Oil exchange-traded funds (ETFs) give investors a simple way to gain exposure to the oil market without picking individual stocks or trading futures. Depending on the fund, you can target crude oil prices directly, invest in large energy companies, or focus on specific parts of the oil value chain like pipelines or exploration.

Here’s how oil ETFs work, what to watch out for, and which funds stand out this year.

Why invest in oil ETFs?

The oil sector is volatile and cyclical, but it remains essential to the global economy. Demand continues to grow, and energy companies generate significant cash flow when prices are strong.

Oil ETFs can make sense if you want:

- Exposure to oil without relying on one company

- A way to benefit from higher prices or rising demand

- Income from dividend-paying energy infrastructure

Using an ETF also helps avoid a common pitfall: being right about oil prices but backing the wrong stock.

Types of oil ETFs

Oil ETFs include:

- Oil price-focused ETNs: Oil price exchange-traded notes (ETNs) aim to provide investors with direct exposure to the rise and fall of oil prices. They strive to track the daily movement of a common oil price benchmark, such as West Texas Intermediate (WTI) or Brent crude. Oil price ETFs allow investors to potentially profit from a more direct bet on oil prices.

- Broad oil stock-focused ETFs: Oil stock ETFs hold a large basket of companies focused on all aspects of the oil market. They give investors diversified exposure to the sector, reducing the risk of investing in an underperforming oil stock. They also provide investors with additional upside potential because oil stocks can outperform crude oil prices.

- Subsector-specific ETFs: Subsector-specific oil stock ETFs take a more focused approach by holding a basket of stocks concentrated on one aspect of the oil market, such as midstream companies or oil-field services. They let investors take a more targeted approach by investing in an oil market segment they believe will perform well.

That's where oil ETFs can play a vital role for investors. They let an investor gain exposure to the oil market and potentially profit from a boom. Using an oil ETF helps reduce the risk of having the correct investment thesis (i.e., that oil demand and prices will rise) but selecting the wrong oil stock to back that bet.

Top oil ETFs to consider

Oil ETF | Assets Under Management | ETF Description |

|---|---|---|

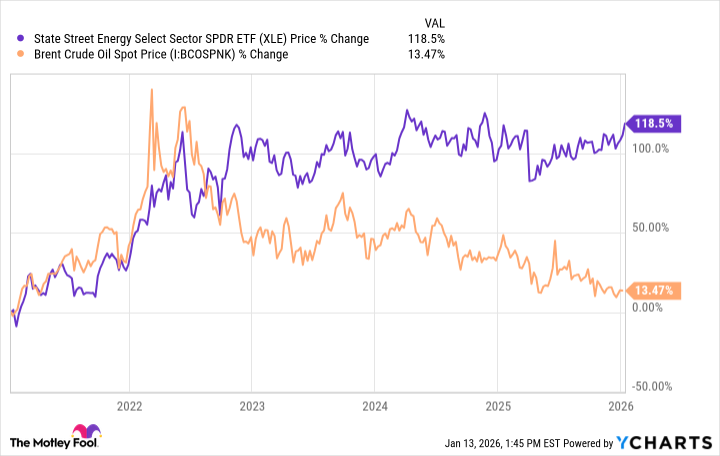

State Street Energy Select SPDR ETF (NYSEMKT:XLE) | $28.0 billion | An ETF focused on energy stocks listed in the S&P 500 index |

Vanguard Energy ETF (NYSEMKT:VDE) | $7.3 billion | A broad oil stock ETF |

Alerian MLP ETF (NYSEMKT:AMLP) | $10.6 billion | A subsector-specific oil ETF focused on midstream companies |

State Street SPDR S&P Oil & Gas Exploration & Production ETF (NYSEMKT:XOP) | $1.8 billion | An oil ETF focused on exploration and production companies |

United States Oil Fund LP (NYSEMKT:USO) | $913.4 million | An oil price ETF aiming to track WTI |

