Dividend stocks are shares of companies that make regular distributions to their shareholders, usually in the form of cash payments. Dividend stocks can be a useful source of income, but the best dividend stocks can also be an excellent way to build wealth over the long term.

However, not all dividend stocks are great investments, and many investors are unsure how to start their search. With that in mind, here's a list of dividend-paying stocks you might want to consider and some of the most important things to look for in top dividend stocks.

Nine best stocks

Nine best dividend stocks

The Dividend Kings list is a great place to find top dividend stocks. Dividend Kings are companies that have paid and raised their base dividends for at least 50 consecutive years.

The Dividend Achievers™ list, whose companies boast 10-plus straight years of dividend increases, is a trademarked property owned by the Nasdaq and another great list to research. Both lists include some great stocks to buy, and we have included a few from each in our list below. Here are nine top dividend stocks to consider buying now.

1. Lowe's

Home improvement giant Lowe's (LOW 0.6%) may not seem like a very exciting stock. And that's true -- unless you like dividend growth. The company has raised its dividend almost every year since going public in 1961 and has raised the payout by more than 300% over the trailing decade alone.

Investors worried about the housing downturn shouldn't fret. When the housing supply is tight, homes are harder to buy, and people tend to spend more to upgrade their existing homes. So, any cyclical weakness in its results will likely return to growth over the long term, even if short-term shifts in consumer spending cause an overall slowdown in renovations.

While consumer expenditures on home improvement projects remain in flux, particularly as concerns about the economy persist, these are durable spending trends over the long run. As consumer spending appetite improves, home upgrades and other projects from which Lowe's has historically experienced considerable growth should see an uptick.

Another important factor that's good for Lowe's is that the typical U.S. home is between 31 and 60 years old, depending on the state. The next generation of DIYers will spend a lot of money at Lowe's, as will home improvement contractors. It's made professionals a priority, and sales to contractors are growing.

2. Realty Income

If you're looking for a simple way to invest in high-quality real estate for income and growth, Realty Income (O -0.12%) might be the perfect stock. The company owns an array of largely e-commerce-resistant properties, earning strong cash flow from tenants on long-term leases.

Realty Income is also a Dividend Achiever, with more than three decades of consecutive annual dividend increases every year since going public in 1994 -- and 55 straight years of paying a dividend every month. Since its founding, Realty has declared 659 consecutive monthly dividends and has habitually increased its dividend for the last 30 consecutive years.

This best-of-breed real estate investment trust (REIT) has also taken steps to continue delivering on its dividend-growing ways. In early 2024, it closed the $9.3 billion acquisition of Spirit Realty Capital, which it said would immediately add 2.5% to its adjusted funds from operations (FFO).

3. Chevron

For years, Chevron (CVX 0.34%) has been a big winner for investors and a solid stock to own, especially for dividend investors. It has maintained a steady track record of generating strong cash flows and growing payouts modestly every year for 38 years and counting.

The stock price can fluctuate with oil prices, and Chevron has been part of the volatility trend afflicting many oil stocks recently. Still, Chevron has proven a profitable investment for dividend-seekers over the long term.

Its 2023 deal to acquire Hess (HES 0.35%) means significantly more low-cost onshore oil in the Permian Basin and some of the cheapest offshore oil currently being produced. However, a legal challenge by competitor ExxonMobil (XOM 1.12%) delayed the deal's closing.

The Chevron-Hess merger is a $53 billion acquisition that shareholders have already approved. In January 2025, the Federal Trade Commission approved a consent order to resolve antitrust issues concerning the deal, satisfying a key closing condition. Arbitration proceedings over the remaining interests off the coast of Guyana concluded in May 2025, with the ruling expected in the latter part of the year.

4. Target

For years, Target (TGT -1.32%) was more profitable than its peers, posting some of the highest gross margins and operating margins in retail. At the same time, its focus on increasing its e-commerce business and expanding in-store offerings helped stabilize its top line while improving profitability.

Recent years have been quite tumultuous as Target has worked through some growing pains, dealing with lower-than-expected growth compared to industry peers, slowdowns in consumer spending, and other notable headwinds. However, Target remains profitable with a robust balance of cash on hand.

In fiscal 2024, the company reported net earnings of $4.1 billion on net sales of $106.6 billion. At the end of the fiscal year, the company had about $4.8 billion in cash and cash equivalents on its balance sheet.

That's great news for dividend investors. With dividend growth at 54 years and counting and shares trading for attractive earnings and cash-flow multiples, dividend investors should put Target on their shopping list.

