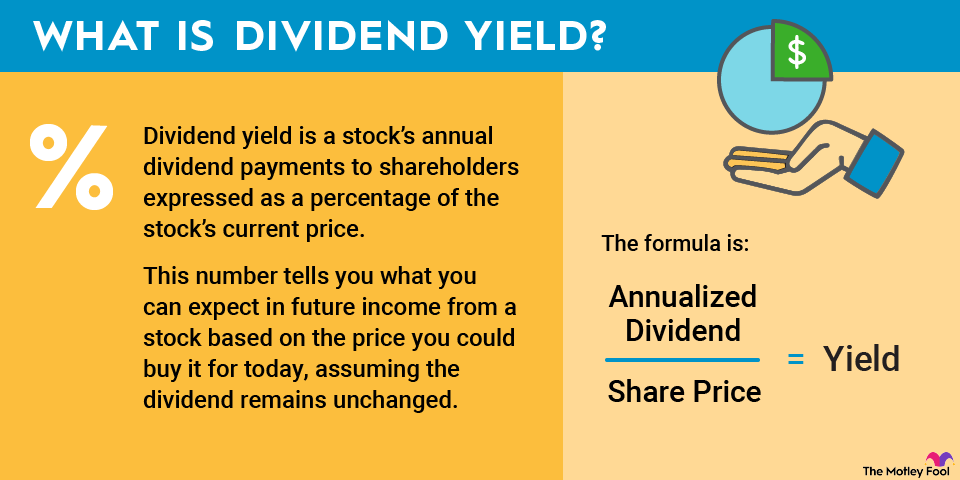

Dividend yield is a stock's annual dividend payments to shareholders expressed as a percentage of the stock's current price. This number tells you what you can expect in future income from a stock based on the price you could buy it for today, assuming the dividend remains unchanged.

For example, if a stock trades for $100 per share today and the company's annualized dividend is $5 per share, the dividend yield is 5%. The formula is: annualized dividend divided by share price equals yield. In this case, $5 divided by $100 equals 5%.

It's important to realize that a stock's dividend yield can change over time, either in response to market fluctuations or as a result of dividend increases or decreases by the issuing company. So unlike a bond, the yield on a stock is not set in stone. It's most useful as a metric to help determine if a stock trades for a good valuation, to find stocks that meet your needs for income, and to let you know if a dividend may be in trouble.

How to calculate dividend yield from quarterly or monthly dividends

Most stocks pay quarterly dividends, some pay monthly, and a few pay semiannually or annually. To determine a stock's dividend yield, you need to annualize the dividend by multiplying the amount of a single payment by the number of payments per year -- 4 for stocks that pay out quarterly and 12 for monthly dividends.

If you're looking to collect dividends as often as possible, stocks that pay monthly may be ideal. Most (although not all) monthly payers are REITs, or real estate investment trusts. This category of companies benefits from some tax advantages that allow them -- actually, require them -- to pay above-average dividends.

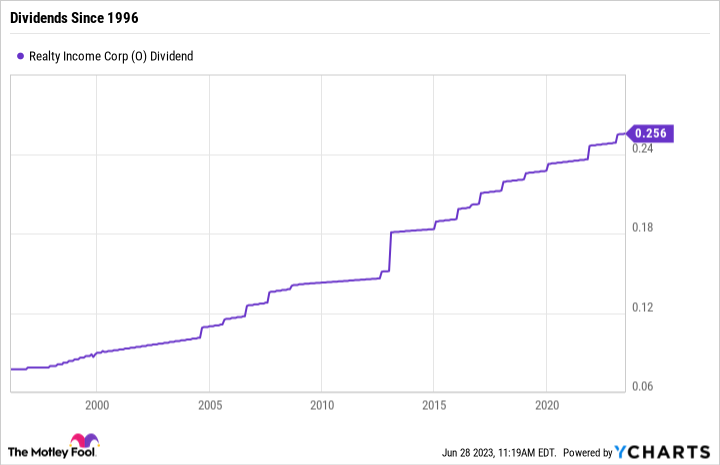

One of the most popular is Realty Income (O +1.32%), which we can use as an example. As of June 2023, the most recent dividend was $0.255 per share, and the share price was near $60. Let's use the formula in the previous section to determine the dividend yield.

