A Roth IRA is a tax-advantaged savings account that can help boost your retirement savings. Because the IRS provides tax benefits for Roth IRAs, they come with a lot of rules. And, if you don't follow those rules, you may lose some of those benefits.

Contribution rules

Roth IRA contribution rules

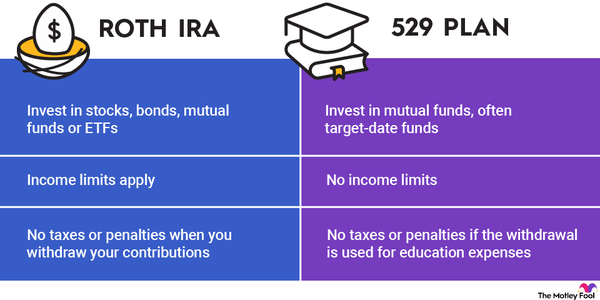

The annual Roth IRA contribution limit for both 2024 and 2025 is $7,000. If you're 50 or older, you can make an additional $1,000 in catch-up contributions for each year, bringing your total limit to $8,000.

There are also income limitations restricting who's eligible to contribute. In 2024, single filers require a modified adjusted gross income (MAGI) of $146,000 or less to contribute the full amount to a Roth IRA. That number climbs to $150,000 in 2025. Married couples can earn a combined $230,000 for 2024, or $236,000 for 2025.

Single filers with MAGIs above the income limit of $161,000 in 2024 or $165,000 in 2025 cannot contribute at all; married couples cannot contribute if they report a MAGI above $240,000 in 2024, or $246,000 in 2025. If your MAGI is lower than this but still higher than the limit for contributing the full amount, you can contribute a reduced amount to a Roth IRA.

Withdrawal rules

Roth IRA withdrawal rules

When you make a Roth IRA withdrawal, your money comes out in a specific order. This is important because each amount gets different tax treatment if you're making an unqualified distribution -- one that doesn't meet certain IRS criteria and is therefore potentially subject to extra taxes.

- Contributions: Contributions are withdrawn first because they can be withdrawn tax- and penalty-free at any time.

- Roth conversions: Conversions are withdrawn second, but they require a five-year wait starting from Jan. 1 of the year of the conversion. Otherwise they're subject to a 10% penalty.

- Earnings: Earnings are withdrawn last and will be subject to taxes at your income tax rate if you're taking unqualified distributions.

Distribution rules

Roth IRA distribution rules

You can withdraw Roth IRA contributions tax- and penalty-free at any time. However, early withdrawals of earnings -- those made before the age of 59 1/2 -- will incur a 10% early withdrawal penalty. According to the IRS, a withdrawal becomes a qualified Roth IRA distribution and is therefore not subject to taxes or penalties when it meets the following criteria:

First, a minimum of five years must have passed since the year of your first contribution to any Roth IRA. (See below for more on meeting the five-year rule.) Second, you must also meet one of the following conditions for a withdrawal to count as a qualified distribution:

- You're at least 59 1/2 years old.

- You're totally and permanently disabled.

- You're withdrawing up to $10,000 for a first-time home purchase.

- You choose to take substantially equal periodic payments.

- You become disabled or die (and the distribution is taken by your heirs).

- You're paying medical insurance premiums during a period of unemployment.

- You're putting the money toward higher education expenses.

- You're paying back taxes to the federal government for a levy placed against your Roth IRA.

If you fail to meet the five-year rule but meet one of the other criteria for a qualified distribution, your Roth conversions and earnings will be exempt from the 10% penalty, but you'll still owe income tax on the earnings portion of your withdrawal.

Required minimum distributions

Roth IRA required minimum distributions

There are no required minimum distributions for a Roth IRA during the account owner's life.

If you inherited a Roth IRA from your spouse and elect to treat it as an inherited IRA instead of doing a spousal transfer, you'll be required to take minimum distributions based on your own life expectancy. This option used to be available to nonspouse beneficiaries, but the SECURE Act restricted it starting in 2020.

