Congress created real estate investment trusts (REITs) in 1960 to enable anyone to invest in wealth-creating commercial real estate. Exchange-traded funds (ETFs) have since made it even easier to invest in REITs. REIT ETFs allow anyone to invest broadly across the REIT sector to quickly add diversified real estate exposure to their portfolio.

Here's a closer look at how these two investment vehicles can combine into an easy way to start investing in real estate.

Best REIT ETFs

These REITs own pools of rental properties or real estate-backed loans that generate rental or interest income. They must distribute at least 90% of their taxable net income to shareholders via dividend payments to remain in compliance with IRS regulations. REITs require less work and capital than buying a property outright. They're also less risky, highly liquid, and have historically delivered strong returns relative to the S&P 500.

However, with almost 200 publicly traded REITs focused on a dozen property sectors, it can be challenging for beginning investors to know where to start. While you could invest in individual REITs, you risk picking the wrong ones that are at risk of underperformance or a dividend cut.

That's where ETFs can help. These entities hold several REITs and other real estate stocks, giving investors broad exposure to the sector and helping reduce risk. Some of the top real estate ETF options are:

Top REIT ETFs | Ticker Symbol | Performance (Total Returns) Over the Past 12 Months | Inception Date | Issuer | Assets Under Management (AUM) |

|---|---|---|---|---|---|

Vanguard Real Estate ETF | 4.4% | 9/23/2004 | The Vanguard Group | $35.1 billion | |

iShares U.S. Real Estate ETF | 3.4% | 6/12/2000 | BlackRock (NYSE:BLK) | $3.5 billion | |

Schwab U.S. REIT ETF | 4.0% | 1/13/2011 | Charles Schwab (NYSE:SCHW) | $9.1 billion | |

State Street Real Estate Select Sector SPDR ETF | 3.5% | 10/7/2015 | State Street (NYSE:STT) | $7.2 billion | |

iShares Select U.S. REIT ETF | 1.9% | 1/29/2001 | BlackRock | $2.0 billion |

2. iShares U.S. Real Estate ETF

The iShares U.S. Real Estate ETF invests in domestic real estate stocks and REITs. The ETF, managed by BlackRock, had more than 60 holdings as of early 2026, led by the following five:

- Welltower: 9.7% portfolio weighting

- Prologis: 9.2%

- Equinix: 5.0%

- Simon Property Group (SPG +0.90%): 4.8%.

- Realty Income (O +0.98%): 4.4%

Those are five of the largest REITs, operating across several property types, including industrial, net lease, data centers, and self-storage. Overall, the ETF's 10 largest holdings make up over 50% of its portfolio, providing investors with similar diversification to that of Vanguard's ETF, even though it has fewer holdings.

One drawback of this REIT ETF is its expense ratio. At 0.38%, it's well above the industry average, so it has slightly underperformed its benchmark over the years as the higher fee has eaten into its returns.

The higher fee also eats into the REIT ETF's dividend income. It has a 2.4% dividend yield (as of early 2026, over the trailing 12-month period).

3. Schwab US REIT ETF

This ETF provides simple access to REITs, holding only REITs, unlike other ETFs that include non-REIT real estate stocks. The fund held 120 REITs as of early 2026, led by the following five:

- Welltower: 9.4%.

- Prologis: 9.1%.

- Equinix: 5.1%.

- Simon Property: 4.8%

- Realty Income: 4.8%

Like many other REIT ETFs, the Schwab fund holds REITs based on their market cap instead of using an equal weighting system, so its top holdings are almost identical to those of most other top REIT ETFs. Meanwhile, its top 10 make up about 50% of its portfolio.

Its expense ratio stands out. It's an ultra-low 0.07%, allowing investors to keep more of the returns from the underlying REITs. That includes its lucrative dividend income (a 3.0% yield over the last 12 months).

4. State Street Real Estate Select Sector SPDR ETF

The State Street Real Estate Select Sector SPDR ETF enables investors to target the largest REITs. The ETF holds only real estate stocks in the S&P 500, limiting its investment universe. As of early 2026, the ETF held only about 30 stocks, led by some familiar names:

- Welltower: 10.2%.

- Prologis: 9.6%.

- Equinix: 6.3%.

- American Tower: 6.1%.

- Simon Property: 4.9%.

As five of the largest REITs, it's no surprise to see this group leading the way. And because this ETF concentrates on real estate stocks in the S&P 500, its top 10 holdings accounted for roughly 60% of its portfolio. That makes it an ideal option for investors seeking to focus on the largest REITs.

The ETF has a low expense ratio of 0.08%. Consequently, it's a solid option for investors seeking low-cost exposure to the biggest REITs. The fund pays attractive dividends, which drives the REIT ETF's roughly 3.3% dividend yield (on a trailing 12-month basis).

