Oil exchange-traded funds (ETFs) are investment vehicles that enable anyone to gain increased exposure to the oil market through a single investment. Oil ETFs provide investors with distinct ways to make a broad bet on the oil market through specific strategies.

Oil ETFs include:

- Oil price-focused ETFs: Oil price ETFs aim to provide investors with direct exposure to the rise and fall of oil prices. They strive to track the daily movement of a common oil price benchmark, such as West Texas Intermediate (WTI) or Brent crude. Oil price ETFs allow investors to potentially profit from a more direct bet on oil prices.

- Broad oil stock-focused ETFs: Oil stock ETFs hold a large basket of companies focused on all aspects of the oil market. They give investors diversified exposure to the sector, reducing the risk of investing in an underperforming oil stock. They also provide investors with additional upside potential because oil stocks can outperform crude oil prices.

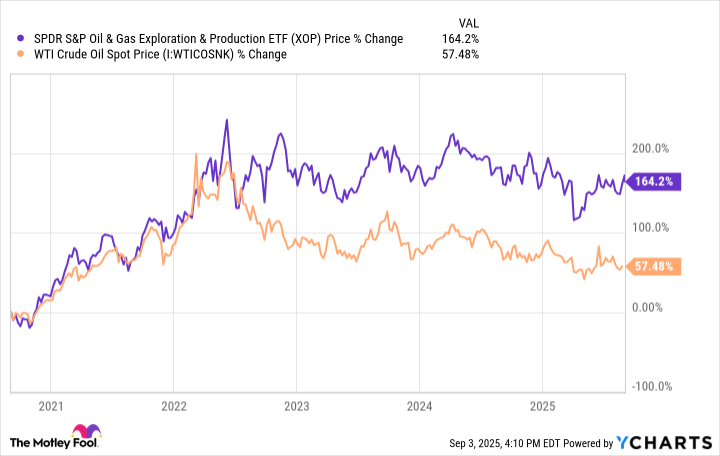

- Subsector-specific ETFs: Subsector-specific oil stock ETFs take a more focused approach by holding a basket of stocks concentrated on one aspect of the oil market, such as midstream companies or oil-field services. They let investors take a more targeted approach by investing in an oil market segment they believe will perform well.

Why invest using oil ETFs?

The oil industry can be extremely challenging for investors. The sector faces a number of risk factors, including:

- Oil price volatility: Oil prices often change quickly on any whiff of imbalance between supply and demand. The cyclical nature of the oil market is a big driver of volatility, with demand ebbing and flowing with the global economy.

- Capital-intensive: It costs a lot of money to drill and complete wells to maintain and increase production rates. Oil and gas companies need to reinvest a significant portion of their cash flow to sustain their output, which can be more challenging when prices fall.

- Geopolitical headwinds: Entities such as OPEC, the coalition of large oil-producing nations, can significantly influence oil prices by changing production quotas.

- Climate change concerns: Growing concerns that fossil fuels are worsening climate change could have a significant future impact on the sector.

- Company-specific issues: Individual oil companies face their own set of problems. Inferior resource quality, too much debt, ill-timed acquisitions, aggressive spending, and poor capital allocation strategies can all cause an oil company's stock price to underperform oil prices and its peers.

Despite all these negatives, the world needs more oil. The International Energy Agency (IEA) expects oil demand to continue growing through 2030. Oil companies should be able to increase their production and cash flow to meet demand, giving them the funds to provide value to their shareholders through share repurchases and dividend payments.

That's where oil ETFs can play a vital role for investors. They let an investor gain exposure to the oil market and potentially profit from a boom. Using an oil ETF helps reduce the risk of having the correct investment thesis (i.e., that oil demand and prices will rise) but selecting the wrong oil stock to back that bet.