5. Starbucks

Over the past four decades, Starbucks (SBUX 0.28%) has established itself as the dominant global brand in coffee beverages. With more than 40,000 global stores and Starbucks-branded ready-to-drink beverages and packaged coffee in hundreds of thousands more locations, nobody sells -- or buys -- more coffee than this company.

In 2023, China returned to more normal public commerce, which has been a big boost for the company. China is Starbucks' second-largest market outside the U.S. and its largest international market. Starbucks has counted on that country to become its biggest and most profitable over the next decade.

The company has also cemented partnerships across Europe, Africa, and the Middle East (both through franchise and licensing agreements) as it seeks to open new profitable stores and expand its international segment. However, the company has some challenges to deal with.

Critics say Starbucks hasn't introduced many exciting new drinks recently, making the menu feel stale and unappealing to customers. Newer coffee chains are gaining popularity, and despite significant expansion in China, Starbucks faces increased competition from local coffee brands, impacting sales in that key market.

Over the long run, though, its strong brand and power as a buyer have resulted in robust competitive advantages, including cost benefits throughout its operations and pricing power with consumers. Those economic moats and the company's strong digital presence have resulted in a cash cow business.

While business results have softened more recently, this isn't the first challenge the company has faced. It could be an enticing opportunity to invest. Starbucks has increased its dividend yearly for 14 consecutive years.

It has also increased annual earnings per share by more than 300% over the last five years alone. Its yield of about 3% at recent prices is on the higher end of its historical range, representing an attractive price to buy company shares.

6. Brookfield Infrastructure

Sometimes, the best stocks are the ones hidden in plain sight. That's the case with Brookfield Infrastructure (BIPC 1.67%) (BIP 0.83%), which owns water, energy, utility, transportation, and communications infrastructure projects worldwide.

Its assets generate steady recession- and inflation-resistant cash flow, and Brookfield returns a sizable portion to shareholders. At recent Class C share prices, it claimed a dividend yield of almost 4.2%, more than 5% for the limited partner units, and aims to raise the payout by 5% to 9% every year.

7. Microsoft

Microsoft (MSFT 1.58%) is one of the most important software companies on the planet. Over the past decade, it has rebuilt its business to focus on recurring subscription-based revenue that keeps its customers connected and the cash flowing. The company has a solid balance sheet with more cash than debt and a very low payout ratio that leaves tons of room to increase the dividend.

Its 20-year streak of dividend increases is easy to miss. Its yield of less than 1% at recent prices hasn't put it on many dividend investors' radars. But what it hasn't paid in yield, Microsoft has absolutely delivered, with total returns of more than 3,000% since 2009 and dividends accounting for a sizable portion of those total returns.

Looking forward, Microsoft wants to take a commanding lead in artificial intelligence (AI). With significant investments in and a partnership with ChatGPT creator OpenAI, the company is integrating AI features across its suite of productivity and communications platforms and its Windows operating system.

8. American Express

Financial services, such as consumer and business lending, are another place to find a handful of top dividend stocks, and American Express (AXP 1.18%) is one of the best. Although it's not on the list of companies that raise their dividends every year, American Express (Amex) has a decades-long track record of either raising or maintaining its dividends through every economic environment.

The big lesson here: When other banks and lenders have cut or even eliminated their dividends, Amex has proven strong enough to keep the payouts coming for its shareholders. That's a credit to its high-quality lending standards and focus on higher-income credit customers who are less likely to default on their debts during weak economic periods.

The bottom line is that Amex appeals to investors who like owning a top financial services company but are also concerned about economic conditions. This is a great stock to buy during broad market downturns and a solid hold for a bull market recovery.

9. Clearway Energy

Renewable energy is mostly considered a place for growth investors, but it's also a wonderful opportunity for dividends. Clearway Energy (CWEN.A 1.65%)(CWEN 2.1%) is a perfect example. The company invests in, acquires, and operates renewable energy facilities, selling the power on long-term contracts -- think decades, not years -- to utility companies and large power consumers.

The stock witnessed extensive volatility in 2023 and 2024 due to concerns that rising interest rates and perceived weakening in demand for renewables could affect its business. The market could be pricing in those concerns now, but the flip side is that its dividend yield was around 6% as of June 2025.

Worries about the business are probably significantly overstated. Yes, rising rates and inflation have sent wind and solar into a downturn. These are cyclical industries that ebb and flow. Plus, Clearway's earnings come from long-term power production, and utilities continue to demand more and more clean power.

Management is moving forward, too, saying their long-term expectations remain unchanged. With ample opportunity ahead and plenty of access to funding, Clearway expects it can continue to grow profits and increase its payout.

Highest dividends

Highest dividend stocks

Whether it's to generate the income you'll use today or the capital you can reinvest to increase your wealth, there's a good chance you're looking for a big dividend payout. If you're hoping to maximize the number of dividends you earn, here are some suggestions.