A monthly dividend of $0.255 times 12 equals an annualized dividend of $3.07 (rounded). That $3.07 dividend divided by a share price of $60 equals a dividend yield of 5%.

If you're calculating a stock's yield, be careful. Don't just assume that the next dividend payment will be equal to the last. Companies occasionally issue special dividends, and dividends can also get cut. Take the time to research the company and make sure the dividend yield you think a stock will pay matches up with reality.

Realty Income's dividend, for example, has been increased three times in the past year, and it has a long history of modest, regular increases. Costco (NYSE:COST) also has a history of modest regular increases and also pays a special dividend some years -- but not in others. Make sure you don't include these special dividends in your expected yield when evaluating companies with a history of special dividends; they don't happen every year.

The dividend yield shown on many popular financial websites can also be misleading. These sites often report trailing dividend yields, and sometimes they still show a yield that's no longer accurate even after a company has announced a dividend cut.

Total return

Dividends are one component of a stock's total rate of return; the other is changes in the share price. Let's say that the $100 stock described above has gone up in value by $10 after a year. So you've gained 10% in appreciation, plus that 5% dividend yield, for a total return of 15%. If you're investing for the long term, be sure to consider a stock's total return potential in addition to the yield. Depending on your investing goals, you could be skipping the best dividend stocks if you're focusing too closely on dividend yield.

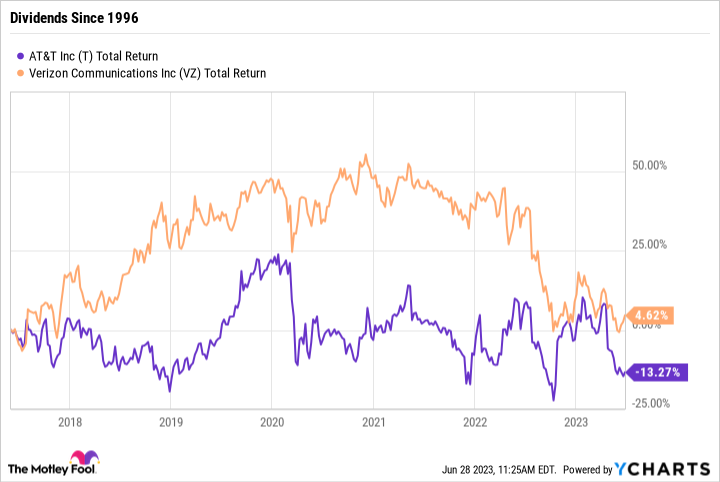

As an example, let's say that (about six years ago at this writing) you bought stock in AT&T (T +1.00%) in June 2017 instead of Verizon Communications (VZ +1.00%) because its dividend yield was a much higher 7.5% than Verizon's 5% yield.

Since then, neither has proven to be a great investment. But Verizon has been the better performer, generating 4.62% in total returns, while AT&T has lost 13.3%.

When you look past the dividend yield at the underlying business, both AT&T and Verizon have struggled under the weight of unsuccessful acquisitions and the high costs of deploying 5G to stay competitive. The lesson: A higher yield is not a promise of future income. It can be a warning sign that a company is struggling.

Pros of dividend yields

Dividend yield is a useful metric when applied appropriately, and when the time is taken to understand whether the company behind the payout is able to keep paying it. Here are a few examples of how dividend yield can be useful.

Income investors, or people looking at their investment portfolio as a source of income today, will rely on dividend yield as a starting point when considering which dividend stocks to buy. After all, if you're living off your portfolio, you have a minimum amount of income you need it to produce. If you're in this situation, you may prioritize stocks that pay the higher yield today as long as the business is doing well and its earnings and balance sheet are strong enough to keep the payout safe.

Valuation

Dividend yield can also be a useful tool to help with valuation. If the dividend yield is significantly different than its historical level or is significantly different from similar companies, it can help inform whether a stock is trading for a better -- or worse -- valuation. It can also serve as a warning sign if the yield is significantly higher than similar companies.

The yield is only the starting point; knowing what is happening with a company's operations and cash flows is important to help keep the dividend yield in the proper context.

Cons of dividend yields

The biggest problem with dividend yield is when investors misuse it or rely on it entirely to make their decisions about which stocks to buy and which to ignore. The example of Verizon and AT&T is a case in point. A higher yield doesn't matter if there are risks to the company that pays the dividend. AT&T struggled under billions in debt from multiple acquisitions that went badly, and investors have paid the price.

