If you're ready to start investing, you may be wondering whether a Roth IRA or a standard brokerage account is right for you.

Roth IRAs and standard brokerage accounts are both types of investment accounts, but there are significant differences between them. Keep reading to learn about how Roth IRAs differ from standard brokerage accounts, the pros and cons of each, and how to decide whether to open a Roth IRA or brokerage account.

What is a brokerage account?

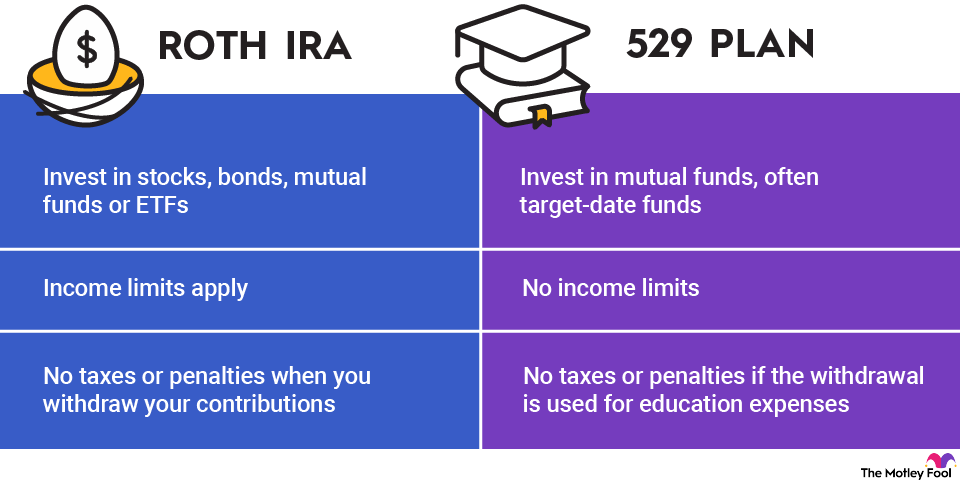

A brokerage account is an investment account that you deposit money into and invest in whatever securities you choose, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). There are no limits on the amount you can deposit or withdraw.

However, the IRS requires you to pay capital gains taxes on the gains in a brokerage account. (That's why standard brokerage accounts are sometimes referred to as taxable accounts.) As we'll see in a bit, this is not the case with a Roth IRA.

If you hold an investment for one year or less, any profits will be taxed as short-term capital gains, meaning you'll pay ordinary income tax rates. But capital gains tax rates are much more favorable when you hold an investment for more than a year, at which point it's considered a long-term capital gain. Long-term capital gains rates are 0%, 15%, or 20%, depending on your income; most people fall into the 15% bracket.

If you're interested in a brokerage account, our list of the best brokerage accounts breaks down options by investing style and experience level.

Advantages of a standard brokerage account

Advantages of a standard brokerage account

A brokerage account has several pros and cons. Here are some key advantages:

- You can contribute an unlimited amount. Retirement accounts limit the amount you can contribute each year, but there are no limits on how much you can contribute to a brokerage account. If you're already maxing out your 401(k) and Roth IRA contributions, a taxable brokerage account is an option for investing additional money.

- There are no early withdrawal penalties. Retirement accounts often hit you with a 10% early withdrawal penalty if you take money out before age 59 1/2, but with a brokerage account, you can withdraw funds whenever you want. For that reason, a brokerage account is often a good choice for investing money you might want before retirement.

- You can take advantage of favorable long-term capital gains tax rates. Although you're not getting a tax break on your contributions or withdrawals from a brokerage account, if you hold your investments for over a year, you can take advantage of long-term capital gains rates on your earnings, which are lower than income tax rates.

Disadvantages of a brokerage account

There are also some downsides of a brokerage account to be aware of, including:

- No tax breaks for contributions or withdrawals. The biggest drawback of a brokerage account vs. a 401(k) or Roth IRA and other retirement accounts is that you don't get a tax break. You fund the account with after-tax money, then pay taxes on your gains when you withdraw it.

- Dividends are usually taxable. Unless you're in one of the three lowest federal income tax brackets, dividends are usually taxable in a brokerage account. When you earn dividends in a tax-advantaged account like a 401(k) or Roth IRA, you don't owe dividend taxes.

