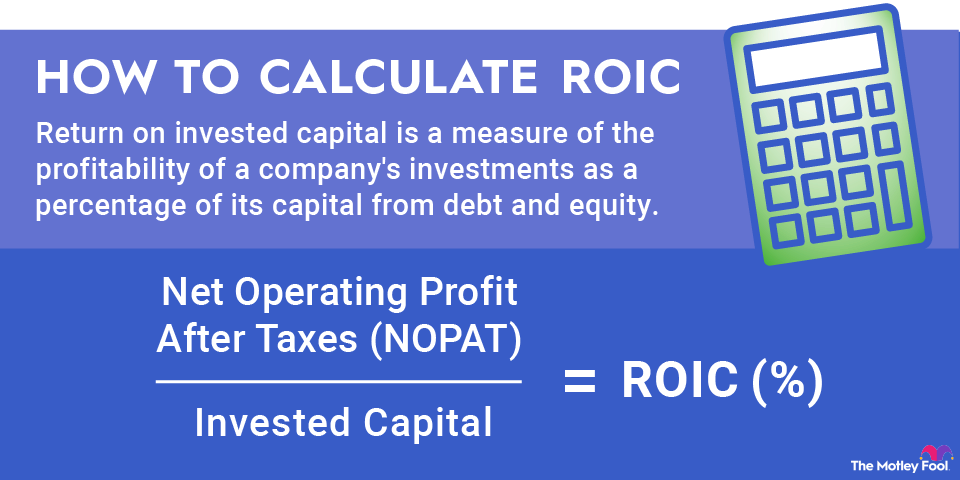

Return on invested capital (ROIC) is a measure of the profitability of a company's investments as a percentage of its capital from debt and equity. It's a useful metric to analyze a company and put its stock valuation in perspective.

Digging through a company's financial statements and doing a little math can help you determine whether a company's stock deserves to be trading at a premium to its peers or if it's undervalued by the stock market.

In this article, we'll go over how to calculate ROIC, what investors can learn from the metric and where it falls short, and give a real-world example.

Understanding ROIC

Return on invested capital can be very informative for investors. It takes into account the entire balance sheet and uses the income statement to evaluate it. It can be used with other profitability ratios such as return on equity to dig deeper into the business. ROIC accounts for the entire capital structure of a business -- both debt and equity -- as it's used to finance operations.

ROIC can be useful on its own. A high return on invested capital is a good sign that management is investing in profitable projects. However, it's best used when compared to the cost of capital for a business.

A weighted average cost of capital (WACC) tells investors how much it costs a business to finance its activities across both debt and equity. If the company produces a ROIC greater than its WACC, it's creating value for shareholders. However, if ROIC is less than WACC, the company is paying more to finance operations than it's generating in profits.

ROIC is much more important in some industries than others. It provides a lot more value for investors in capital-intensive businesses such as brick-and-mortar retailers, telecommunications, and energy companies. Businesses with low capital intensity like software companies won't put too much focus on ROIC. It becomes confusing to use ROIC to evaluate financial companies, where capital is a part of the business itself. That makes it practically inapplicable to the industry.

How to calculate ROIC

Calculating return on invested capital requires you to dig into a company's financial statements.

ROIC is calculated with a simple formula:

Net Operating Profit After Taxes (NOPAT) divided by Invested Capital. (It's expressed as a percentage.)

Calculating NOPAT

To calculate NOPAT, you'll need two numbers that can be found on a company's income statement: Earnings Before Interest and Taxes (EBIT) and the company's marginal tax rate.

You may have to do a little digging to find EBIT. You can take operating income and add in any other income the company generated. Or you may find EBITDA and subtract depreciation and amortization expenses from that.

Depreciation

For most companies based in the U.S., the federal marginal tax rate is currently 21%. The state tax rate will vary depending on where a company is based and where they pay taxes. You can also use the company's effective tax rate for the period, but be sure to adjust for any one-time tax events.

Once you have those numbers, the formula is NOPAT = EBIT * (1-tax rate).