Roth IRA five-year rules

There are two main five-year rules for Roth IRAs:

- The first rule states that withdrawn earnings will be taxed unless at least five years have passed since the year of your first Roth IRA contribution. The clock starts on Jan. 1 of the year for which you made a contribution of any amount to any Roth IRA. If you contribute to a Roth for the first time in early 2025 (prior to the tax deadline) but the contribution was for the 2024 tax year, then the starting point was Jan. 1, 2024. The five-year requirement will then be met on Jan. 1, 2029.

- The second rule is that Roth conversions must remain in the account for at least five years before withdrawal. The clock starts on Jan. 1 of the year you make the conversion. Withdrawing conversions early results in a 10% penalty unless you otherwise meet the criteria to avoid this penalty.

Related Retirement Topics

Additional guidelines

Roth IRA rollover rules

Roth IRAs are eligible to receive rollovers from a wide variety of account types, including:

- Traditional IRA

- SEP-IRA

- 457(b)

- 403(b)

- 401(k) or other qualified plan

- SIMPLE IRA (after two years)

- A designated Roth account (in a retirement plan)

- Another Roth IRA

There's no limit to the amount you can roll over, but it must be from another account into a Roth IRA. You cannot roll over in the opposite direction -- from a Roth IRA into another type of account.

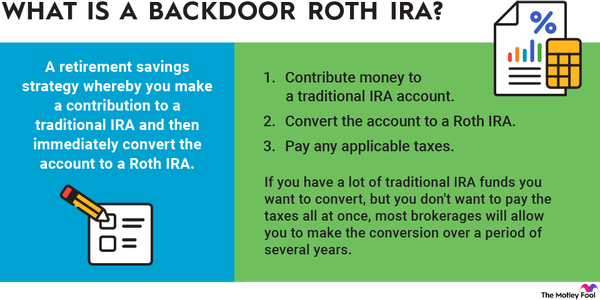

When you roll over funds from a pre-tax account, you'll have to pay income taxes on the previously untaxed amount you roll over. This is considered a conversion.

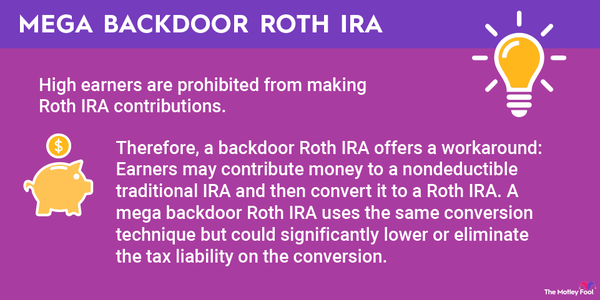

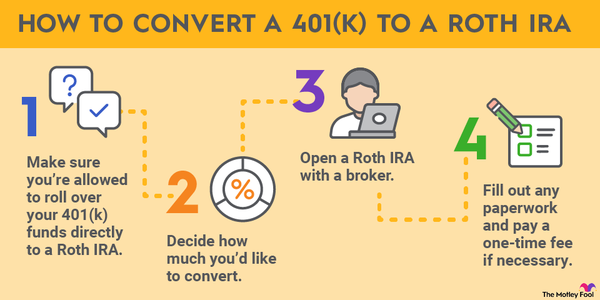

Roth IRA conversion rules

You can convert funds from a traditional IRA or many other pre-tax retirement accounts into a Roth IRA. There's no limit to the amount you can convert; however, doing so requires you to pay income tax on the previously untaxed portion of the funds you're converting.

Roth conversions cannot be recharacterized as traditional IRA funds. This option was eliminated in 2018 by the Tax Cuts and Jobs Act.