- May encourage more frequent trading. Because you can withdraw your money whenever you want without penalty, you may be tempted to trade more frequently. A buy-and-hold investment strategy usually produces the best returns in the long run.

What is a Roth IRA?

A Roth IRA is an individual retirement account that you fund with after-tax money. In other words, you don't get an upfront tax break for contributions to a Roth IRA, although there are big tax benefits when you reach retirement age. The "individual" means that you open it on your own, unlike a 401(k) or 401(a), which you open through an employer.

Although you don't get an upfront tax deduction when you fund your Roth IRA, the tax breaks are generous in retirement. Once you're 59 1/2 and have had the account for a minimum of five years, your withdrawals are tax-free.

But the Roth IRA rules also give you a lot of flexibility. For example, you can withdraw your contributions (but not your earnings) at any time without owing taxes or an early withdrawal penalty.

If you're interested in a Roth IRA, take a look at our list of the best Roth IRAs to choose from.

Advantages of a Roth IRA

Some of the many Roth IRA benefits for investors include:

- You get unlimited tax-free withdrawals in retirement. Taxes are a big concern in retirement planning. But because you've paid money on Roth contributions, you don't have to pay taxes on the earnings in retirement. If you let your money grow for several decades, that could add up to serious tax-free retirement income.

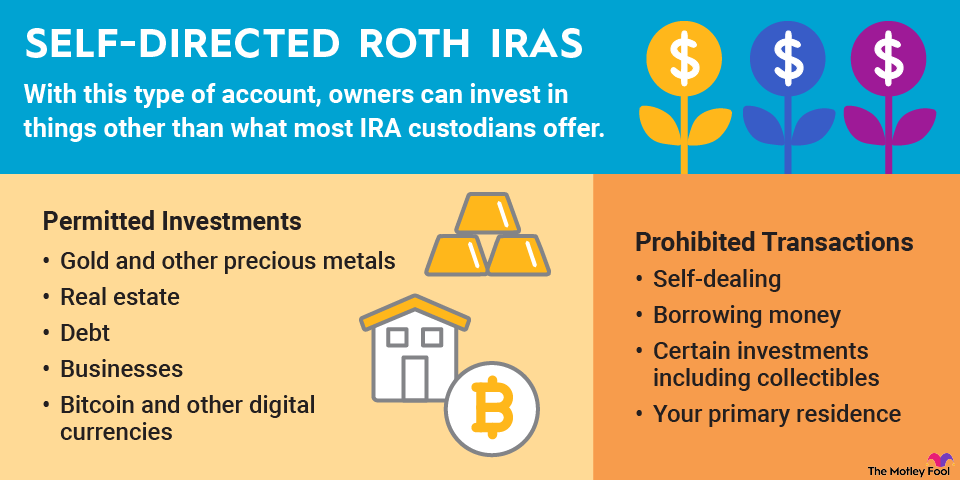

- Flexible investment choices. The account isn't tied to any employer, so you can open it through whatever IRA brokerage you want. As with a brokerage account, you can invest your Roth IRA money in virtually any securities you choose.

- Ability to access contributions at any time. Ideally, you'll let your Roth IRA money grow for as long as possible. However, being able to access your contributions at any time without paying taxes or penalties offers an extra layer of financial security in case of a crisis.

Disadvantages of a Roth IRA

There are a few drawbacks to be aware of if you're considering a Roth IRA, such as:

- You don't get a tax break on your contributions. Contributing to a traditional IRA or 401(k) will usually decrease your taxable income. But there's no tax break for Roth IRA contributions since Roth accounts are always funded with after-tax money. The tradeoff -- that you get tax-free withdrawals in retirement -- is worth it for many savers, though.