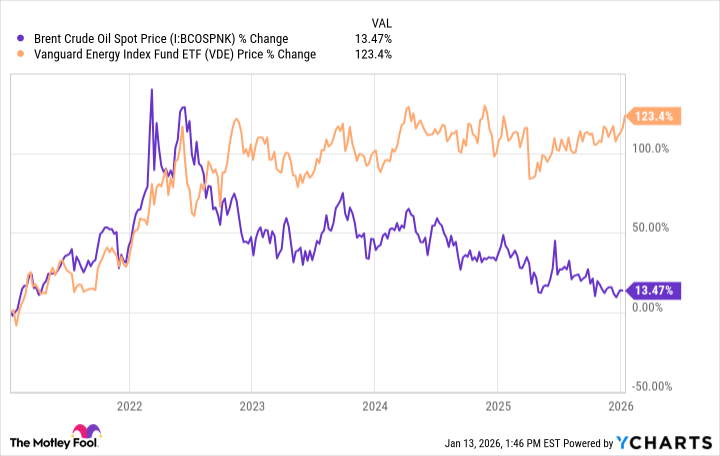

2. Vanguard Energy ETF

The Vanguard Energy ETF (VDE +1.22%) is a broad-based fund providing investors with exposure to companies involved in producing energy products such as oil, natural gas, and coal. The fund held about 110 energy stocks in early 2026. However, because it also has a market-weight strategy, it is highly concentrated at the top. Its five largest holdings include:

- ExxonMobil: 22.2% of the fund's holdings

- Chevron: 15.0%

- ConocoPhillips: 5.6%

- Williams: 3.9%

- Marathon Petroleum (MPC +3.88%): 3.2%

The oil ETF also features a low ETF expense ratio of 0.9%. Given its broader focus on energy stocks beyond those listed in the S&P 500, the ETF provides investors with even more diversification benefits for a low cost, helping to reduce risk. It can also deliver a solid performance compared to oil prices during a strong oil market:

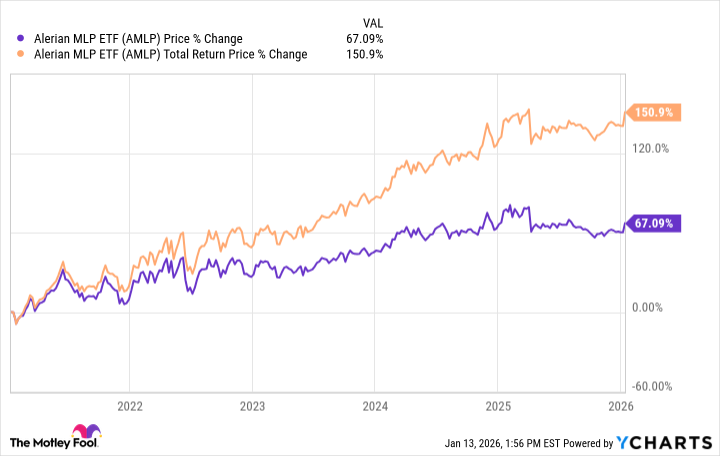

3. Alerian MLP ETF

The Alerian MLP ETF (AMLP +0.40%) is a fund that allows investors to target energy infrastructure midstream master limited partnerships (MLPs). These companies make money by providing midstream services such as operating pipelines or liquefied natural gas (LNG) export facilities.

They tend to earn steadier cash flow than oil and gas producers, making them better oil dividend stocks since they tend to pay high-yielding dividends. In early 2026, the ETF offered a trailing-12-month yield of 8.1%, making it ideal for investors seeking to generate passive income from the oil market. The ETF had 13 holdings in early 2026, led by the following five:

- Plains All American Pipeline (PAA +0.59%): 12.6% of the fund's holdings

- Energy Transfer (ET -0.52%): 12.4%

- Sunoco LP (SUN -0.42%): 12.3%

- Western Midstream Partners (WES +1.81%): 12.5%

- Enterprise Products Partners (EPD +1.33%): 11.6%

One drawback of the ETF is its relatively high expense ratio of 0.85%. The fees eat into the income that the fund's holdings produce. However, the cost can be worth it because it lets investors own a basket of income-producing energy companies with a single investment.

It's also worth noting that this fund processes the Schedule K-1s sent by the MLPs and sends its investors a Form 1099. That reduces the tax complexities of investing in MLPs, which can be a deterrent for some investors. Because it's a yield-focused vehicle, dividend payments make up a sizable portion of the fund's total returns:

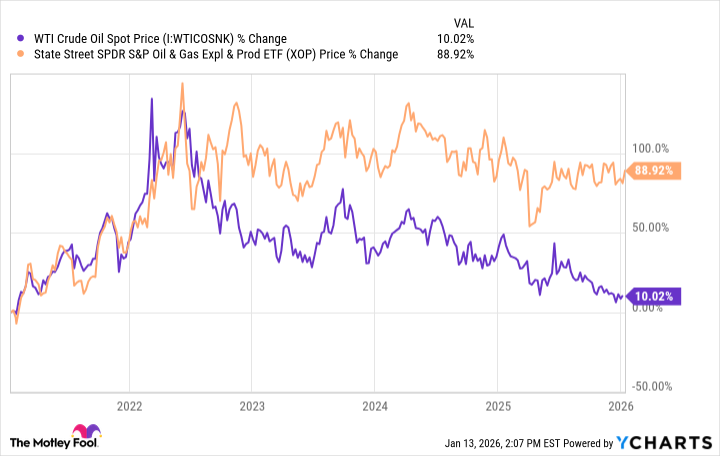

4. State Street SPDR S&P Oil & Gas Exploration & Production ETF

The State Street SPDR S&P Oil & Gas Exploration & Production ETF (XOP +2.26%) gives investors exposure to integrated oil and gas companies, oil and gas exploration and production companies, and refining and marketing companies. The fund had more than 50 holdings in early 2026, led by:

- Venture Global (VG +0.74%): 3.3% of the fund's assets

- Texas Pacific Land (TPL +1.30%): 3%

- Chevron: 2.9%

- ExxonMobil: 2.9%

- Magnolia Oil & Gas (MGY +2.11%): 2.8%

The oil ETF takes an equal-weight approach, meaning it provides very broad and diversified exposure to the entire U.S. oil industry by owning roughly equal amounts of each oil stock. Meanwhile, it charges a reasonable fee of 0.35%. These features make it a great option for investors looking for a less-concentrated oil ETF focused on oil and gas companies. It can also produce solid returns relative to oil prices:

5. United States Oil Fund LP

The United States Oil Fund (USO +1.96%) is an ETN that provides investors with more direct exposure to oil prices. It invests in futures contracts based on WTI prices. This approach allows investors to make a directional bet on the price of oil without having to engage in futures trading or risk that an oil stock investment will underperform the price of crude oil.

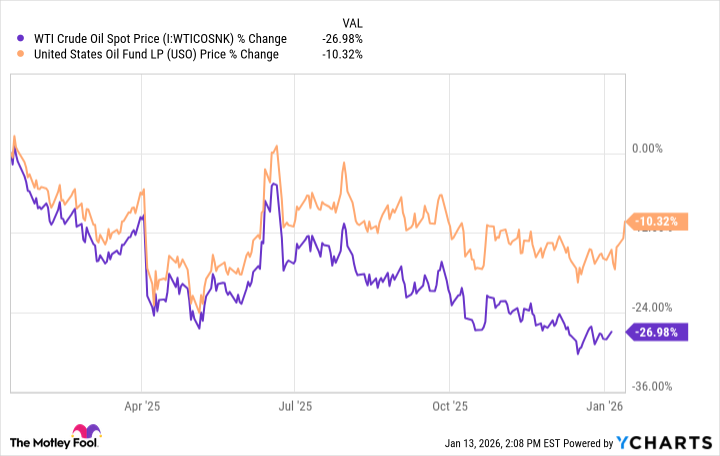

However, the fund has a rather hefty total expense ratio of 0.7%. The costs of rolling futures contracts can also eat into the fund's return over the long term, causing it to lag the price of oil over longer periods.

Because of these drags on performance, the oil ETF isn't an ideal long-term investment. Instead, it's best for making a short-term wager on crude oil prices since it tends to do a good job of tracking WTI prices over short periods:

How to choose an oil ETF

Investors should look at a few things when selecting an oil ETF to buy, including:

- Investment focus: Oil ETFs often concentrate on specific sectors of the oil market, such as the largest energy companies, smaller exploration and production (E&P) companies, MLPs, or crude oil futures contracts. You need to determine the focus area that best aligns with your investment thesis and risk tolerance.

- Fees: All oil ETFs charge investors a management fee. Higher fees can eat into your investment returns over the long term.

- Dividend yield: Some oil ETFs focus on investing in pipeline companies, which tend to pay higher-yielding dividends. Others invest in E&P companies or oil futures contracts, which might have a smaller yield or none at all.

Oil ETFs vs. Oil ETNs

Oil ETFs invest in oil stocks. They enable you to invest in the long-term demand growth of oil by benefiting from the production growth of oil companies or the infrastructure expansion of midstream companies to support rising demand. Oil ETNs, on the other hand, invest in oil futures contracts. They enable you to potentially profit from the short-term price movement of crude oil.

The bottom line

Oil ETFs make it easier to gain exposure to a volatile but essential sector. Whether you want broad diversification, income, or short-term price exposure, there’s likely an oil ETF that fits your strategy. The key is matching the fund’s structure to your risk tolerance and time horizon.