First, consider dividend yield above dividend size. The dividend yield is a percentage of the share price you paid for the stock, paid in dividends annually. That's far more relevant than the dollar amount of dividends per share.

Next, don't make owning high-dividend-yielding stocks your No. 1 priority. Focus first on business quality and a company's ability to maintain and increase the payout. Only then can you know whether a high dividend yield is sustainable.

Dividend investors should focus not on dividend size but on dividend yield.

How to invest

How to invest in dividend stocks

This article hits on a few things to avoid (e.g., focusing too much on a high yield that might be a trap) and the power of dividend growth stocks as some of the best winners. Here are some key things to look for when investing in dividend stocks.

- Identify dividend stocks that meet your criteria. You may be looking to yield for income, a history of dividend growth, and so forth.

- Research the history of earnings growth. Dividend growth is sustainable only if a company's earnings have also steadily grown at a similar or higher rate over time.

- Consider valuation. While paying a modest premium for a high-quality business can sometimes be justified, overpaying can significantly weigh on long-term returns.

- Determine position sizing. Consider how much exposure you want to a particular stock, how much income you expect it to generate, and other factors to ensure you buy an appropriate amount.

- Focus on the long term. Dividend stocks deliver best when bought and held for many years. Having patience and letting exceptional managers run great companies while you just sit back and own them is how you get the best returns from dividend stocks.

What to look for

What to look for in dividend stocks

If you're new to dividend investing, it's smart to familiarize yourself with dividend stocks and why they can make excellent investments. Once you have a firm grasp of how dividends work, a few key concepts can help you find excellent dividend stocks for your portfolio.

- Payout ratio: A stock's payout ratio is the amount of money the company pays per share in dividends divided by its earnings per share. In other words, this tells you the percentage of earnings a stock pays to shareholders. A reasonably low payout ratio (say, 70% or less) is a good sign that the dividend is sustainable.

- History of increases: It's a very good sign when a company raises its dividend year after year, especially when it can continue to do so during recessions and other tough economic times.

- Steady revenue and earnings growth: When looking for the best dividend stocks to own for the long term, prioritize stability. Erratic revenue (up one year, down the next) and fluctuating earnings can be signs of trouble.

- Durable competitive advantages: This is perhaps the most important feature. A durable competitive advantage can take several forms, such as proprietary technology, high barriers to entry, high customer switching costs, or a powerful brand name.

- Supportable yield: This is last on the list for a reason. A high yield is obviously preferable to a lower one, but only if the other criteria are met first. A high dividend is only as strong as the business that supports it. So, compare dividend yields after ensuring the business is healthy and the payout is stable.

Related investing topics

Dividend stocks are long-term investments

Even the most rock-solid dividend stocks can experience significant volatility over short periods. There are simply too many market forces that can move them up or down over days or weeks, and many have nothing to do with the underlying business itself.

So, while the companies above should make great long-term dividend investments, don't worry too much about day-to-day price movements. Instead, focus on finding companies with excellent businesses, stable income streams, and (preferably) strong dividend track records. The long term will take care of itself.

Dividend stocks vs. dividend funds

Investing in dividend stocks and dividend funds are both popular ways to generate income and potentially grow your investments. Dividend funds, such as mutual funds and exchange-traded funds (ETFs), invest in a portfolio of multiple dividend stocks. Dividend funds offer diversification and professional oversight by investment managers who carefully select the underlying stocks. With a dividend fund, it's important to pay attention to the expense ratio to determine how much of your investment may go towards fees.

Dividend stocks provide the potential for higher returns but also higher risk. It also takes time and effort to carefully research each business so you can understand whether it is a good fit for your portfolio. Depending on your investing style, you might prefer investing in dividend funds for the instant diversification and exposure they provide to a wide range of income stocks vs. putting cash to work in individual businesses. However, both types of investments can offer advantageous returns for a long-term investor with a well-diversified portfolio.

FAQ

Best dividend stocks: FAQ

What stocks pay the highest dividend?

While chasing yield can often lead to bad outcomes, some stocks are just built to be yield machines. Two categories known for paying above-average yields are utilities and REITs, or real estate investment trusts. But just as with any other dividend stock, don't assume that the highest-yielding ones are the best. Be sure to evaluate business quality and whether a company's cash flows support a dividend.

