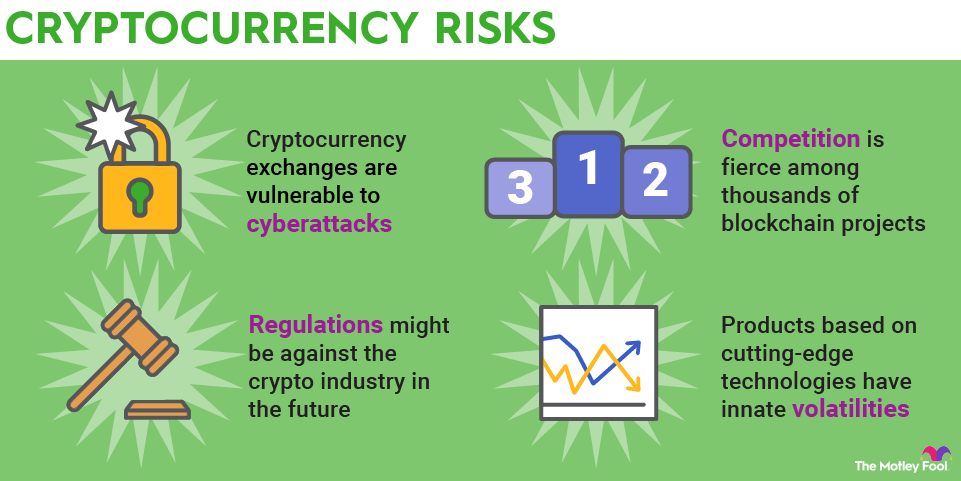

On the upside, these suits should help Congress and courts hammer out long-term rules and regulations for owning and trading digital assets in the long run. The cutting-edge technology elements of cryptocurrency also increase the risks for investors.

Cryptocurrency adoption

Crypto futures markets are being established, and many companies are gaining direct exposure to the cryptocurrency sector. Professional and individual investors are gradually receiving the tools they need to manage and safeguard their crypto assets. Financial giants, such as Block (NYSE:SQ) and PayPal (PYPL +1.97%), are making it easier to buy and sell cryptocurrency on their popular platforms and other companies are entering the space.

Tesla (TSLA +3.74%) held almost $2 billion of the cryptocurrency in early 2022. The electric vehicle maker sold off most of its crypto holdings later that year, but still owned $1.24 billion in Bitcoin in September 2025.

Strategy (MSTR +5.87%) -- a business intelligence software company -- has been accumulating Bitcoin since 2020. It held $33.1 billion worth of Bitcoin as of September 2025. Chairman Michael Saylor was dubbed by Forbes in 2025, "The Bitcoin Alchemist."

Although other factors still affect the riskiness of cryptocurrency, the increasing pace of adoption is a sign of a maturing industry.