Businesses looking to raise money by selling stock may offer one of two kinds: common stock or preferred stock. Both can be worthwhile investments, and you can find both types of stock on major exchanges.

The main difference between preferred stock and common stock is that preferred stock acts more like a bond, with a set dividend and redemption price, while common stock dividends are less guaranteed and carry more risk of loss if a company falls on hard times. On the other hand, with risk comes opportunity: There's far more potential for stock price appreciation with common stock.

Though the name might suggest that preferred stock is the better investment, the better choice depends on your objective: income now or long-term returns for the future. The table below shows the key differences between common and preferred stock.

| Factor | Common Stock | Preferred Stock |

|---|---|---|

| Upside potential | Almost unlimited | Limited to redemption value, except for convertible preferred |

| Downside risk | Can fall to $0 | Can fall to $0 but is less likely to do so |

| Share price volatility | More dramatic movements | Less dramatic movements |

| More suitable for | Long-term growth investors | High-yield dividend investors |

| Number of classes of stock | Usually one but sometimes more | Often multiple, with no limit on how many a company can issue |

Common stock

Common stock

Common stock gives investors an ownership stake in a company. Most companies exclusively issue common stock, and there is much more common stock selling on stock exchanges than preferred stock.

Investors holding common stock typically -- but not always -- have the right to vote on the company's board of directors and to approve major corporate decisions, such as mergers. Some companies have multiple classes of common stock, with different classes having more voting power than others.

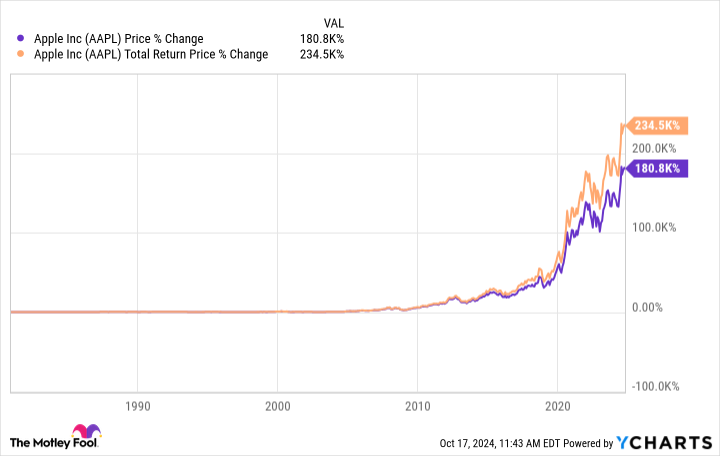

The most attractive feature of common stock is that it's an ownership stake in the company. Its value can rise dramatically as a company grows bigger, more profitable, and more valuable. This can create enormous returns for investors. For example, here's how much Apple (AAPL -0.19%) stock has gone up since going public:

A $1,000 investment in Apple's stock on the first day of trading after its initial public offering (IPO) would be worth $1.8 million at recent prices (as of Oct. 2024). Add in the dividends it has paid, and the total return goes to $2.37 million.

However, there have also been times when Apple shares have fallen sharply over shorter periods, and that volatility is another of the risks -- and differences -- between common stock and preferred stock. In addition to the risk of losses due to volatility in the short term, common shareholders, as the company's owners, are last in line to receive anything if a company fails.

Lenders, suppliers, bond and other debt holders, and preferred stock owners are all ahead of common shareholders because the company has a contractual obligation to pay them first. A common shareholder's willingness to take on the risk of losses if things go badly is offset by the potential for big returns if things go well.

Preferred stock

Preferred stock

Preferred stock often works more like a bond than common stock does. Preferred stock dividend yields are often much higher than dividends on common stock and are fixed at a certain rate, while common dividends can change or even be cut entirely.

Preferred stock also has a set redemption price that a company will eventually pay to redeem it. This redemption value, like a bond at maturity, limits how much investors are willing to pay for preferred shares. The label "preferred" comes from three advantages of preferred stock:

- Preferred stockholders are paid before (get preference over) common stockholders receive dividends.

- Preferred shares have a higher dividend yield than common stockholders or bondholders usually receive (very compelling with low interest rates).

- Preferred shares have a greater claim on being repaid than common shares if a company goes bankrupt.

In other words, they're really "preferred" by investors looking for a more secure dividend and lower risk of losses.

The two main disadvantages of preferred stock are that they usually have no voting rights and limited potential for capital gains. A company may issue more than one class of preferred shares. Each class can have a different dividend payment, a different redemption value, and a different redemption date.

Companies can also issue convertible preferred stock. In addition to the normal attributes of preferred stock, convertible preferred stock gives shareholders the right to convert preferred shares into common stock under certain circumstances.

Related investing topics

Most investors buy stocks for long-term growth, so investing in common stock is usually the better choice because of the greater upside potential. The key is to consider your ability and willingness to hold the stock for many years and ride out volatility that can lead to losses if you sell in a downturn.

If your goal is generating income, preferred stock may be the type you're looking for, especially when interest rates are low, resulting in lower yields for the safest bonds. With fixed dividend payouts that are more reliable and usually higher than common stock dividends, they can be very attractive. Just remember that although preferred stock is safer than common shares, it's still not as secure as a bond.

FAQ

Common stock versus preferred stock: FAQ

What is an example of preferred stock?

AT&T (NYSE:T) is a good example, with multiple preferred shares, including preferred notes due in 2066 (TBB) and 2067 (TBC). Both have a face value (par) of $25 and currently trade at a small discount to that price (not uncommon) with a coupon rate (yield) of 5.35% for TBB and 5.625% for TBC.

Both are callable, which means AT&T can repay investors their $25 per preferred share before 2066 and 2067, respectively. For comparison, AT&T's common stock dividend yield is 5.1% at recent prices, and the payout was cut by about half in 2022, sending the stock price down sharply.

Over the past five years, AT&T's stock price has lost about 26% of its value (while the preferred shares have held steady), wiping out much of the value of the company's dividend. This a good example of how a preferred stock can be safer and a better investment than a company's common stock.

What is an example of common stock?

We can use AT&T from the first FAQ above. While the company's preferred shareholders have been relatively well insulated -- the issues described above continue to trade close to the $25 face value, and AT&T keeps paying preferred investors their regular dividends -- common shareholders have been on a different journey.

Since the beginning of 2020, the company's common share, traded under the ticker "T," has lost 26% of its value, and the dividend has been cut by 47%. This is a good example of when the risk of owning common shares can harm investors. If a company cannot grow earnings, its common share price suffers, while preferred shares hold their value.

Why would you convert preferred stock to common stock?

In short, you see an opportunity to profit. If you expect that a company's stock price could appreciate in value, taking on the risk of becoming an owner versus being a lender can have significant upside.

What is the difference between preferred stock and common stock?

The long answer is described in this article. However, the short answer is that common stock is ownership in the business, with all the upside and risk that comes along with that.

Preferred stock is more like debt, with a fixed redemption price and a regular, agreed-upon dividend payment that's pretty safe. Preferred shares are also more likely to be repaid if a company goes bankrupt, while common shareholders stand at the very end of the line to get anything left over.