For example, if a company generated $1 billion in EBIT with a marginal tax rate of 25%, its NOPAT is $1 billion * (1-25%) = $750 million.

Calculating invested capital

There are two ways to calculate invested capital: One looks at the company's assets, and another looks at its financing from debt and equity. Given the choice, it's better to calculate invested capital using the company's assets since it will give you a better view of how the company is using its capital.

Using the assets on the balance sheet, start calculating invested capital by determining working capital. Working capital is equal to current assets minus non-interest-bearing current liabilities such as accounts payable or accrued expenses.

To net working capital, you then add property, plants, and equipment, goodwill, and other operating assets to get invested capital.

For example, if a company had $2 billion in current assets; $1 billion in non-interest-bearing current liabilities; $2.5 billion in property, plants, and equipment; $500 million in goodwill; and $1 billion in other operating assets, it would have invested capital of $5 billion.

You may reduce invested capital by excess cash, which is any cash not needed for day-to-day operations. There are no hard and fast rules, however, for determining how much cash is necessary and how much is excess.

Putting it all together

Once you have NOPAT and invested capital figured out, it's a simple division problem.

From the example given above, ROIC = $750 million / $5 billion = 15%.

Drawbacks of ROIC

There are a few drawbacks of using ROIC.

Many companies operate multiple segments. Some may be extremely capital-intensive; others may not. They may operate in entirely different industries from one another. Since ROIC takes into account the entire company's operations, it can be difficult to know whether the bulk of value is generated by a single segment or if the entire company is producing strong investment returns.

The metric also is less applicable to some industries than others. Trying to use ROIC to evaluate financial companies is going to create a mess because banks and insurance companies use capital in their products.

Some factors might generate misleading ROIC numbers. For example, a company with a lot of goodwill on its balance sheet will generate a lower ROIC as a result of the bigger denominator. If a company writes down goodwill, you'll need to make adjustments to perform a useful historical analysis of its ROIC.

Lots of capital leases compared to competitors also may skew the results of ROIC analysis unless you make adjustments to account for leases. Excess cash on hand will deflate ROIC unless adjusted. Since cash isn't really invested capital, any excess cash on hand should be removed from net working capital.

Additionally, a non-recurring event generating a big gain or loss could affect profits and shouldn't be used for evaluating normal operations of the business. Be sure to account for differences in balance sheets and anomalies in the income statements when comparing ROIC across companies.

Real-world example of ROIC

Let's take a look at Walmart's (NYSE:WMT) return on invested capital from fiscal 2022.

First, we need to calculate Walmart's NOPAT. To do that, we can take its operating income of $25.942 billion and multiply by its effective tax rate of 25.44%. While the effective tax rate isn't necessarily the same as its marginal tax rate, it presents the best approximation of the figure available. As such, we get a NOPAT of $19.342 billion.

Next, determine Walmart's invested capital. Walmart had $244.86 billion in total assets on its balance sheet at the end of fiscal 2022. That includes capital and finance lease rights-of-use, but those are arguably necessary for its operations. It had $82.172 billion in accounts payable, accrued liabilities, and accrued taxes, leaving it with $162.688 billion in invested capital. Its cash holdings of $14.76 billion seem reasonable enough, so no adjustments are needed.

Doing the same calculation for invested capital at the beginning of the year results in a total of $165.147 billion. So, the average invested capital over the year was about $163.918 billion.

Therefore, Walmart's ROIC in 2022 = $19.432 / $163.918 = 11.8%.

Related investing topics

The bottom line

Using return on invested capital can give you a better understanding of a business and how it uses its balance sheet to generate profits for investors. You can also analyze its financing and future investments based on ROIC and analyze its historical trends.

ROIC can be very valuable in comparing one company against its competitors. If one company has a notably higher ROIC -- after adjusting for differences in balance sheets -- it indicates that it has a competitive advantage. As such, its stock ought to trade at a premium valuation relative to its peers. If it doesn't, it may present a buying opportunity for a savvy investor.

At the very least, performing an ROIC analysis will require you to dig into a company's financial statements and learn more about the companies you're analyzing. The practice will make you a better investor.