Do you have $20,000 to invest? Congratulations! Putting that money to work immediately is the best way to set yourself up for financial success. The key to achieving your financial goals is knowing that investing requires a long-term mindset -- thinking in terms of years and decades, not weeks and months.

Hopefully, you've already established your emergency fund -- a savings account with enough money to cover your expenses for three to six months. With your additional $20,000, here are some ideas about how to invest those funds.

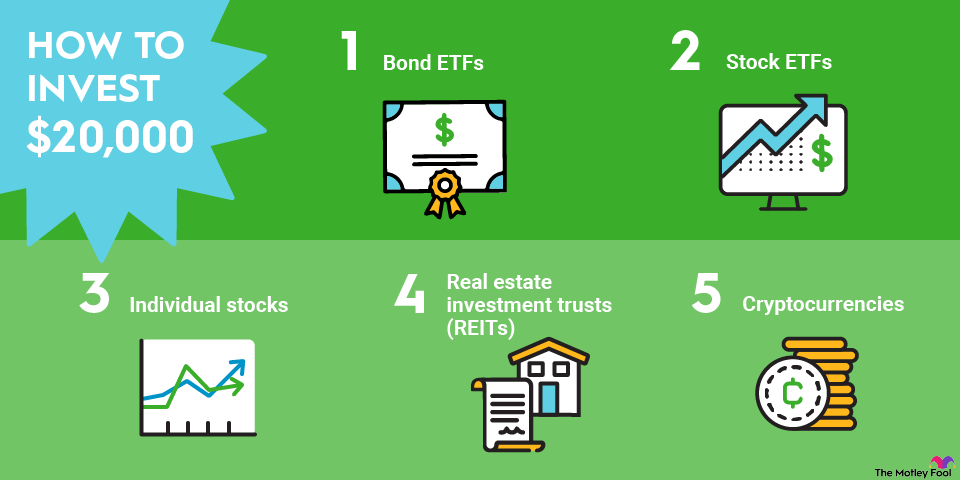

The best ways to invest $20,000

Here are five great investment options to consider:

1. Bond ETFs

Because bonds have a stated date when the borrower will pay back the face value of the bond, these are great investments if you need a certain amount of money at a known point in time. But bonds are usually sold in increments of $1,000 to $5,000, so buying shares in a bond-focused exchange-traded fund (ETF) might be an alternative if you have $20,000 to put to work.

3. Individual stocks

It's easier than ever to purchase individual shares of a company. Owning individual stocks gives you control over exactly what's in your investment portfolio, which you may choose to align with both your values and goals, as well as your desired performance over time.

Since owning individual stocks increases your portfolio's exposure to the performance of individual companies, it's a good idea to diversify your stock holdings by investing in at least 10 to 15 stocks to start. With $20,000 to invest, that works out to about $1,500 to $2,000 per company.

Like buying shares in stock ETFs, the key to investing in individual stocks is to buy and hold them for a long period of time. The prices of individual stocks can be volatile, so it's important to focus on the business fundamentals or other original reasons for your stock purchase, regardless of how the price fluctuates.

Stock Market Volatility

4. Real estate investment trusts (REITs)

Buying shares in a real estate investment trust (REIT) is a convenient way to profit from the growth in real estate's value without being obligated to buy and maintain real estate. REITs generate income in the form of rent payments from portfolios of properties managed by real estate firms. The rental income is then distributed to the REIT's shareholders in the form of dividend payments.

You can also buy shares in targeted REITs. If you're worried about declining values in office REITs in the wake of the COVID-19 pandemic, you can look at REIT options that include data center REITs, infrastructure REITs, healthcare REITs, and others.

Like individual stocks, the share prices of REITs can fluctuate in value, usually in tandem with real estate prices. However, most REITs are generally safe investments that both diversify an investment portfolio and generate stable streams of income.

5. High-yield savings accounts

The humble savings account may not be the sexiest investment out there, but it's surely one of the safest, with deposits insured for as much as $250,000. And with interest rates still relatively elevated, high-yield savings accounts can be an attractive place to park money while still growing wealth.

Let's say you put your $20,000 into a high-yield savings account. You immediately begin earning interest; once that interest hits your account, you earn interest on that interest, or what's called compound interest. So, an account that offered a 4.25% annual percentage yield (APY) would give you $20,900 after the first year. After the second year, you'd have $21,840, and after a decade, your balance would swell to $31,059 -- all without making another deposit or lifting a finger.

