If you've ever wondered whether there's a way to model how money moves through the economy, look no further than the concept of velocity of money. It may not seem very exciting on the surface, but it's important to understand the way money moves, not just that it does, so you can better understand the pressures faced by businesses and consumers.

What is the velocity of money?

The velocity of money is a way to model how often money is exchanged in an economy during a window of time. This tool helps gauge the health of a monetary system by comparing the frequency of money transactions to the total money supply over time.

Two types of money supplies are measured and tracked: M1 and M2. M1 is money as most people think about it: dollars, cents, and liquid accounts such as checking and savings. M2 money comprises this type of money, plus money market funds and deposits that are locked in for less than a year, like a 30-day certificate of deposit.

Factors that affect the velocity of money

Several factors affect the velocity of money, including:

- Total money supply. The amount of money in circulation matters. If there's not enough money to go around, the velocity of money will increase, and vice versa. The money supply and velocity of money have an inverse relationship.

- Consumer savings. There are two forms of saving: casual saving and hoarding money. When consumers are afraid of the economy going south, they tend to hoard cash, removing it from circulation and throwing the brakes on spending. When consumers feel secure enough to save money for a rainy day, they may choose to spend a portion of their rainy day fund instead of holding on to it for dear life.

- Income consistency. When consumers are paid consistently, they feel more secure about spending money since the next payday is just around the corner. This increases the velocity of money.

- Money-related technology. Technology can also affect the velocity of money. The faster money moves between people and businesses, the faster it can continue to move, increasing the velocity of money. It's the difference between waiting a week for a paper paycheck to clear and receiving an instant electronic transfer from an employer.

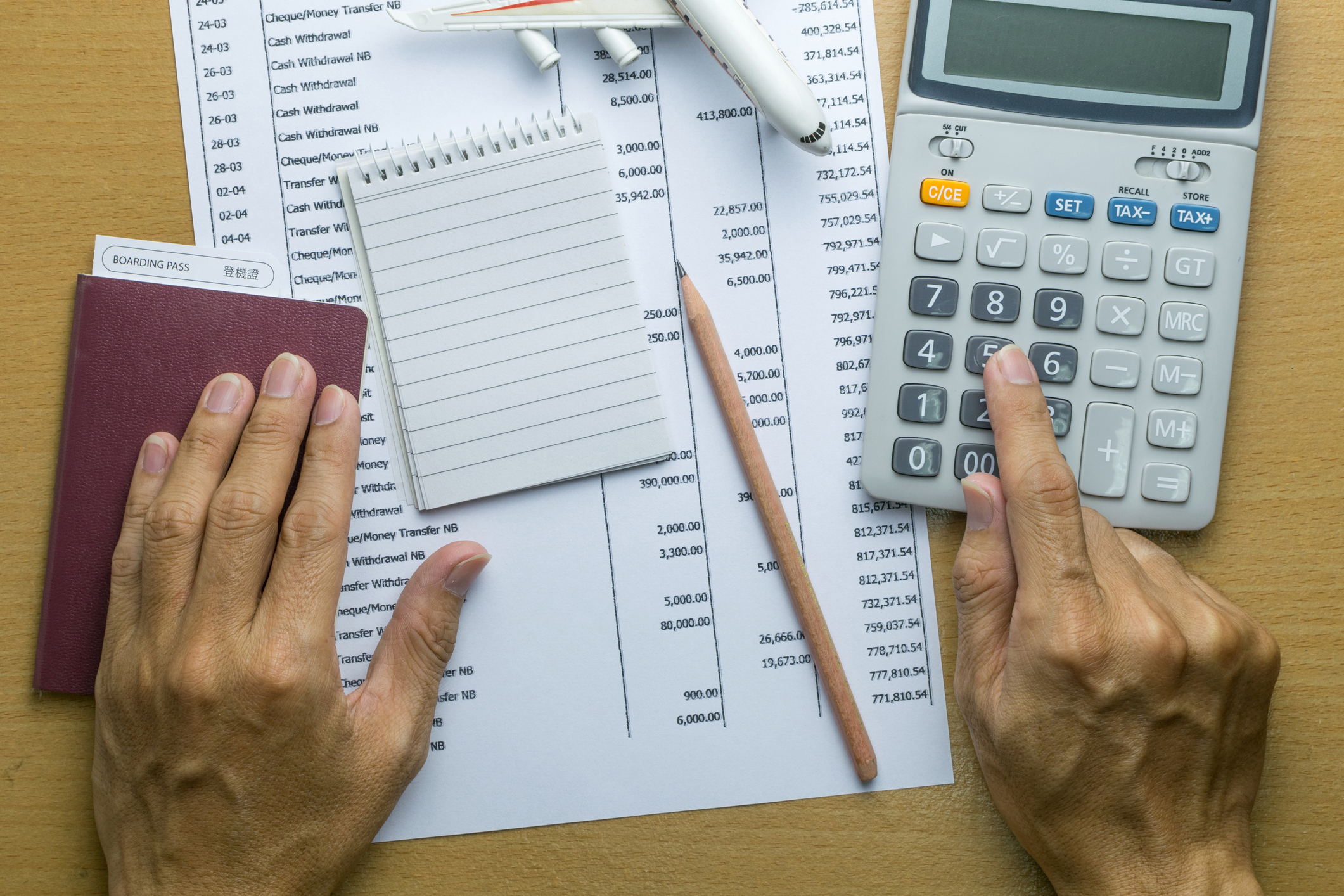

How to calculate the velocity of money

Calculating the velocity of money is pretty simple. All you need to know is the gross domestic product (GDP) of the country whose money supply you want to examine and the specific money supply you want to examine. For example, in the United States, you can easily look at either M1 or M2 money supplies, as they're both closely tracked.

The formula for the velocity of money:

Velocity of money = GDP / money supply

So, if you used a theoretical country with a GDP of $1,000,000 (it's a tiny island nation) and its money supply was $500,000, you'd have this:

Velocity of money = $1,000,000 / $500,000

Velocity of money = 2.0

Interpreting this would require examining the country over time and comparing the result of your calculation to the past. So, if this is high for the nation, it might imply an increase in transactions and a growing economy. If it is low for the nation, that might indicate a slowdown. However, the velocity of money is just one piece of the puzzle and must be considered alongside other economic indicators to be truly useful.

Why the velocity of money matters to investors

Investors should be concerned with the health of the economy in the countries in which they invest, as well as those where their investments are major players. For example, investing in a country with a slowing velocity of money might be a bad move since it's a market with customers who aren't really prepared to spend.

On the other hand, jumping into an economy where money is flying by like mosquitoes on a humid summer night, making it a prime time for consumers to buy, can help an investment grow considerably.

Related investing topics

Of course, the velocity of money can change over time, so it's important to keep an eye on it. If you notice that your investments are in countries where the velocity of money is slowing, it might be time to hedge your investments with something safer or trade those investments for something in a more active economy.

But it also depends on the products or services the company sells. Some, such as niche tools or parts, which must be replaced regardless of how consumers are spending, don't really need a highly active overall market.