The top oil ETFs in 2026

There are dozens of oil ETFs and similar investment vehicles, giving investors many options. Here's a look at the top five oil ETFs to consider:

Oil ETF | Assets Under Management | ETF Description |

|---|---|---|

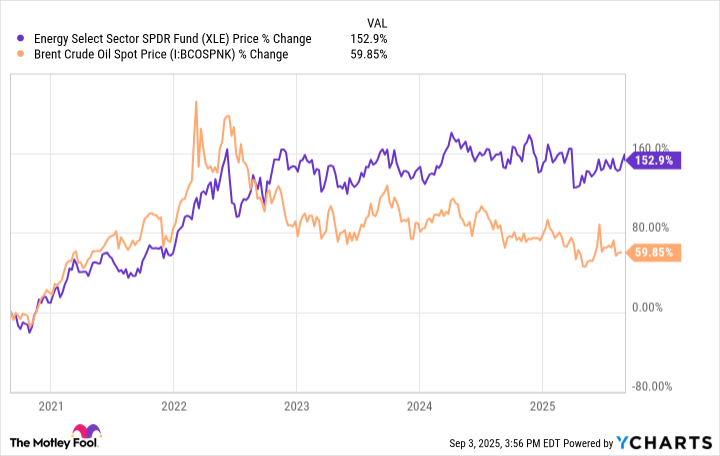

Energy Select SPDR Fund (NYSEMKT:XLE) | $27.6 billion | An ETF focused on energy stocks listed in the S&P 500 index |

Vanguard Energy ETF (NYSEMKT:VDE) | $7.4 billion | A broad oil stock ETF |

Alerian MLP ETF (NYSEMKT:AMLP) | $10.7 billion | A subsector-specific oil ETF focused on midstream companies |

SPDR S&P Oil & Gas Exploration & Production ETF (NYSEMKT:XOP) | $1.8 billion | An oil ETF focused on exploration and production companies |

United States Oil Fund LP (NYSEMKT:USO) | $1 billion | An oil price ETF aiming to track WTI |

2. Vanguard Energy ETF

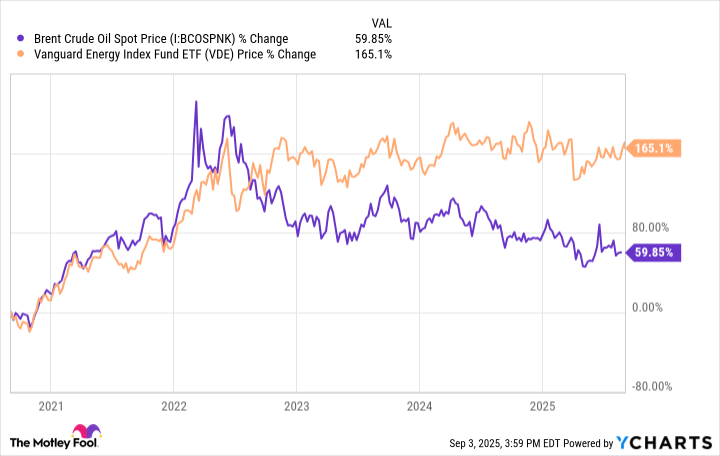

The Vanguard Energy ETF is a broad-based fund providing investors with exposure to companies involved in producing energy products such as oil, natural gas, and coal. The fund held about 110 energy stocks as of late 2025. However, because it also has a market-weight strategy, it is highly concentrated at the top. Its five largest holdings include:

- ExxonMobil: 22.7% of the fund's holdings

- Chevron: 16.0%

- ConocoPhillips: 6.4%

- Williams: 3.9%

- EOG Resources (EOG -1.57%): 3.5%

The oil ETF also features a low ETF expense ratio of 0.9%. Given its broader focus on energy stocks beyond those listed in the S&P 500, the ETF provides investors with even more diversification benefits for a low cost, helping to reduce risk. It can also deliver a solid performance compared to oil prices during a strong oil market:

3. Alerian MLP ETF

The Alerian MLP ETF is a fund that allows investors to target energy infrastructure midstream master limited partnerships (MLPs). These companies make money by providing midstream services such as operating pipelines or liquefied natural gas (LNG) export facilities.

They tend to earn steadier cash flow than oil and gas producers, making them better oil dividend stocks since they tend to pay high-yielding dividends. In late 2025, the ETF offered a trailing 12-month yield of 8.54%, making it ideal for investors seeking to generate passive income from the oil market. The ETF had 13 holdings in late 2025, led by the following five:

- Plains All American Pipeline (PAA +1.84%): 12.4% of the fund's holdings

- Western Midstream Partners (WES -0.14%): 12.1%

- MPLX (MPLX +1.09%): 12.1%

- Energy Transfer (ET -0.63%): 11.9%

- Enterprise Products Partners (EPD +0.86%): 11.8%

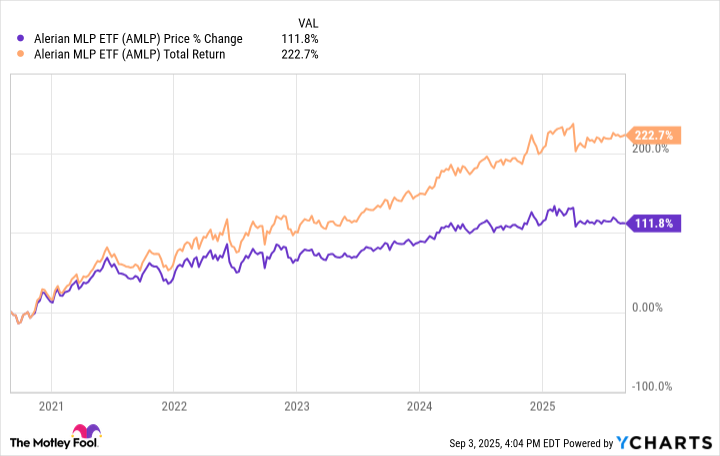

One drawback of the ETF is its relatively high expense ratio of 0.85%. The fees eat into the income that the fund's holdings produce. However, the cost can be worth it because it lets investors own a basket of income-producing energy companies with a single investment.

It's also worth noting that this fund processes the Schedule K-1s sent by the MLPs and sends its investors a Form 1099. That reduces the tax complexities of investing in MLPs, which can be a deterrent for some investors.

Because it's a yield-focused vehicle, dividend payments make up a sizable portion of the fund's total returns:

5. United States Oil Fund LP

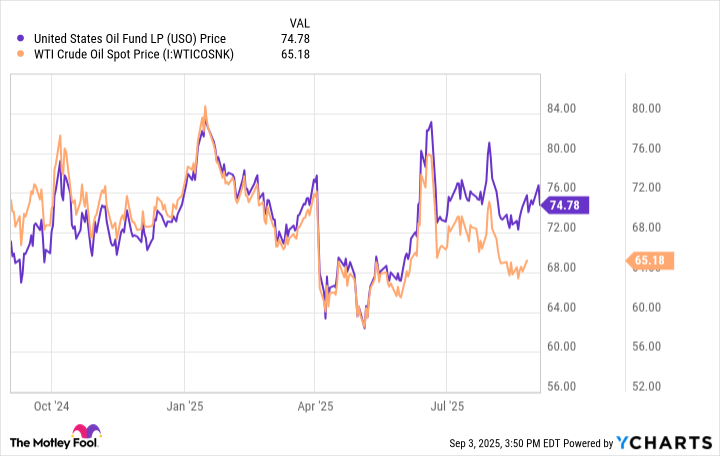

The United States Oil Fund is an exchange-traded security that provides investors with more direct exposure to oil prices. It invests in futures contracts based on WTI prices. This approach allows investors to make a directional bet on the price of oil without having to engage in futures trading or risk that an oil stock investment will underperform the price of crude oil.

However, the fund has a rather hefty total expense ratio of 0.7%. The costs of rolling futures contracts can also eat into the fund's return over the long term, causing it to lag the price of oil over longer periods.

Because of these drags on performance, the oil ETF isn't an ideal long-term investment. Instead, it's best for making a short-term wager on crude oil prices since it tends to do a good job of tracking WTI prices over short periods:

Factors to consider when choosing oil ETFs

Investors should look at a few things when selecting an oil ETF to buy, including:

- Investment focus: Oil ETFs often concentrate on specific sectors of the oil market, such as the largest energy companies, smaller exploration and production (E&P) companies, MLPs, or crude oil futures contracts. You need to determine the focus area that best aligns with your investment thesis and risk tolerance.

- Fees: All oil ETFs charge investors a management fee. Higher fees can eat into your investment returns over the long term.

- Dividend yield: Some oil ETFs focus on investing in pipeline companies, which tend to pay higher-yielding dividends. Others invest in E&P companies or oil futures contracts, which might have a smaller yield or none at all.

Related investing topics

Oil ETFs help investors gain increased exposure to the oil market

The oil industry is challenging for investors because of its volatility and other risk factors. However, it's also essential for the economy.

Investors will want to consider having some exposure to the oil market in their portfolio. Oil ETFs make getting into the sector easy by allowing investors to potentially profit from the sector's upside by holding either a basket of oil stocks or an ETF focused on crude oil prices. There are several top oil stock ETFs, giving investors many easy ways to add some oil market exposure to their portfolios.