The Vanguard S&P 500 ETF (VOO +0.38%) is one of the largest exchange-traded funds (ETFs) by assets under management (AUM). The ETF had more than $600 billion in AUM in mid-2025, making it the biggest ETF at the time. The fund's massive size, low cost, and focus on the S&P 500 index have made it one of the most popular ETFs.

This guide will teach you everything you need to know about the Vanguard S&P 500 ETF and how to invest in ETFs for beginners.

NYSEMKT: VOO

Key Data Points

How to buy Vanguard S&P 500 ETF

It's very easy to invest in the Vanguard S&P 500 ETF. You can buy shares directly from Vanguard or in your regular brokerage account. Here's a step-by-step guide to buying shares of the ETF.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Holdings of Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF tracks the S&P 500. The broad market index holds roughly 500 of the largest publicly traded companies in the U.S. (it had 505 stocks in mid-2025). The index weighs its holdings based on their market caps. That means companies with larger market caps have a greater impact on the index.

As of mid-2025, the Vanguard S&P 500 ETF's top 10 holdings were:

- Apple (AAPL +0.53%): 7% of the fund's holdings

- Microsoft (MSFT +0.28%): 5.9%

- Nvidia (NVDA -0.32%): 5.6%

- Amazon (AMZN +0.11%): 3.8%

- Meta Platforms (META +0.39%): 2.7%

- Berkshire Hathaway Class B (BRK.B +0.17%): 2.1%

- Alphabet Class A (GOOGL -0.08%): 1.9%

- Broadcom (AVGO +0.26%): 1.7%

- Alphabet Class C (GOOG -0.00%): 1.6%

- Tesla (TSLA -0.03%): 1.5%.

Those 10 stocks make up about one-third of this ETF's assets. So, while it provides broad exposure to the country's largest stocks, the biggest companies have a significant impact on its returns.

The Vanguard ETF, like the S&P 500, provides investors with diversified exposure to several stock market sectors. Its weighed sector exposure in mid-2025 was:

- Information technology: 29.7%

- Financials: 14.6%

- Health Care: 11.2%

- Consumer Discretionary: 10.3%

- Communication Services: 9.2%

- Industrials: 8.5%

- Consumer Staples: 6%

- Energy: 3.7%

- Materials: 2%

- Real Estate: 2.3%

- Utilities: 2.5%

Because it provides broad sector exposure, investors don't need to invest in sector ETFs unless they want to invest specifically in a particular industry.

Should I invest in Vanguard S&P 500 ETF?

Making any investment is a personal decision. You need to make sure it aligns with your goals, values, and risk tolerance. Here are some reasons you might want to invest in the Vanguard S&P 500 ETF:

- You're seeking an investment that can deliver returns that roughly match those of the S&P 500 index.

- You want a low-cost passive investment.

- You understand that while the Vanguard S&P 500 ETF provides market returns, it also has market risk with volatility that will match the S&P 500.

- You're seeking a diversified investment that provides broad exposure to the U.S. stock market.

On the other hand, here are some reasons the Vanguard S&P 500 ETF might not be right for you:

- You're seeking investments that can deliver higher returns than the S&P 500.

- You're a more risk-averse person and want an investment with lower volatility than the S&P 500.

- You're at or nearing retirement and need more income than the Vanguard S&P 500 ETF can produce.

- You're seeking an investment with less concentration among its top holdings.

Does Vanguard S&P 500 ETF pay a dividend?

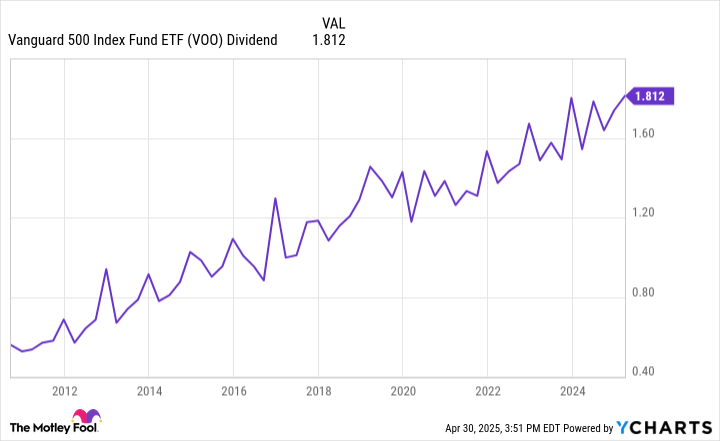

The Vanguard S&P 500 ETF paid a dividend of roughly 1.3% in mid-2025 (approximating the S&P 500's dividend yield). The fund makes quarterly dividend income payments. While they will fluctuate from quarter to quarter based on the dividends received, payments have steadily risen over the years:

Although its low dividend yield might not make it one of the best dividend ETFs for income seekers, it does provide a market-matching and steadily rising dividend payment.

What is Vanguard S&P 500 ETF's expense ratio?

A low expense ratio is a hallmark of a Vanguard-managed fund. Since fund investors own the company, it can pass on its economies of scale and lower investment costs to them through a lower expense ratio, enabling fund investors to keep more of their returns.

ETF Expense Ratio

The Vanguard S&P 500 ETF has an ultra-low expense ratio of 0.03%, significantly below the industry average of 0.22%. The low expense ratio enables investors to keep more of the fund's return.

For example, the management fees charged by Vanguard on a $10,000 investment in the Vanguard S&P 500 ETF would be only $3 per year. For comparison, a similar $10,000 investment in a fund charging 0.22% would cost $22 per year. That higher cost would add up over the years by eating into an investor's returns.

Historical performance of Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF's goal is to closely track the average stock market return as measured by the S&P 500 index. It has delivered on its objective over the years:

Fund | 1-Year | 3-Year | 5-Year | 10-Year |

|---|---|---|---|---|

Vanguard S&P 500 ETF | 8.27% | 8.99% | 18.56% | 12.46% |

S&P 500

Index | 8.25% | 9.06% | 18.59% | 12.50% |

As that table shows, the fund's returns have roughly matched those of the S&P 500 over the past one-, three-, five-, and 10-year periods. It has delivered a very slight underperformance due to its quite modest expense ratio. Its ability to deliver market-matching returns makes it one of the best ETFs to buy.

Related investing topics

The bottom line on Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF is one of the largest ETFs focused on delivering returns that match the S&P 500. It has done an excellent job over the years, largely thanks to its ultra-low expense ratio. It's a great fund for investors seeking a low-cost way to earn market-matching returns. It can be a core piece of an investor's portfolio.