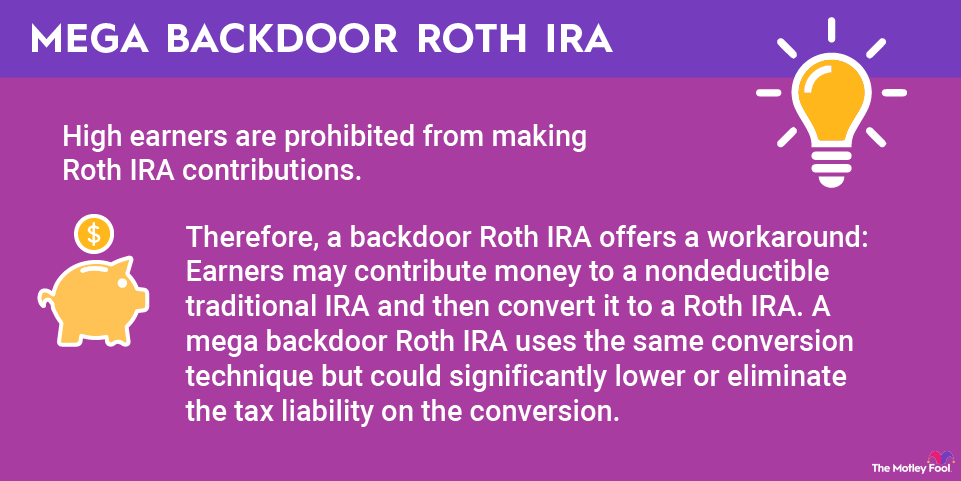

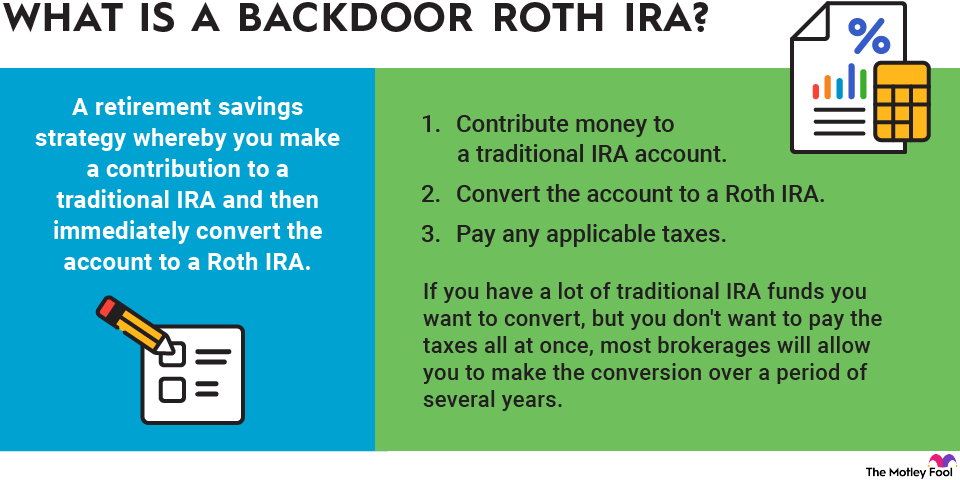

- You can only contribute to a Roth IRA if you earn less than the Roth IRA income limits. It may be possible, however, to skirt these income limits using a backdoor Roth IRA strategy.

- You can't contribute more than the Roth IRA limits for the year. In 2025, the maximum Roth IRA contribution is $7,000 if you're younger than 50 or $8,000 if you're 50 or older. This is increasing to $7,500 and $8,600, respectively, for 2026. You can only contribute the amount of earned income you have in a given tax year. So, if you only earned $5,000 in 2025, your contribution limit is $5,000.

Choosing between a brokerage account and a Roth IRA

Fortunately, you don't necessarily have to choose between a standard brokerage account vs. a Roth IRA. You can contribute to both accounts, although Roth IRAs have additional eligibility requirements.

A Roth IRA is meant for retirement savings, while a taxable brokerage account is better for investing money that you may need before retirement. It can also be a good way to supplement your retirement savings if you're already maxing out your retirement accounts.

So, how do you prioritize? Typically, it's best to go in this order:

- Before you fund a Roth IRA or a taxable brokerage account, contribute enough to take advantage of your employer's 401(k) match.

- Then, max out your Roth IRA.

- If you have additional money to invest, open a taxable brokerage account (if you want a broad range of investment options and the flexibility to withdraw money at any time) or make unmatched 401(k) contributions (if you want tax-advantaged investing and are fine with a more limited range of investments).