If you're looking to collect dividends as often as possible, stocks that pay monthly may be ideal. Most (although not all) monthly payers are REITs, or real estate investment trusts. This category of companies benefits from some tax advantages that allow them -- actually, require them -- to pay above-average dividends.

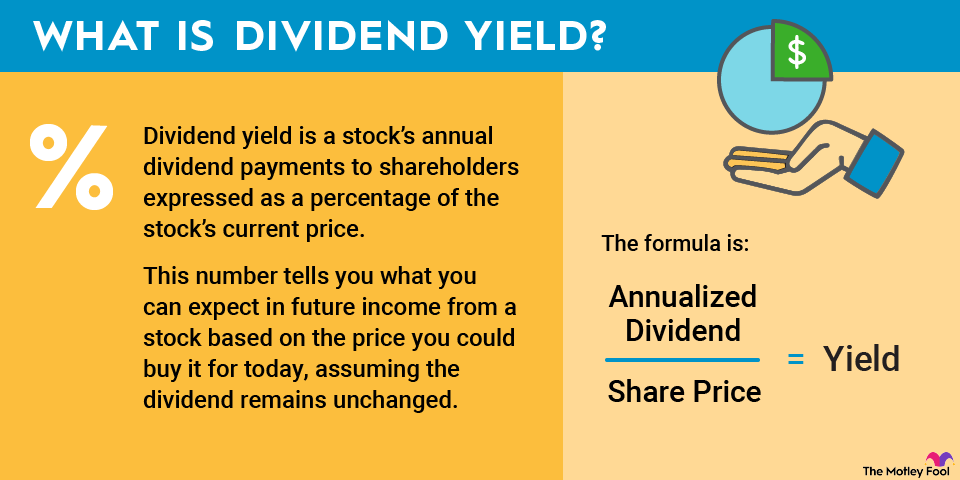

One of the most popular is Realty Income (O +0.88%), which we can use as an example. As of June 2023, the most recent dividend was $0.255 per share, and the share price was near $60. Let's use the formula in the previous section to determine the dividend yield.

A monthly dividend of $0.255 times 12 equals an annualized dividend of $3.07 (rounded). That $3.07 dividend divided by a share price of $60 equals a dividend yield of 5%.

If you're calculating a stock's yield, be careful. Don't just assume that the next dividend payment will be equal to the last. Companies occasionally issue special dividends, and dividends can also get cut. Take the time to research the company and make sure the dividend yield you think a stock will pay matches up with reality.

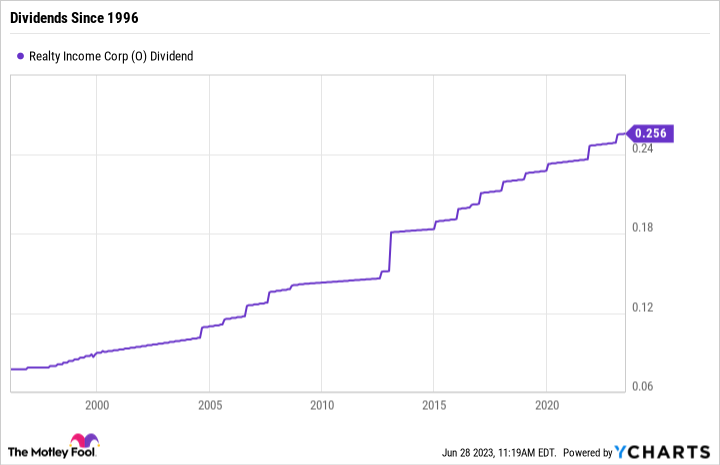

Realty Income's dividend, for example, has been increased three times in the past year, and it has a long history of modest, regular increases. Costco (NYSE:COST) also has a history of modest regular increases and also pays a special dividend some years -- but not in others. Make sure you don't include these special dividends in your expected yield when evaluating companies with a history of special dividends; they don't happen every year.