Rental arbitrage is a real estate investing strategy that capitalizes on the difference between long- and short-term rental rates. Rental arbitrage involves a relatively low up-front investment, making it a potentially enticing option for beginning real estate investors without much capital. Instead of buying a property to capitalize on the growing short-term rental market, an investor will lease it and then sublease it to short-term renters.

Here's a closer look at rental arbitrage, its pros and cons, and how to determine if it's the right investment strategy for you.

What is it?

What is rental arbitrage?

Rental arbitrage is a real estate investment strategy designed to take advantage of different prices for the same asset. In a short-term rental arbitrage strategy, the investor seeks to capitalize on the difference between the long-term rental rate of a property and its rental income potential on the short-term rental market.

Landlords will typically lease a property at a lower long-term rate than they could achieve by renting it under shorter-term agreements because the approach provides a more predictable and stable rental income stream. An investor can capitalize on this by signing a long-term lease on the property and subleasing it to short-term renters on vacation rental platforms such as Airbnb (ABNB 0.36%). The investor makes money on the spread between their rental costs (rent, utilities, and related expenses) and the net income from short-term rentals (booking revenue minus platform fees, cleaning fees, and other expenses).

The strategy, also known as Airbnb arbitrage and short-term rental arbitrage, has a relatively low initial investment. Instead of buying a property for the short-term rental market, which could have a significant up-front investment (e.g., down payment, closing costs, and repairs to make the property ready to rent), the capital required for a rental arbitrage strategy would be much less.

For example, the up-front costs typically only include the security deposit, the first month's rent, and any furniture and decor if renting an unfurnished property. That makes the strategy much more accessible for beginning real estate investors who don't have a lot of capital to invest.

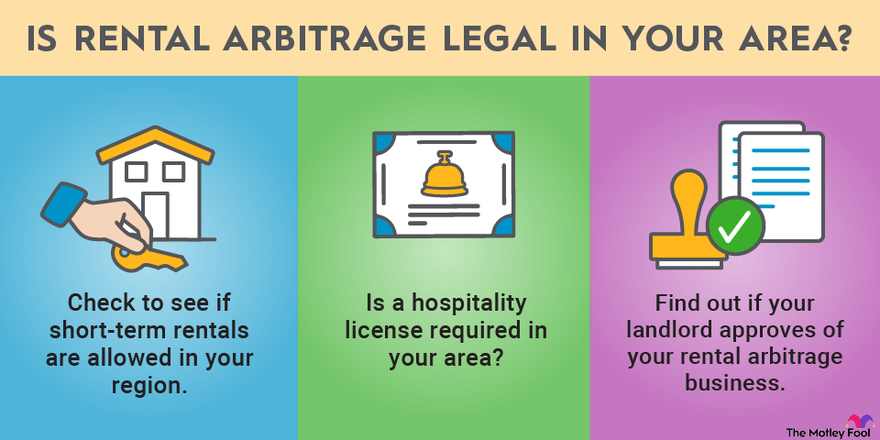

However, it's important to note that while rental arbitrage can be very lucrative, it's only legal if the local governing bodies (municipality and property owners association) permit short-term rentals. In addition, the landlord must allow the tenant to sublease the property.

Understanding rental arbitrage

Understanding rental arbitrage

Rental arbitrage is a relatively straightforward concept. It's a strategy to make money on the difference between what a property rents for on the long-term market and its rental income potential on the short-term rental market.

Here's an example of how this strategy works. An investor finds a well-located four-bedroom home in a city with a strong short-term rental market currently available for rent at $2,950 per month. They estimate that this property can generate $64,200 per year ($5,350 per month) of rental income on Airbnb. Because of that, the property could make $2,400 per month in rental arbitrage income before other expenses such as utilities, renters' insurance, cleaning fees, furniture and decor rentals, and any additional costs.

The up-front cost for this property is relatively modest compared to the investment required to purchase the property. It would include a damage deposit, one month's rent, and other start-up costs, such as furniture and decor. Depending on the property, those expenses could range from a few hundred to several thousand dollars.