5. iShares Select U.S. REIT ETF

The iShares Select U.S. REIT ETF is another REIT ETF managed by BlackRock. It takes a slightly different approach to investing in REITs, focusing on large real estate companies that dominate their respective property categories. As a result, it has a concentrated portfolio of 30 REITs.

However, these 30 include some familiar names, led by:

- Prologis: 8.5%

- Welltower: 8.1%

- Equinix: 7.9%

- American Tower: 7.5%

- Simon Property Group: 6.2

Overall, its top 10 holdings made up more than 60% of its portfolio as of early 2026.

Because the ETF takes a more active approach to REIT investing, it charges a relatively high expense ratio of 0.32%. It also offered a lower dividend yield (2.9% on a trailing 12-month basis). It's best for investors who want to focus on the dominant REITs without limiting themselves to only those in the S&P 500.

How REIT ETFs Work

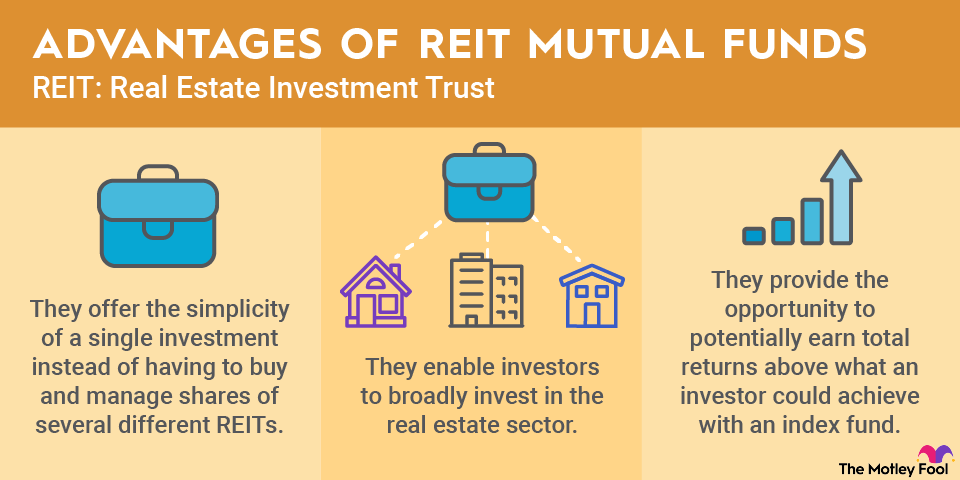

REIT ETFs work by pooling investor capital to invest broadly across REIT sectors. Many REIT ETFs track a common REIT index by investing in the REITs held by that index to match its returns. Other ETFs take a more active approach, investing in REITs that their management teams believe will deliver the highest returns.

REIT ETFs own equity in the REITs, entitling them to any capital appreciation and dividend income. Most REIT ETFs distribute dividends to investors each quarter.

Benefits and drawbacks of investing in REIT ETFs

Investing in REIT ETFs has its share of pros and cons. Some of the benefits include:

- Diversification: They offer broad diversification across the entire REIT sector, which can help lower your portfolio's risk.

- Income: REITs pay dividends, which REIT ETFs distribute to investors each quarter.

- Capital appreciation potential: REITs can deliver price appreciation as they grow their portfolios, earnings, and dividends.

On the other hand, REIT ETFs have some cons, such as:

- Underperformance potential: REIT ETFs can underperform the share prices of the top REITs.

- Costs: REIT ETFs charge investors a management fee (expense ratio), which can eat into returns.

What to Consider Before Investing in REIT ETFs

Here are some key factors investors should evaluate when choosing REIT ETFs:

- Whether you want to invest in a REIT ETF that passively tracks a REIT index or is a more actively managed fund.

- Its expense ratio versus other funds.

- The ETF's historical track record.

- Its size compared to other REIT ETFs.

Related investing topics

These ETFs make it easy to invest in REITs

REITs have historically generated attractive total returns for investors by providing them with above-average dividend income and price appreciation. With so many great REITs to choose from, it can be hard for investors to determine which are best for their portfolio. That's where REIT ETFs can help. They make it easy to invest in the sector by providing broad exposure to the leading REITs. Although most REIT ETFs have similar top holdings, the best ones offer unique spins, giving investors several excellent options.

FAQ

FAQ on REIT ETFs

About the Author

Charles Schwab is an advertising partner of The Ascent, a Motley Fool company. Matt DiLallo has positions in American Tower, Crown Castle, Equinix, Prologis, and Public Storage and has the following options: long January 2026 $170 calls on American Tower and short January 2026 $175 calls on American Tower. The Motley Fool has positions in and recommends American Tower, Charles Schwab, Crown Castle, Equinix, Prologis, and Vanguard Real Estate ETF. The Motley Fool recommends the following options: long January 2026 $180 calls on American Tower, long January 2026 $90 calls on Prologis, short January 2026 $185 calls on American Tower, and short June 2024 $65 puts on Charles Schwab. The Motley Fool has a disclosure policy.