Investors have several ways to potentially profit from the cannabis industry's growth. You can invest in specific marijuana stocks. However, another alternative is to invest in marijuana exchange-traded funds (ETFs), which are ETFs that own stakes in multiple cannabis companies.

And this industry is poised for strong growth. Cannabis is projected to be a $444 billion global market by 2030, according to Forbes Business Insights. The industry is expected to grow by an impressive compound annual growth rate of 34%.

The main benefit of buying marijuana ETFs is that your money is spread across a basket of stocks, which can lower your risk compared to investing in only a few individual stocks. Here's what you need to know about the top marijuana ETFs on the market.

Top marijuana ETFs in 2026

Below are six top marijuana ETFs with their assets under management and net expense ratios.

ETF | Assets Under Management | Net Expense Ratio |

|---|---|---|

AdvisorShares Pure U.S. Cannabis ETF (NYSEMKT:MSOS) | $1 billion | 0.77% |

Amplify Alternative Harvest ETF (NYSEMKT:MJ) | $209.9 million | 0.75% |

Global X Marijuana Life Sciences Index ETF (OTC:HMLSF) | $59.8 million | 1.00% |

AdvisorShares Pure Cannabis ETF (NYSEMKT:YOLO) | $47.7 million | 1.12% |

Amplify Seymour Cannabis ETF (NYSEMKT:CNBS) | $124.5 million | 0.76% |

Cambria Cannabis ETF (NYSEMKT:TOKE) | $18.1 million | 0.43% |

1. AdvisorShares Pure U.S. Cannabis ETF

The largest marijuana ETF based on assets under management is the AdvisorShares Pure U.S. Cannabis ETF (MSOS -5.57%). It's the first ETF to focus exclusively on the U.S. cannabis market.

This ETF had more than 20 holdings in late 2025, including U.S. marijuana stocks and swaps (derivative contracts, where the values or cash flows of one asset are exchanged for another). Its top positions included swaps for Curaleaf Holdings (CURLF -5.90%), Trulieve Cannabis (TCNNF -4.54%), Green Thumb Industries (GTBIF -6.33%), Cresco Labs (CRLBF -4.80%), Verano Holdings (OTC:VRNOF), and Glass House Brands (GLAS.F -4.21%).

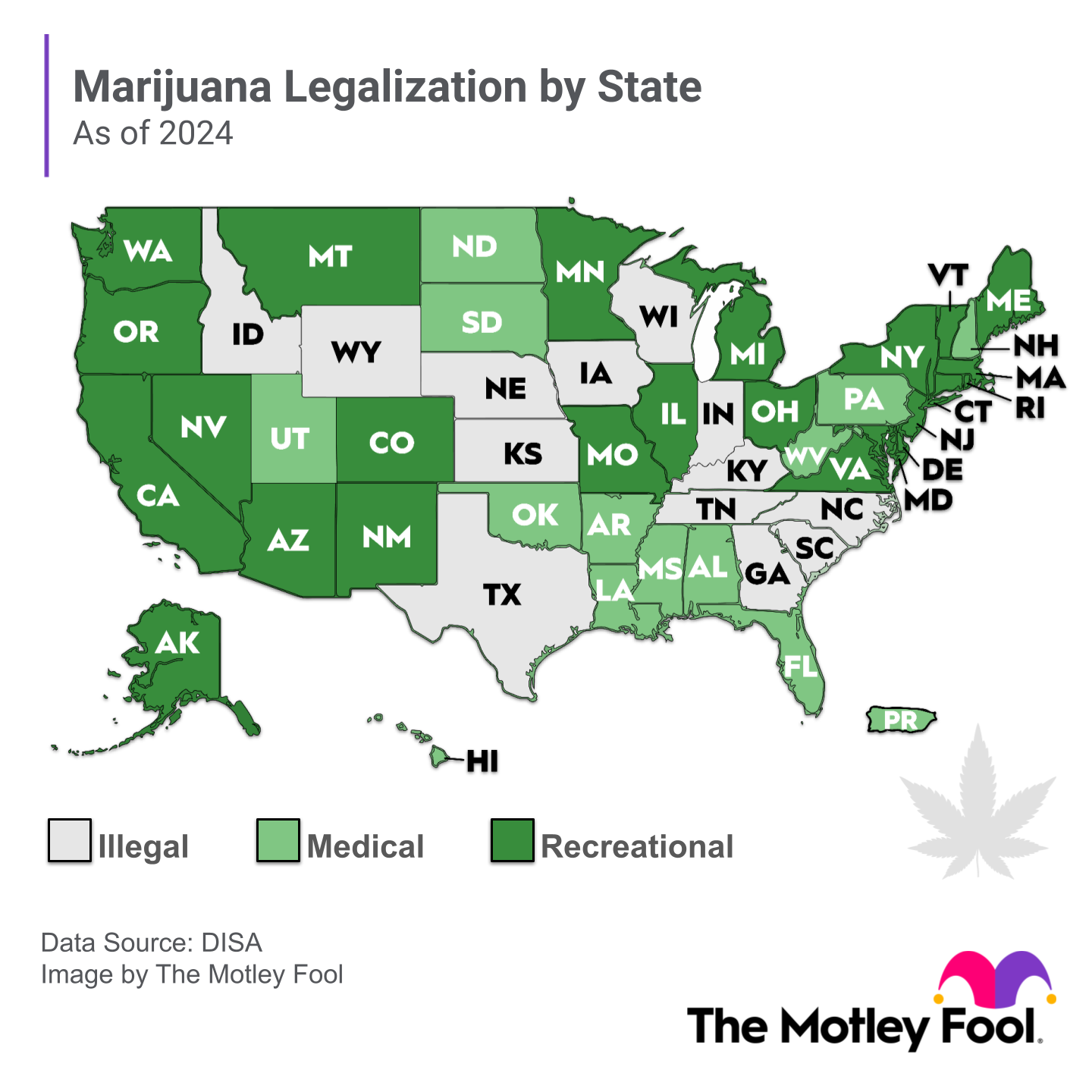

It's possible that the ETF's focus on the U.S. market could give investors greater growth opportunities than other ETFs. Although marijuana remains illegal at the federal level in the U.S., many states have legalized marijuana for medical and/or recreational use.

Pros and cons of investing in marijuana ETFs

The pros of investing in marijuana ETFs include:

- The potential for significant long-term gains.

- Diversification across multiple marijuana stocks.

- Exposure to some U.S. multi-state cannabis operators that can't list their shares on U.S. stock exchanges.

However, there are also cons associated with investing in marijuana ETFs, such as:

- High risk and volatility.

- Relatively high expense ratios.

- Marijuana ETFs could own some marijuana stocks that investors would prefer to avoid.