By comparison, buying the property could require an initial investment of more than $100,000, depending on the down payment, closing costs, renovations and repairs, and other start-up costs. In addition, a property owner could eventually need to make significant additional investments in a property for a major repair or necessary renovation. Because of the lower investment, rental arbitrage can generate very high returns on capital.

Rental arbitrage can be a mutually beneficial arrangement between a landlord and tenant.

For landlords

Rental arbitrage for landlords

Most landlords want to earn passive income from real estate. Rental arbitrage can enable a landlord to achieve this goal by signing a long-term lease for their property with another investor who intends to capitalize on the short-term rental market. That allows the landlord to achieve their aim of generating steady rental income from a long-term tenant.

Landlords allowing rental arbitrage can benefit from a lower overall property vacancy since the tenant will likely continue renewing their lease if the property generates income. A landlord could earn more money by allowing this strategy by charging a premium rental rate to a tenant for rental arbitrage or receiving a percentage of the profits.

For tenants

Rental arbitrage for tenants

The rental arbitrage method capitalizes on a landlord's desire to be a passive real estate investor. They're usually willing to take less rent to lease a property long-term than they could earn on the short-term rental market. That's because it's a much more active strategy with more in common with the hospitality industry than real estate investment.

Short-term rental operators must manage a constant flow of guests that they need to keep satisfied. They also need to schedule and manage cleaners. Meanwhile, the income is much more volatile since external factors such as the weather, seasonality, and the economy can affect demand and pricing.

However, rental arbitrage can be a very lucrative investment strategy. It can generate a lot of income from a low initial investment, earning the investor a high return on that capital and giving them the money to quickly scale their business.

Pros and cons

Pros and cons of rental arbitrage

Rental arbitrage has its share of benefits and drawbacks for landlords and tenants. Before moving forward with this strategy, here are the pros and cons.

Pros for landlords

- It fills a rental with a long-term tenant.

- It provides a more stable rental income stream than a short-term rental strategy.

- It's a more passive investment strategy.

- It can reduce the overall vacancy rate if the tenant is successful and continues renewing the lease.

- The landlord may charge a higher rental rate or participate in some arbitrage upside.

Cons for landlords

- An increased risk of damages.

- An increase in the wear and tear on the property, likely leading to higher maintenance costs.

- Inability to screen every guest.

- There's the potential for seasonality or other issues affecting the tenant's ability to make their rental payments.

- The potential for increased legal liability.

- The potential for guests to cause problems with the neighbors, property owners' associations, or municipalities.

Pros for tenants

- There's no need to purchase a property.

- Relatively low start-up costs.

- Relatively easy to get started.

- They can use the property when it isn't booked.

- There's a minimal property-related risk since the landlord is responsible for maintenance and repairs.

- Limited business-related risk because a tenant can either sublease or not renew the lease if the property isn't generating enough income to cover the costs.

- It offers the ability to quickly scale the business due to low costs and technology.

- There's the potential to earn high returns on investment.

- It offers the ability to build income for other investments.

Cons for tenants

- Seasonality and other issues can affect bookings and profits.

- Increased responsibilities to manage the business and property's condition.

- Rent and other recurring expenses, such as furniture rental fees, are due each month even if there are no bookings.

- The potential for eviction if you don't pay the rent.

- The tenant is responsible for any damage their guests cause to the property.

- Potential for a loss of business if a municipality or property owners association bans short-term rentals.

Related investing topics

Should you invest?

Is rental arbitrage right for you?

Rental arbitrage can be a worthwhile and mutually beneficial investment strategy. It can enable a beginning investor to start in the short-term rental market for a relatively low up-front cost. The short-term rental arbitrage method can help them quickly increase their capital to pursue other real estate investments. Meanwhile, it can provide a landlord with a long-term tenant for their property.

However, rental arbitrage increases risk and the workload for the landlord and the tenant. It's not for everyone. Both parties must do a lot of due diligence to ensure rental arbitrage is the right strategy for their specific circumstances.