2.79% | Healthcare |

How Dogs of the Dow works

How Dogs of the Dow works

Dogs of the Dow is a long-term investing strategy that is relatively simple in its execution. It is designed to provide investors with a good chance at generating strong returns, while also being relatively lower-risk. Its focus on dividend stocks also makes it compelling to investors looking for income.

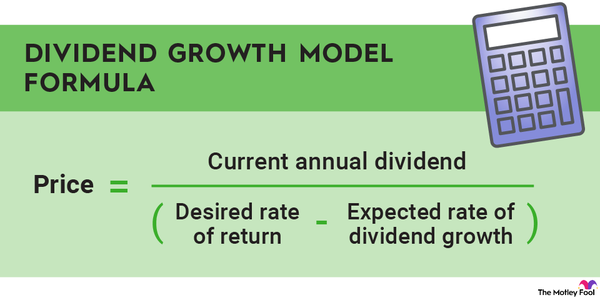

To use this strategy, one starts by investing equal amounts into the 10 highest-dividend-yielding stocks from the Dow Jones Industrial Average. The idea is that by selecting from only the 30 stocks in the Dow, investors are already filtering to blue-chip companies. The Dow Jones Industrial Average is widely considered a benchmark of the broader U.S. stock market, and the component stocks have been carefully selected to be representative of the U.S. market and strong enough to stand the test of time.

The next step is to rebalance the portfolio every year into equal amounts of the 10 highest-yielding stocks in the Dow and to repeat this process every year. Why? The work done by O'Higgins and others indicates that, over the long term, the strategy can generate higher returns than investing in an index fund that tracks the Dow -- or even the broader S&P 500 Index (SNPINDEX:^GSPC), which tracks a much larger subset of the biggest U.S. companies.

The reasoning behind this strategy is also relatively simple. The idea is that the Dow stocks with the highest yields are often the ones that have underperformed recently, or even lost value. But, as a Dow component, these are already some of the highest-quality companies out there, and whatever reasons the stock price has fallen and pushed the yield higher are likely to prove temporary, giving investors an opportunity to buy favorable stocks at out-of-favor prices.

By repeating this process each year, investors can -- in theory -- take advantage of these temporary price dislocations and an eventual recovery, profiting from above-average dividend yields along the way.

Dogs of the Dow example

Dogs of the Dow example

Let's look at how the Dogs of the Dow strategy would have worked in recent years, starting in 2018. The portfolio would have included current Dow stocks Verizon, IBM, Chevron, Merck, Coca-Cola, Cisco Systems (CSCO 1.69%), and Procter & Gamble (PG -0.32%), plus former components Pfizer (PFE 0.3%), ExxonMobil (XOM 1.12%), and General Electric (GE 0.87%).

In 2018, the Dow generated 21% in total returns, while the Dogs of the Dow portfolio would have generated 27% in total returns. Four of the Dogs returned more than 45%, more than making up for the six Dogs that underperformed the index (one of which lost 8% in value).

The results in 2019 and 2020 were not favorable, with the Dogs of the Dow portfolio generating 18.7% and (7.9%) in total returns (losses) respectively, while the Dow returned 25.3% and 9.7% in those years. In 2021, Dogs of the Dow once again outperformed, with 25.3% in total returns, compared to 21% for the index.

As this illustrates, the Dogs of the Dow portfolio strategy can result in widely divergent results from year to year. Moreover, there are more consequences investors must consider before adopting this strategy, especially regarding taxes.

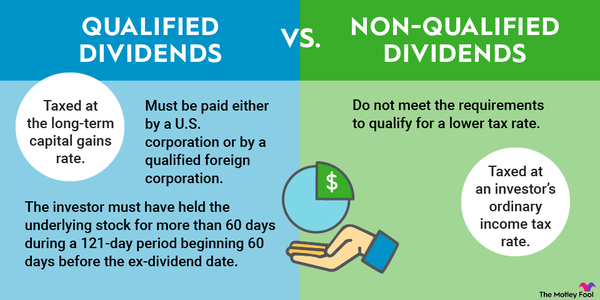

Since the portfolio is rebalanced and reallocated every year, there is the potential for significant tax costs weighing on realized returns. By rebalancing to the highest-yield components of the Dow, investors following this strategy will often sell some -- or even all -- of their biggest gainers from the prior year. As a result, a significant portion of any outperformance can be lost in capital gains taxes each year. Conversely, it is not uncommon for the Dogs that continue to lag to remain Dogs. So investors may not be able to offset capital gains by selling the losers and realizing those losses.

Related investing topics

The bottom line

While the Dogs of the Dow strategy has delivered modest outperformance of the Dow Jones Industrial Average and the S&P 500 over various periods of time in the past, its results from year to year can be spotty. This is why proponents recommend investors who adopt it use it as a long-term strategy. Unfortunately, the short-term nature of its methodology -- selling off holdings each year to rebalance to the new Dogs -- can undermine the results, particularly for investors who are not using tax-deferred investing accounts such as IRAs.

And, while this is a very simple -- even elegant -- strategy on the surface, its reductive nature of concentrating to only 10 stocks can make it riskier than one might think. Filtering to blue-chip stocks in the Dow helps lower this risk to some extent but certainly doesn’t eliminate it.

Whether the Dogs of the Dow strategy makes sense for any investor is a very personal decision. While it has strong advocates who tout past successes, its future results may or may not generate the returns investors expect.