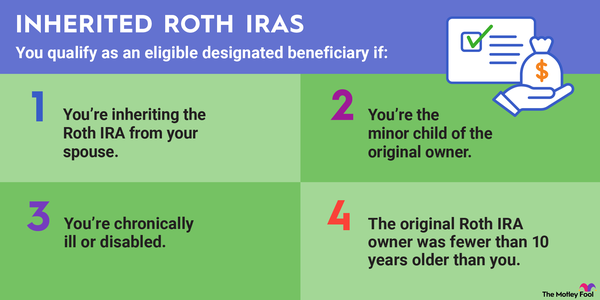

Inherited Roth IRA rules

If you inherit a Roth IRA from your spouse, you have several options:

- Treat the IRA as your own.

- Treat it as an inherited IRA and begin taking required minimum distributions based on your life expectancy beginning the year following the owner's death.

- Treat it as an inherited IRA and deplete the account within five years.

- Take a lump-sum distribution.

If you inherit a Roth IRA from someone other than your spouse, your options have been limited by the 2019 SECURE Act. These beneficiaries may take a lump-sum distribution or cash out the account within 10 years.

Roth IRA transfer rules

When you are transferring Roth IRA funds from one custodian to another, such as in a rollover or conversion, there are two common methods:

- Direct transfer: The assets are transferred directly to the Roth IRA account at your preferred financial institution. This type of transfer can be done in kind, which allows you to keep your existing investments rather than converting them to cash.

- Indirect transfer: You request a check from your custodian and personally deposit the cash in your other Roth IRA. This method is subject to the 60-day rule, meaning you have only 60 days (from the time of fund dispersal to the time of submission to a new account) to transfer your funds tax- and penalty-free. If you fail to complete the transfer within 60 days, you may owe an early withdrawal penalty and income taxes on a portion of it. Additionally, you'll be unable to redeposit the funds into a Roth account beyond your annual contribution limit. Doing so will result in an excess contribution.

Roth IRA trading rules

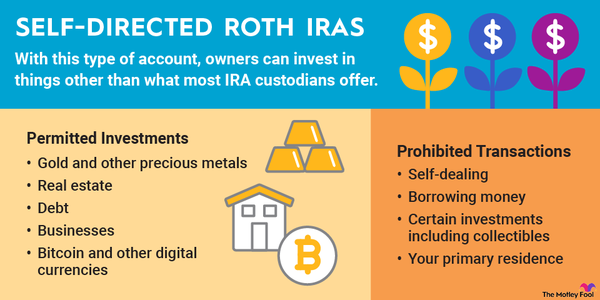

There are some investments the IRS prohibits you from holding in a Roth IRA:

- Collectibles, including art, rugs, metals, antiques, gems, stamps, coins, alcoholic beverages such as fine wines, and certain other tangible personal property

- Life insurance

The IRS also doesn't allow you to invest borrowed money in your Roth IRA. Therefore, margin accounts are prohibited. Certain options contracts that could require margin borrowing are off-limits, and you're also unable to short-sell stocks.

Other than these restrictions, there's nothing preventing you from day trading in your Roth IRA. Day trading in a Roth IRA protects you from paying taxes on your gains. However, it also means you cannot write off your trading losses -- which is the more likely result for most people attempting to day trade.

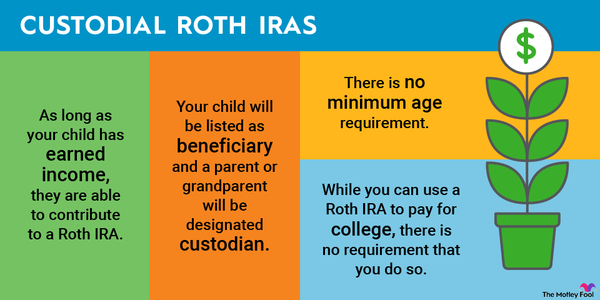

Custodial Roth IRA rules

A custodial Roth IRA allows you to put money away for your child if they earned income. An adult custodian will maintain control of the account for the benefit of the minor until they reach age 18 or 21 (depending on the state they live in). The beneficiary then takes full control of the Roth IRA, converting it into a standard Roth IRA.

Custodial Roth IRAs follow the same rules regarding contribution limits, withdrawals, and trading as regular Roth IRAs.