Savings bonds are financial assets that earn interest over time. When you buy a savings bond, you are loaning money to the federal government. The government repays the loan, including principal and interest, when the savings bond matures.

Let's explore the interest on savings bonds in more detail and share the steps you will take to collect that interest when your bond matures.

When do they mature?

When do savings bonds mature?

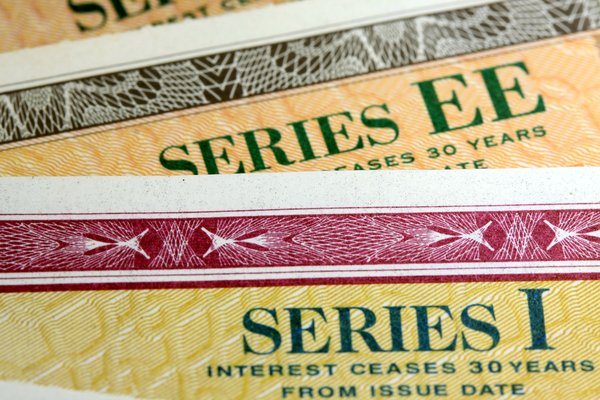

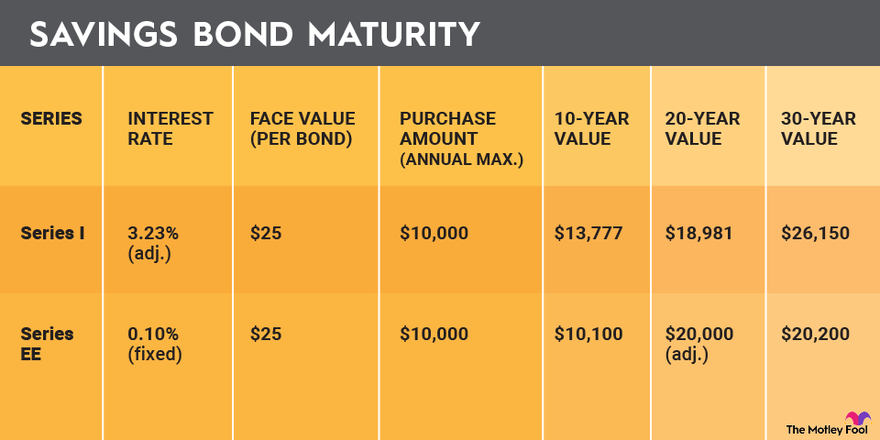

There are two types of savings bonds available for purchase: Series I bonds and Series EE bonds. Both mature 30 years after they are issued. Once a bond reaches maturity, it no longer accrues interest.

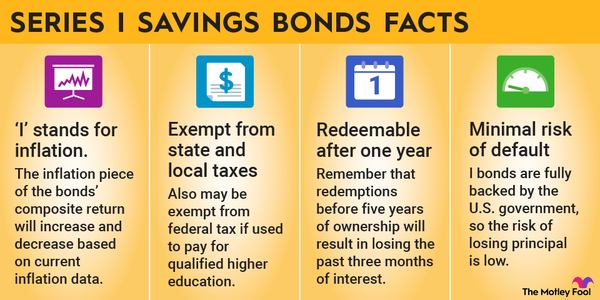

Series I bonds, also known as I bonds, carry a variable interest rate. The rate has two components: a fixed rate of 1.3% plus a variable rate that changes twice annually based on inflation. The combined total rate can rise or fall depending on how prices change in the period prior to the adjustment date.

Although I bonds take 30 years to mature, you can redeem them after 12 months. Redeeming, also called cashing, involves closing out the bond in exchange for the principal and accrued interest. If you cash an I Bond less than five years after issuance, you will forfeit three months of interest.

Series EE bonds, or EE bonds, pay a fixed interest rate and are guaranteed to double in value in 20 years. If that doubling does not happen by way of accrued interest after two decades, the Treasury adjusts the bond's value. Also, the fixed rate is subject to change after 20 years.

