Cryptocurrencies have become a hot investment that is gaining mainstream adoption. Markets for digital currencies such as Bitcoin (BTC +1.39%) were virtually unheard of in 2012, but they have since grown into a massive industry.

The cryptocurrency sector reached a market value of $3 trillion in the fall of 2021 and has continued to rise to a total market cap of roughly $3.9 trillion. The sudden surge in value and rapid evolution created immense wealth for early crypto investors.

Everyone wants to know which token will become the next Bitcoin or Ethereum (ETH +0.70%). With thousands of active cryptocurrencies on the market, investing in technologies linking the digital blockchain space with society could be even more lucrative. And there is no shortage of innovative companies and investment vehicles trying to bridge the gap between the two.

Cardano (ADA)

1. Coinbase Global

Coinbase Global (COIN +9.82%), a top cryptocurrency trading exchange, made its initial public offering (IPO) in April 2021. The company is a popular platform for purchasing major cryptocurrencies such as Bitcoin, Ethereum, and Cardano (ADA +1.27%), allowing users to trade about 250 cryptocurrencies, including many altcoins.

The Coinbase platform's success has been contingent on the increase in crypto prices, which in turn has led to millions of new users creating accounts. Coinbase earns a small transaction fee whenever someone buys or sells a cryptocurrency.

But the company aspires to be more than just a place to trade. It also sponsors a debit card that allows consumers to spend from the balance in their digital wallet, and it's launched a cloud platform for companies using and storing digital currencies.

Coinbase offers two game-changing innovations. The first is bringing the practice of asset loans -- which were previously only available to affluent investors -- to the masses. Users can pledge their Bitcoin or other cryptocurrencies as collateral and receive a low-interest loan to cover expenses. Using crypto as collateral means investors don't have to sell their assets when emergencies arise, allowing their principal to continue compounding.

The second innovation is the rising adoption of Coinbase's blockchain analytics by governments and financial institutions. Because most blockchains operate on a public ledger, the company can harness and monitor the data for illicit transactions and wallet addresses.

Suppose hackers managed to break through an individual's computer and demand a ransom in the form of Bitcoin to unlock the machine. In that case, Coinbase could then match the hacker's wallet address with millions of know-your-customer (KYC) data points stored on its platform. This could help law enforcement track down the flow of funds and apprehend the cybercriminals -- building greater trust in the crypto space.

All in all, investing in Coinbase is a broad bet on the crypto market. If crypto trading and ownership gain traction in the long run, Coinbase and its shareholders will benefit from the digital currency trend.

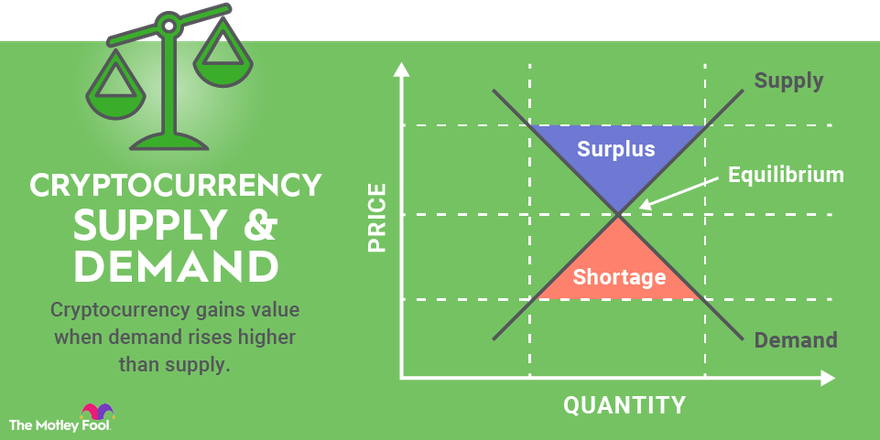

[Cryptocurrency] is a new asset class, but like real estate, there's only so much Earth. So it's defined, and therefore this moving price of the commodity is just how much, within this finite class of a commodity, this new asset class, how much people value it or want it.