Related investing topics

Investment options by time horizon

Long-Term Investing (5+ years)

From our perspective at The Motley Fool, there shouldn't be any such thing as a bad long-term investment. Our best advice is to stick with a buy-and-hold strategy, only making investments that you'll be comfortable owning for the long term.

Having said that, your mix of long- and short-term investments will depend heavily on your investment objectives. Someone who's considering retirement in the next decade, for example, is likely to view investments through a different lens than someone who's interested in paying for a child's college tuition or a major medical procedure.

Our suggestion for long-term investing? ETFs and mutual funds are excellent building blocks for a long-term portfolio, providing you with a set-it-and-forget-it mentality that allows you to sleep at night.

Short-Term Investing (less than 5 years)

We like stocks, and think everyone should own a few. However, the best stocks are those that you're going to hold for the long term, whether as individual parts of your portfolio or as part of an index fund.

One of the biggest reasons for a short-term investment is simply liquidity, or the ability to quickly use your money when it's needed. For that reason, a high-yield savings account may be the best approach for a short-term investment if you think you'll need money sooner rather than later.

Which type of investment is right for you?

Before you decide exactly how to invest your money, consider these important factors:

- Your financial objectives: What's your investment goal? You may choose to invest differently depending on whether you need to make a specific purchase, such as a down payment on a home, or want to use the money as income in retirement.

- Your investment timeline: When do you need the money? Whether you have a specific date in mind or are thinking in decades is relevant to the types of investments you choose.

- Your appetite for risk: How will you respond if your portfolio significantly drops in value? Investing always confers risk, but you can choose safe investments with relatively low return profiles or riskier investments that are more likely to generate high returns.

After pondering your priorities, it's time to start choosing some investments. No matter how you choose to allocate that $20,000, you can increase your wealth exponentially over time. The key is to maintain a well-diversified portfolio, focus on the long term, and consider making more deposits to your account over time to maximize your investment returns.

Tips for investing $20K

A few things to keep in mind before you invest your windfall:

- Clarify your goals. Make sure your investment aligns with your goals and timeline. For example, if you're young and willing to take risks, a stock-heavy focus might be just the ticket. On the other hand, if you're thinking about retiring soon, you'd probably want to ensure capital preservation through safe bonds and savings accounts.

- Make sure your high-interest debt is paid off. A 20% return on an investment is good in almost anyone's universe, but it doesn't mean much if your gains are being offset by 24% credit card or loan rates.

- Double-check your emergency fund. If you had an emergency -- say, your house needs a new roof or you get hit with a major medical bill -- would you have to liquidate all or part of your $20,000 investment? Losing that money to an unanticipated event would hurt. The possibility of having to pay short-term capital gains taxes would be salt in the wound. You also risk losing money if you have to sell your investment while it's down because it's your only way to get cash.

- Diversify, diversify, diversify. The temptation is strong to put all your eggs in one basket. Don't. While it might give you fewer things to keep tabs on, limiting your investment to one option can set you up for a big loss.

- Stay away from hot tips and short-term moves. Hot tips with the promise of big gains can be tempting but also disastrous. It's been said often, but can't be said often enough: Time in the market is always better than trying to time the market.

How to track, manage, and review your $20K investments

Managing $20,000 in investments can take as much (or, to be honest, as little) time as you want. Assuming your goal is to pay attention to your investments (but not obsess over them), we recommend a five-part strategy:

- Create a spreadsheet in Microsoft Excel or Google Sheets to track holdings, returns, and any custom metrics that might help you monitor the performance of your investments. Most brokerage platforms, like Fidelity and Schwab (SCHW -1.31%), have tools to let you monitor your investment portfolio.

- Determine your cadence, or how often you'll want to review your investments. We'd suggest quarterly, but there's nothing wrong with monthly. (Daily is a bit much.)

- Set rebalancing parameters. Decide how often you'll want to tinker with the composition of your portfolio. An annual approach works for most people, but you can also use a parameter-based approach, i.e., if the value of an asset class falls more than 10% or increases more than 15%.

- Review your investments for tax purposes. Here, you may want to consider specialized software such as Quicken to ensure that your tax accounting for investments is accurate and not excessive. This should be an annual chore.