The early redemption rules also apply to EE bonds. You can redeem an EE bond early, but you will lose three months of interest by cashing it before it has aged five years.

Accrued and compound interest

Accrued and compound interest

Savings bonds accrue interest monthly, starting from the day they are issued. Every six months, the accrued interest is added to the bond's principal value. The higher principal balance results in higher interest accruals. This process, where interest begins earning its own interest, is called compounding. Compounding is the key to long-term investing success.

You can maximize the lifetime interest on a savings bond by holding it until maturity. This allows for the highest number of wealth-producing accrual and compounding cycles available on that bond.

Example

Savings bond value example

The image below shows how a bond builds value over time. You can see how the advantage of holding the bond until maturity -- it has time to grow to its maximum value.

Admittedly, it can be challenging to hold a 30-year asset to maturity. For that reason, it's wise to plan your savings bond strategy carefully. Factors to consider include your needs for liquidity and inflation protection as well as your risk tolerance.

Liquidity refers to the relative ease of converting an asset into cash. S&P 500 ETF shares are liquid because you can sell them for cash quickly during regular trading hours. Real estate, on the other hand, is not liquid. It takes time to find a buyer and close the transaction.

Savings bonds have liquidity after 12 months because you can redeem them for cash. But if you intend to maximize your interest, you may prefer to treat savings bonds as illiquid. Once you commit to holding a savings bond until maturity, you assume it won't satisfy any cash needs you have for 30 years.

Inflation protection is offered by I bonds, but not EE bonds. While EE bonds are guaranteed to double in value after 20 years, the interest rate is fixed. The variable rate paid on I bonds is tied to inflation, so it can go up when prices are rising.

Note that interest earned by savings bonds is not paid out regularly. Instead, you receive all accrued interest and outstanding principal when you redeem the bond.

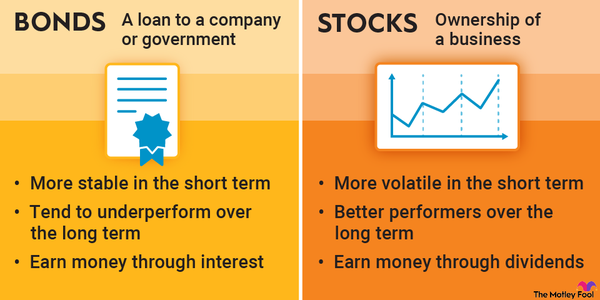

Risk tolerance should always play a role in your savings and investing decisions. U.S. savings bonds have low risk and low returns. If you have a high tolerance for risk, you may prefer a small position in savings bonds or none at all; you might instead focus on more aggressive assets with higher earnings potential. If you want to keep your overall risk low and diversify your net worth, savings bonds could be a good fit.

When it matures

What to do when your savings bond matures

You've waited for three decades, and your bond has finally matured. To cash in your bonds, first identify if you hold an electronic savings bond or a paper one.

Electronic savings bonds are redeemed using the TreasuryDirect website. The minimum redemption value is $25, and you can cash whole or partial bonds. If you cash part of a bond, you only receive interest earned on the portion you liquidate.

Paper savings bonds are cashed at a financial institution, usually one where you hold an account. Each bank has policies on whether they redeem savings bonds, how much they will cash at once, and the forms of identification required to process the transaction.

If you have lost a paper bond or are not sure whether it has already been cashed, you can contact the Treasury Department for help. Ideally, you will have the bond's serial number. At a minimum, you will need your Social Security number, name, and state.

Note that you will owe federal taxes on your bonds once you cash them or they mature. Expect to receive a 1099-INT detailing the earnings after the redemption or maturity of your bonds.

Related investing topics

Low risk, long timeline

Low risk, long timeline

Savings bonds are low-risk, long-term assets. I bonds provide inflation protection, while EE bonds have a guaranteed return after 20 years. Either asset is one you should plan on holding until maturity to maximize your returns.