NYSEMKT: LQD

Key Data Points

This guide will teach you everything you need to know about the iShares iBoxx $ Investment Grade Corporate Bond ETF. It will also show you how to invest in ETFs for beginners.

What is iShares iBoxx $ Investment Grade Corporate Bond ETF?

iShares iBoxx $ Investment Grade Corporate Bond ETF is exactly as its name suggests: an ETF focused on investment-grade corporate bonds. Investment-grade bonds have a lower default risk than non-investment-grade bonds (i.e., junk bonds) and carry slightly higher credit risk than treasuries and municipal bonds.

Exchange-Traded Fund (ETF)

This BlackRock (BLK -0.09%)-managed ETF provides investors with broad exposure to a range of high-quality U.S. corporate bonds. It aims to track the investment results of an index composed of investment-grade corporate bonds denominated in U.S. dollars (Markit iBoxx USD Liquid Investment Grade Index).

The ETF makes it easy to invest in a large portfolio of investment-grade bonds through a single fund. Adding corporate bonds to a portfolio increases diversification, lowers risks, and provides a stable source of income.

Does iShares iBoxx $ Investment Grade Corporate Bond ETF pay a dividend?

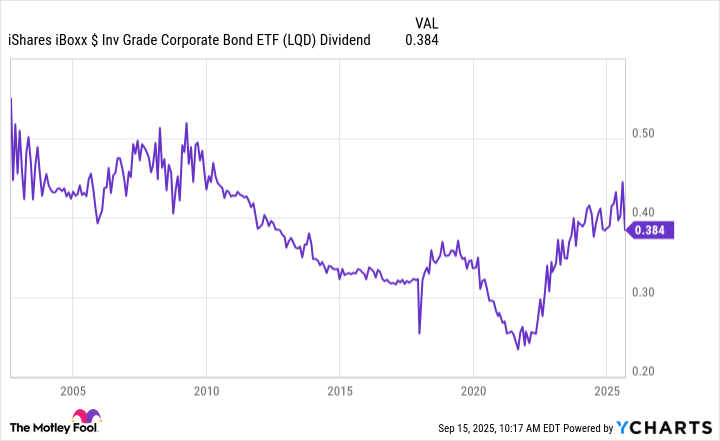

iShares iBoxx $ Investment Grade Corporate Bond ETF pays a dividend. It makes monthly distributions of the interest income generated by the bonds it holds. Those payments fluctuate based on the interest rates of the bonds in its portfolio.

As of late 2025, the fund delivered a 4.32% income yield over the trailing-12-month period. The average yield to maturity of its bonds was 4.87%, so the fund could make higher income distributions in the future. That could make it a solid dividend ETF for those seeking income.

What is iShares iBoxx $ Investment Grade Corporate Bond ETF's expense ratio?

The ETF charges investors a 0.14% expense ratio. That's a relatively low ETF expense ratio overall and in line with many other top bond ETFs. However, it's higher than many of the lowest-cost bond funds.

ETF Expense Ratio

Fund | 1-Year | 3-Year | 5-Year | 10-Year |

|---|---|---|---|---|

iShares iBoxx $ Investment Grade Corporate Bond ETF | 3.36% | 4.41% | (0.63%) | 3.00% |

Benchmark (Markit

iBoxx USD Liquid Investment Grade Index) | 3.41% | 4.54% | (0.52%) | 3.15% |

While investment-grade corporate bonds have been a rather unappealing investment over the years, this ETF has only slightly underperformed its benchmark due to its expense ratio.

On a more positive note, higher interest rates in recent years are starting to have a positive impact on bond returns. If interest rates remain relatively high, bonds could deliver higher returns in the future.

Related investing topics

The bottom line on iShares iBoxx $ Investment Grade Corporate Bond ETF

iShares IBoxx $ Investment Grade Corporate Bond ETF enables investors to gain fairly broad exposure to high-quality bonds. The fund allows investors to diversify their portfolios by adding a fixed-income element, which helps reduce risk. Investment-grade bonds also supply relatively stable income.

However, the tradeoff for this lower-risk profile involves lower returns, especially during periods of low interest rates. Despite that, investment-grade bonds are an excellent addition to any investor's portfolio, especially as they approach retirement. This ETF makes it easy to invest in high-quality bonds.