Nike (NKE +1.38%) likely doesn't need much introduction. It's a leader in the sporting goods industry. The company designs and sells footwear, apparel, equipment, and accessories for a variety of athletic activities. It owns its namesake iconic Nike brand and Converse.

Many people wear Nike-branded shoes and apparel when they engage in physical activity. (You might have some on right now, which could have sparked your interest in learning how to invest in the iconic sporting goods company.)

This in-depth guide will teach you everything you need to know about Nike and how to add the shoe stock to your portfolio.

How to buy Nike stock

Anyone interested in buying Nike stock can purchase shares. The athletics company trades publicly on the New York Stock Exchange.

This six-step guide will show you how to invest in stocks and add Nike to your portfolio.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Fund your account: Transfer money so you’re ready to invest.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should you invest in Nike?

Investing is a personal endeavor. Your stock portfolio should reflect your values, risk tolerance, and return objectives. Not every stock will be a good fit for your portfolio.

Reasons to consider Nike

- You are a fan of Nike's products.

- You want to invest in mature companies with strong cash flow and balance sheets.

- You're seeking companies that pay a solid and growing dividend.

- You think Nike stock trades at a good value relative to the broader market.

- Adding Nike would help diversify your portfolio.

- You think Nike can continue to grow its earnings per share at a solid rate in the coming years.

- You believe the company will continue delivering market-beating total returns over the long term.

Reasons to be cautious

- You don't like Nike's products.

- You already own shares of several sporting goods, footwear, and apparel stocks.

- You're seeking more dividend income than Nike currently provides.

- You want companies delivering faster growth than Nike.

- You're not convinced Nike will outperform the market in the coming years.

NYSE: NKE

Key Data Points

Is Nike profitable?

Profitability is crucial to a company's success. Earnings tend to be the biggest factor driving a stock's long-term performance. Investors should take the time to research a company's profitability to ensure it's heading in the right direction.

Nike is a very profitable company. It reported $12.4 billion of revenue in its fiscal 2024 third quarter, up slightly from the previous year. Meanwhile, revenue over the first nine months of its fiscal year was $38.4 billion, a 1% increase from the previous year. The company's net income was almost $1.2 billion in its fiscal third quarter and $4.2 billion over the nine-month period. While its net income declined 5% year over year in the third quarter, it increased by 4% over the nine-month period compared to the previous year. Nike's earnings per share have grown even faster over the nine-month period (7%) due to a steady decline in its outstanding shares as it repurchases stock.

The company also produces a lot of cash, allowing it to return money to shareholders via dividends and share repurchases. Nike paid $562 million of dividends in its fiscal third quarter (up 6% year over year) and repurchased $866 million in shares. The repurchases were part of the company's four-year, $18 billion program, which its board of directors approved in June 2022. Nike had repurchased $8 billion of its stock under the program through early 2024.

Nike's solid and growing profitability has enabled it to maintain a strong balance sheet. It had $10.6 billion of cash, equivalents, and short-term investments at the end of its fiscal third quarter, exceeding its long-term debt ($8.9 billion).

Does Nike pay a dividend?

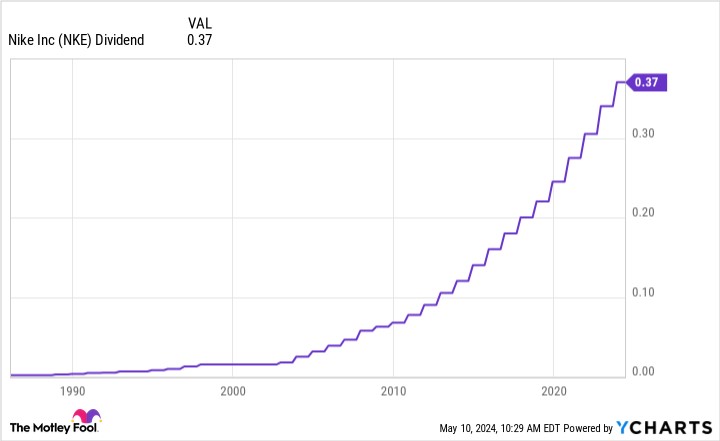

Nike pays a dividend to its investors each quarter. In mid-2024, its quarterly dividend rate was $0.37 per share ($1.48 annually). With its share price in the low $90s at the time, Nike had a 1.6% dividend yield, slightly higher than the S&P 500's 1.4% dividend yield.

The athletics company has a long history of growing its dividend. It has increased the payment rate every year since 2004:

Nike's above-average yield and long history of dividend growth make it an ideal stock for investors seeking a steadily rising income stream.

How to invest in Nike through ETFs

Not everyone wants to be an active investor picking a portfolio of stocks they need to manage. The good news is that you don't have to be a stock picker, thanks to the ease of investing in exchange-traded funds (ETFs). These investments allow you to gain passive exposure to companies through a thematic approach or broad market index.

Exchange-Traded Fund (ETF)

Will Nike stock split?

Nike didn't have an upcoming stock split as of mid-2024. The company's stock price traded in the low $90 range, a reasonably attainable level for most investors, so the company likely won't complete another stock price anytime soon.

Nike has split its stock several times throughout its history:

Date | Stock Split Type |

|---|---|

December 2015 | 2-for-1 |

December 2012 | 2-for-1 |

April 2007 | 2-for-1 |

October 1996 | 2-for-1 |

October 1995 | 2-for-1 |

October 1990 | 2-for-1 |

January 1983 | 2-for-1 |

If Nike continues to grow its earnings per share, its stock price should keep rising, eventually leading the company to announce another stock split.

The bottom line

Nike is an iconic sports brand. The company has created tremendous value for its shareholders over the years. It could continue doing so in the future as its earnings keep rising and it returns cash to shareholders through dividends and share repurchases. Those features make Nike look like a solid long-term investment.