NYSEMKT: LQD

Key Data Points

This guide will teach you everything you need to know about the iShares iBoxx $ Investment Grade Corporate Bond ETF. It will also show you how to invest in ETFs for beginners.

What is iShares iBoxx $ Investment Grade Corporate Bond ETF?

iShares iBoxx $ Investment Grade Corporate Bond ETF is exactly as its name suggests: an ETF focused on investment-grade corporate bonds. Investment-grade bonds have a lower default risk than non-investment-grade bonds (i.e., junk bonds) and carry slightly higher credit risk than treasuries and municipal bonds.

Exchange-Traded Fund (ETF)

This BlackRock (BLK +0.56%)-managed ETF provides investors with broad exposure to a range of high-quality U.S. corporate bonds. It aims to track the investment results of an index composed of investment-grade corporate bonds denominated in U.S. dollars (Markit iBoxx USD Liquid Investment Grade Index).

The ETF makes it easy to invest in a large portfolio of investment-grade bonds through a single fund. Adding corporate bonds to a portfolio increases diversification, lowers risks, and provides a stable source of income.

How to buy iShares iBoxx $ Investment Grade Corporate Bond ETF

Anyone can buy shares of iShares iBoxx $ Investment Grade Corporate Bond ETF. It trades on a major stock exchange, allowing you to purchase shares in your brokerage account. Here's a guide to help you add the bond ETF to your portfolio.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the ETF: Enter the ticker or ETF name into the search bar to bring up the ETF's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this ETF.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Holdings of iShares iBoxx $ Investment Grade Corporate Bond ETF

iShares iBoxx $ Investment Grade Corporate Bond ETF is one of the larger bond ETFs by assets under management (AUM). It held more than $30 billion of net assets in late 2025, consisting of more than 2,950 investment-grade corporate bonds.

The 10 largest bond issuers held by the fund in late 2025 were:

- JPMorgan Chase (JPM +1.04%): 2.91% of its holdings

- Bank of America (BAC +0.72%): 2.59% of its holdings

- Morgan Stanley (MS -1.12%): 2.22% of its holdings

- Goldman Sachs (GS -1.42%): 2.10% of its holdings

- Wells Fargo (WFC -0.65%): 2.04% of its holdings

- Citi (C +0.49%): 1.66% of its holdings

- Oracle (ORCL +0.65%): 1.63% of its holdings

- UnitedHealth Group (NASDAQ:UNH): 1.57% of its holdings

- Verizon (VZ -1.14%): 1.52% of its holdings

- AT&T (T -1.01%): 1.50% of its holdings

While the fund holds a diversified portfolio of bonds, it has meaningful exposure to the banking sector (22.81% of its net assets). That's largely because banks issue lots of debt to fund new loans.

The ETF's exposure to bank debt is a potential risk investors will need to monitor. A future financial crisis could weigh on the ETF's value and the income it produces if bank issuers can't pay the interest on their debt.

Should I invest in iShares iBoxx $ Investment Grade Corporate Bond ETF?

Investing can be very personal. You want to make sure your portfolio aligns with your investing goals, personal values, and risk tolerance.

Here are some reasons why you might want to invest in iShares iBoxx $ Investment Grade Corporate Bond ETF.

- You want to invest in a sector ETF focused on a broad range of investment-grade bonds.

- You're seeking a lower-risk, income-focused investment.

- You want a monthly income stream.

- You want to diversify your portfolio by adding a fixed-income investment.

- You would like a higher income yield than U.S. treasuries offer.

- You're comfortable with having meaningful credit exposure to the U.S. banking sector.

On the other hand, here are some reasons why you might decide that iShares iBoxx $ Investment Grade Corporate Bond ETF isn't right for your situation.

- You're seeking a higher return than investment-grade corporate bonds can provide.

- You'd prefer an investment with less exposure to the U.S. banking sector.

- You're seeking a lower-risk, fixed-income stream like U.S. treasuries.

- You'd prefer to hand-pick the bonds you invest in.

- You're seeking a lower-cost bond ETF.

- You want a more diversified bond ETF that also holds government, junk, and international bonds.

Does iShares iBoxx $ Investment Grade Corporate Bond ETF pay a dividend?

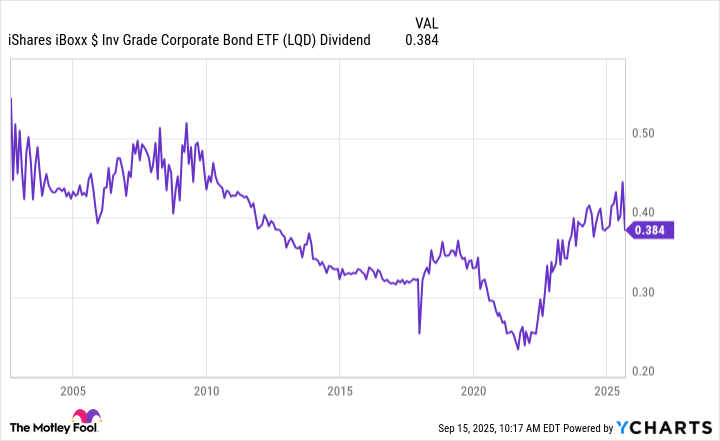

iShares iBoxx $ Investment Grade Corporate Bond ETF pays a dividend. It makes monthly distributions of the interest income generated by the bonds it holds. Those payments fluctuate based on the interest rates of the bonds in its portfolio.

As of late 2025, the fund delivered a 4.32% income yield over the trailing-12-month period. The average yield to maturity of its bonds was 4.87%, so the fund could make higher income distributions in the future. That could make it a solid dividend ETF for those seeking income.

What is iShares iBoxx $ Investment Grade Corporate Bond ETF's expense ratio?

The ETF charges investors a 0.14% expense ratio. That's a relatively low ETF expense ratio overall and in line with many other top bond ETFs. However, it's higher than many of the lowest-cost bond funds.

ETF Expense Ratio

Fund | 1-Year | 3-Year | 5-Year | 10-Year |

|---|---|---|---|---|

iShares iBoxx $ Investment Grade Corporate Bond ETF | 3.36% | 4.41% | (0.63%) | 3.00% |

Benchmark (Markit

iBoxx USD Liquid Investment Grade Index) | 3.41% | 4.54% | (0.52%) | 3.15% |

While investment-grade corporate bonds have been a rather unappealing investment over the years, this ETF has only slightly underperformed its benchmark due to its expense ratio.

On a more positive note, higher interest rates in recent years are starting to have a positive impact on bond returns. If interest rates remain relatively high, bonds could deliver higher returns in the future.

Related investing topics

The bottom line on iShares iBoxx $ Investment Grade Corporate Bond ETF

iShares IBoxx $ Investment Grade Corporate Bond ETF enables investors to gain fairly broad exposure to high-quality bonds. The fund allows investors to diversify their portfolios by adding a fixed-income element, which helps reduce risk. Investment-grade bonds also supply relatively stable income.

However, the tradeoff for this lower-risk profile involves lower returns, especially during periods of low interest rates. Despite that, investment-grade bonds are an excellent addition to any investor's portfolio, especially as they approach retirement. This ETF makes it easy to invest in high-quality bonds.