Focusing exclusively on dividend yield can also cause investors to miss out on better opportunities.

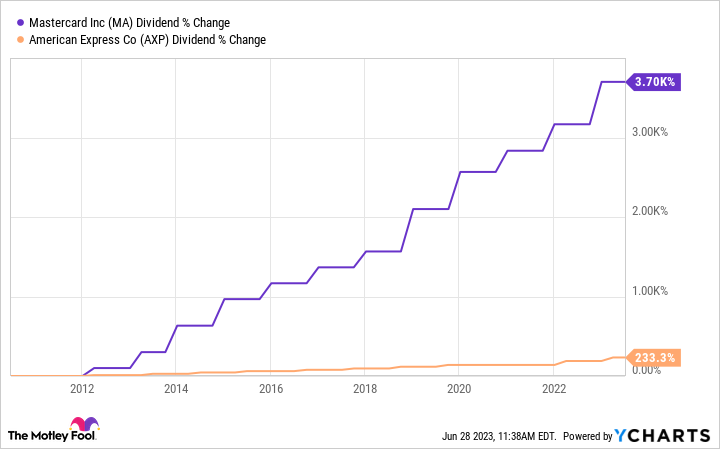

Here's another case in point. In 2010, Mastercard's (MA +0.72%) dividend yield was a paltry 0.26%, while competitor American Express's (AXP +0.21%) shares yielded almost 2%. For some investors, Amex's higher yield represented a "safer" investment since you could always count on that trickle of income each quarter from dividend payments. Yet over the past 13 years, Mastercard has proven to be the far better investment with 1,940% in total returns, more than 4 times the 419% American Express has delivered.

Mastercard's enormous growth made it one of the best dividend growth stocks over that period, having grown its payout more than 37-fold. Amex has been no slouch, tripling its dividend, but Mastercard's dividend growth has been otherworldly.

The lesson here is that focusing too closely on yield can cause you to invest in struggling companies and overlook investments that could do more to boost your total wealth.

It's not all about yield

When shopping for dividend stocks, it's important to keep in mind that a high dividend yield alone doesn't make a stock a great investment. To the contrary, a yield that seems too good to be true very well could be.

However, there are several things you should consider before buying any dividend-paying stocks, including, but not limited to:

- Dividend growth: Does the company have a strong history of increasing earnings and then rewarding investors with regular dividend increases? A good starting point is the Dividend Achievers, a group of stocks that have increased their dividends for at least 10 consecutive years.

- Financial strength: Does the company have a reasonable debt load based on its industry and an investment-grade credit rating? Does it have sufficient cash and working capital to ride out an unexpected change in the economy or a downturn in its industry?

- Dividend stability: Does it have a margin of safety between how much it earns and how much it pays in dividends? The payout ratio, which is the percentage of profits that a company spends on dividends, is a useful way to measure this. This metric is best used over an extended period, not just a single quarter or even a year, and it can be augmented with the cash payout ratio since there are many non-cash expenses that can affect a company's net income going by generally accepted accounting principles (GAAP).

- Competitive advantages: How does the company continually beat its competitors or keep them at bay? A cost advantage, the network effect, and a brand that people will pay a premium for are some examples of durable competitive advantages, sometimes called economic moats.

- Growth prospects: Is the company in an industry that is growing quickly or is demand for its products or services shrinking? Even the best company in a declining industry may find it harder to maintain (much less increase) its dividend over time, unless it can consistently take more market share.

- Dividend traps: High yields aren't bad, but, in some cases, they are a sign of trouble. Certain industries tend to pay high yields, including REITs, as well as utilities, refiners, and pipeline operators that may have low growth prospects. But if a stock's dividend yield is far higher than those of its nearest competitors or peer companies, that could indicate a dividend yield trap or value trap, meaning a company whose yield looks high because the stock price has fallen and there's a good probability that the dividend payout is going to get cut.

Related dividend stocks topics

The bottom line

Although it's useful, dividend yield is only one number. Broadly speaking, relying on it alone can lead to mistakes, but when used appropriately and with other metrics to help you measure a company's strength and valuation, it can help you unlock your own investing superpower.