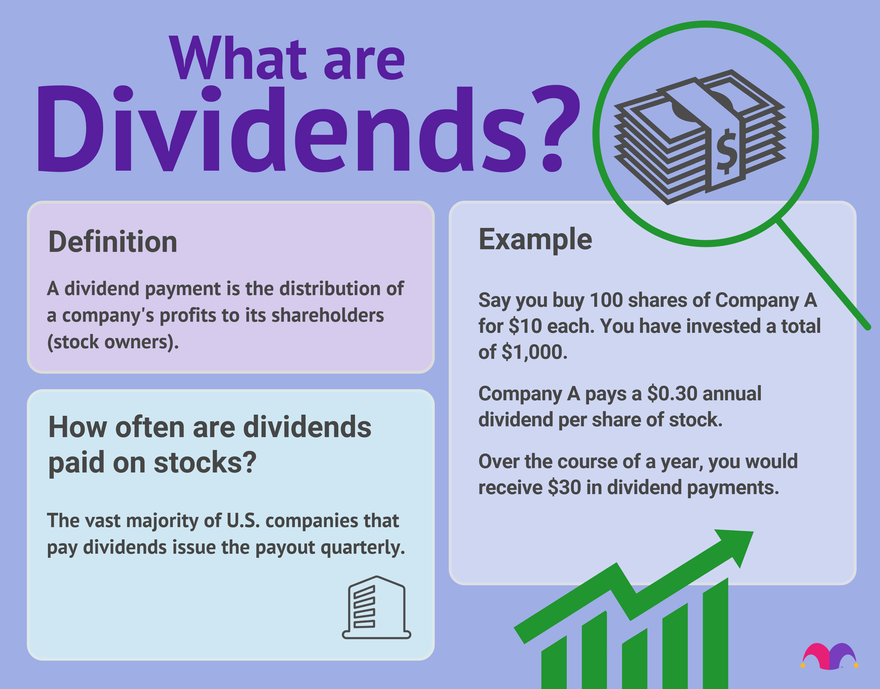

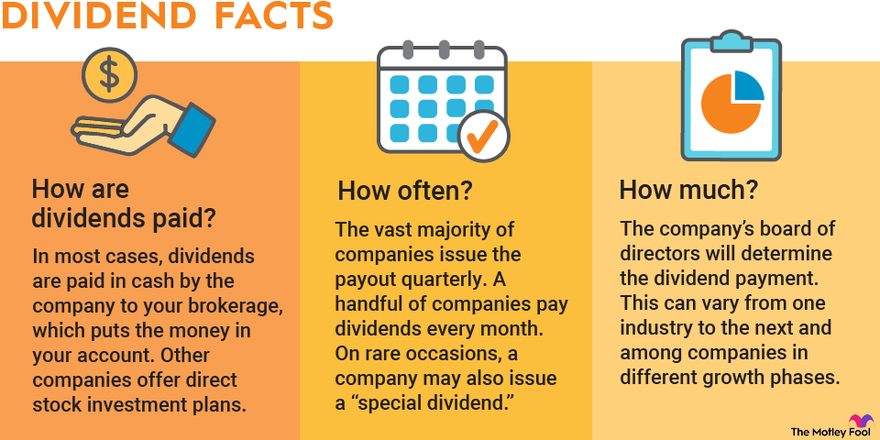

What are dividends in stocks?

Dividends are payments made by a company to its shareholders. U.S. companies typically pay dividends quarterly, though some pay less often, and a few even pay monthly.

Dividends are generally paid in cash, but some companies pay in "scrip," which is dividends paid in stock. Note that this is not the same as a dividend reinvestment plan, or DRIP, where a company (or your brokerage) automatically takes your cash dividend and purchases shares for you.

What is considered a good stock dividend?

It can vary by sector and even particular industries within a sector, but the most important answer is "one that can be sustained." This is why chasing yield is so dangerous, as a high yield that can't be maintained is no good at all.

A useful metric for determining a dividend's safety is the dividend payout ratio, which is the percentage of a company's earnings that it pays out in dividends. The safest dividends generally have the lowest payout ratios.

Is it a good idea to buy dividend stocks?

Whether you're looking for income or just the best possible total returns, chances are good that many dividend stocks can be ideal ways to reach your financial goals. Just remember that yield is often less important than other factors, such as a company's ability to maintain and grow the payout for the long term.

How do dividends work?

A dividend occurs when a company sends money (or stock, though very rarely) to its shareholders. When a company reaches the point that it consistently earns more than management can effectively reinvest, establishing a dividend policy and sending those excess profits back to investors is a smart move.

Do ETFs pay dividends?

Yes, many ETFs pay dividends. Dividend ETFs hold stocks that pay dividends, and the ETF then distributes those dividends to its investors

Does it matter when you buy a dividend stock?

When you buy dividend stocks, it matters if you purchase them before the ex-dividend date. To receive the next dividend payment, you need to own the stock on or before the ex-dividend date.